Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

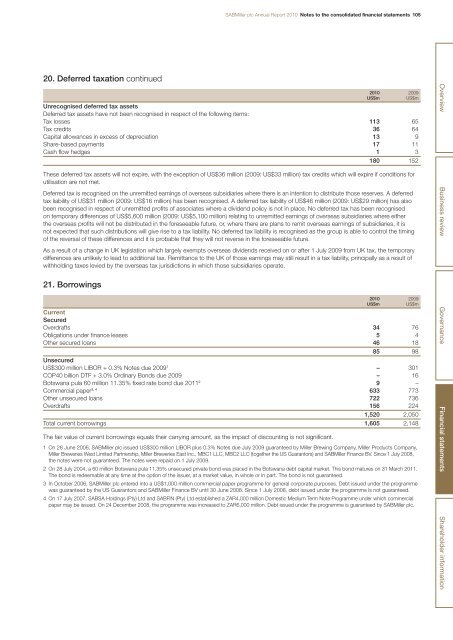

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Notes to the consolidated financial statements 10520. Deferred taxation continued2010 2009US$mUS$mUnrecognised deferred tax assetsDeferred tax assets have not been recognised in respect of the following items:Tax losses 113 65Tax credits 36 64Capital allowances in excess of depreciation 13 9Share-based payments 17 11Cash flow hedges 1 3180 152These deferred tax assets will not expire, with the exception of US$36 million (2009: US$33 million) tax credits which will expire if conditions forutilisation are not met.Deferred tax is recognised on the unremitted earnings of overseas subsidiaries where there is an intention to distribute those reserves. A deferredtax liability of US$31 million (2009: US$16 million) has been recognised. A deferred tax liability of US$46 million (2009: US$29 million) has alsobeen recognised in respect of unremitted profits of associates where a dividend policy is not in place. No deferred tax has been recognisedon temporary differences of US$5,600 million (2009: US$5,100 million) relating to unremitted earnings of overseas subsidiaries where eitherthe overseas profits will not be distributed in the foreseeable future, or, where there are plans to remit overseas earnings of subsidiaries, it isnot expected that such distributions will give rise to a tax liability. No deferred tax liability is recognised as the group is able to control the timingof the reversal of these differences and it is probable that they will not reverse in the foreseeable future.As a result of a change in UK legislation which largely exempts overseas dividends received on or after 1 July 2009 from UK tax, the temporarydifferences are unlikely to lead to additional tax. Remittance to the UK of those earnings may still result in a tax liability, principally as a result ofwithholding taxes levied by the overseas tax jurisdictions in which those subsidiaries operate.21. Borrowings2010 2009US$mUS$mCurrentSecuredOverdrafts 34 76Obligations under finance leases 5 4Other secured loans 46 1885 98UnsecuredUS$300 million LIBOR + 0.3% Notes due 2009 1 – 301COP40 billion DTF + 3.0% Ordinary Bonds due 2009 – 16Botswana pula 60 million 11.35% fixed rate bond due 2011 2 9 –Commercial paper 3, 4 633 773Other unsecured loans 722 736Overdrafts 156 2241,520 2,050Total current borrowings 1,605 2,148The fair value of current borrowings equals their carrying amount, as the impact of discounting is not significant.1 On 28 June 2006, <strong>SABMiller</strong> plc issued US$300 million LIBOR plus 0.3% Notes due July 2009 guaranteed by Miller Brewing Company, Miller Products Company,Miller Breweries West Limited Partnership, Miller Breweries East Inc., MBC1 LLC, MBC2 LLC (together the US Guarantors) and <strong>SABMiller</strong> Finance BV. Since 1 July 2008,the notes were not guaranteed. The notes were repaid on 1 July 2009.2 On 28 July 2004, a 60 million Botswana pula 11.35% unsecured private bond was placed in the Botswana debt capital market. This bond matures on 31 March 2011.The bond is redeemable at any time at the option of the issuer, at a market value, in whole or in part. The bond is not guaranteed.3 In October 2006, <strong>SABMiller</strong> plc entered into a US$1,000 million commercial paper programme for general corporate purposes. Debt issued under the programmewas guaranteed by the US Guarantors and <strong>SABMiller</strong> Finance BV until 30 June 2008. Since 1 July 2008, debt issued under the programme is not guaranteed.4 On 17 July 2007, SABSA Holdings (Pty) Ltd and SABFIN (Pty) Ltd established a ZAR4,000 million Domestic Medium Term Note Programme under which commercialpaper may be issued. On 24 December 2008, the programme was increased to ZAR6,000 million. Debt issued under the programme is guaranteed by <strong>SABMiller</strong> plc.Overview Business review Governance Financial statements Shareholder information