62 Remuneration report <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Remuneration report continuedFor the purpose of calculating TSR the share prices and dividends ofthe comparator companies are converted, as necessary, into sterlingat the exchange rates prevailing at the relevant times. The conversioninto sterling is intended to remove distortions arising from differingrates of inflation in the countries in which the comparator companiesare listed. TSR and the relevant statistical quartiles are determined inaccordance with current market practice. The companies comprisingthe TSR comparator group for all the performance share awards whichhad not yet vested or lapsed as at 31 March 2010 are listed below:Anheuser-Busch InBev (formerly InBev)Anheuser-Busch* (acquired by InBev)Asahi BreweriesCarlsberg AConstellation BrandsDiageoFemsa UBD* (acquired by Heineken)Fosters GroupGrolsch* (acquired by <strong>SABMiller</strong>)HeinekenKirin HoldingsLion Nathan*(acquired by KirinHoldings)Molson CoorsPernod RicardSapporo BreweriesScottish & Newcastle*(acquired by Heinekenand Carlsberg)*Denotes company has been removed from the comparator group.Kepler Associates undertakes each year the assessment of thecompany’s TSR performance relative to the comparator group,and the methodology used and the final results for each awardare subject to review by the company’s auditors.For awards made to executive directors in June 2010, the committeereduced the number of shares subject to an EPS-based performancecondition by approximately 14% compared with the number awardedin May 2009. Also in June 2010, the first awards of performance sharessubject to the new Value Sharing TSR-based performance conditiondescribed above (see pages 59 to 60) were made to the executivedirectors. Under these awards, Mr Mackay and Mr Wyman receivedawards of 220 and 130 shares respectively for each £10 million ofadditional shareholder value created, being the amount by which thegrowth in <strong>SABMiller</strong>’s market capitalisation plus net equity cash flowsexceeds the median growth of a weighted peer group index over thethree to five-year performance period.DilutionTaking account of all shares newly issued as a consequence of exercisesof share options over the 10-year period ended 31 March 2010 plusoutstanding share options under all the company’s share option plans,where new issue shares may be used to satisfy their exercise, potentialdilution amounts to 3.41% of the issued ordinary shares of the company(excluding shares held in treasury) on 31 March 2010. Obligationsunder the company’s other long-term incentive plans are typicallysettled by the EBT from shares transferred from treasury or purchasedin the market. The dilution calculation also excludes shares arisingfrom any options granted before 8 March 1999, as disclosed in theoriginal listing particulars relating to the company’s listing in London.The <strong>SABMiller</strong> plc Employees’ Benefit Trust (EBT)At 31 March 2010 the number of shares held in the EBT was 8.7 million,representing 0.55% of the issued ordinary shares of the company.During the year, 5.3 million ordinary shares which were formerly heldby the company as treasury shares were acquired by the trustee onbehalf of the EBT to ensure that the EBT continued to hold sufficientordinary shares to meet potential future obligations in respect ofperformance share awards and share-settled share appreciationrights. During the year, the EBT repurchased 0.4 million shares fromparticipants upon the vesting of their awards at an average priceof £12.55 per share which amounted to 0.02% of the issued sharecapital of the company. The trustee of the EBT has waived its rightto receive dividends on shares held in the EBT, and will only voteshares or claim dividends on shares which are beneficially ownedby an employee of the group, and only then in accordance with theinstructions of the underlying employee shareholder. As at 31 March2010, there were 0.3 million beneficially held shares in the EBT.PensionsIt is the company’s policy to provide money purchase occupationalretirement funding schemes wherever possible so as to minimisethe company’s funding risk. Where feasible, the company appliesthis policy to its new acquisitions.The rate of contribution from the company as a percentage ofbase salaries paid in sterling is set at 30% for the executive directors.During the year the company made contributions for the executivedirectors to the <strong>SABMiller</strong> plc Staff Pension Scheme, an ApprovedOccupational Pension Scheme in the United Kingdom. Contributionswere paid in respect of each executive director to the extent allowedin light of the changes to pension allowances that took effect in 2006,with any excess credited in an unfunded corporate plan. Furtherdetails on executive directors’ pension contributions during thefinancial year are on page 64.Service contractsMr Mackay and Mr Wyman have service contracts with the companywhich are terminable on not less than 12 months’ notice to be givenby the company or by the executive. A payment in lieu of notice maybe made on termination of employment, calculated by reference tothe executive’s base salary plus company pension contributions forthe relevant period, less any deduction considered by the companyto be appropriate and reasonable to take account of acceleratedreceipt and the executive’s duty to mitigate his loss.Execution Date first Date last Date nextdate of appointed re-elected due forservice contract to the board as a director re-electionEAG Mackay 27/02/1999 08/02/1999 31/07/2008 July 2011MI Wyman 26/02/1999 08/02/1999 31/07/2007 July 2010Other benefitsThe executive directors are provided with medical insurance, permanenthealth insurance, company car allowance, accompanied travel, legaland professional fees, club subscriptions, death in service benefit andoccasional London accommodation. The estimated values of theseprovisions are included in the summary of emoluments paid table onpage 64.

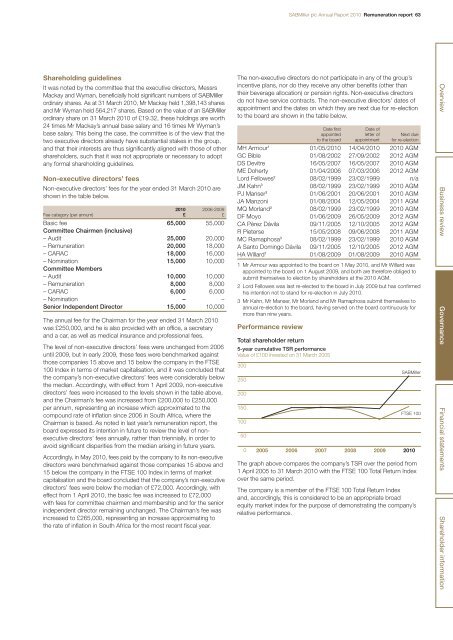

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Remuneration report 63Shareholding guidelinesIt was noted by the committee that the executive directors, MessrsMackay and Wyman, beneficially hold significant numbers of <strong>SABMiller</strong>ordinary shares. As at 31 March 2010, Mr Mackay held 1,398,143 sharesand Mr Wyman held 564,217 shares. Based on the value of an <strong>SABMiller</strong>ordinary share on 31 March 2010 of £19.32, these holdings are worth24 times Mr Mackay’s annual base salary and 16 times Mr Wyman’sbase salary. This being the case, the committee is of the view that thetwo executive directors already have substantial stakes in the group,and that their interests are thus significantly aligned with those of othershareholders, such that it was not appropriate or necessary to adoptany formal shareholding guidelines.Non-executive directors’ feesNon-executive directors’ fees for the year ended 31 March 2010 areshown in the table below.2010 2006-2009Fee category (per annum) £ £Basic fee 65,000 55,000Committee Chairmen (inclusive)– Audit 25,000 20,000– Remuneration 20,000 18,000– CARAC 18,000 16,000– Nomination 15,000 10,000Committee Members– Audit 10,000 10,000– Remuneration 8,000 8,000– CARAC 6,000 6,000– Nomination – –Senior Independent Director 15,000 10,000The annual fee for the Chairman for the year ended 31 March 2010was £250,000, and he is also provided with an office, a secretaryand a car, as well as medical insurance and professional fees.The level of non-executive directors’ fees were unchanged from 2006until 2009, but in early 2009, these fees were benchmarked againstthose companies 15 above and 15 below the company in the FTSE100 Index in terms of market capitalisation, and it was concluded thatthe company’s non-executive directors’ fees were considerably belowthe median. Accordingly, with effect from 1 April 2009, non-executivedirectors’ fees were increased to the levels shown in the table above,and the Chairman’s fee was increased from £200,000 to £250,000per annum, representing an increase which approximated to thecompound rate of inflation since 2006 in South Africa, where theChairman is based. As noted in last year’s remuneration report, theboard expressed its intention in future to review the level of nonexecutivedirectors’ fees annually, rather than triennially, in order toavoid significant disparities from the median arising in future years.Accordingly, in May 2010, fees paid by the company to its non-executivedirectors were benchmarked against those companies 15 above and15 below the company in the FTSE 100 Index in terms of marketcapitalisation and the board concluded that the company’s non-executivedirectors’ fees were below the median of £72,000. Accordingly, witheffect from 1 April 2010, the basic fee was increased to £72,000with fees for committee chairmen and membership and for the seniorindependent director remaining unchanged. The Chairman’s fee wasincreased to £265,000, representing an increase approximating tothe rate of inflation in South Africa for the most recent fiscal year.The non-executive directors do not participate in any of the group’sincentive plans, nor do they receive any other benefits (other thantheir beverage allocation) or pension rights. Non-executive directorsdo not have service contracts. The non-executive directors’ dates ofappointment and the dates on which they are next due for re-electionto the board are shown in the table below.Date firstDate ofappointed letter of Next dueto the board appointment for re-electionMH Armour 1 01/05/2010 14/04/2010 2010 AGMGC Bible 01/08/2002 27/09/2002 2012 AGMDS Devitre 16/05/2007 16/05/2007 2010 AGMME Doherty 01/04/2006 07/03/2006 2012 AGMLord Fellowes 2 08/02/1999 23/02/1999 n/aJM Kahn 3 08/02/1999 23/02/1999 2010 AGMPJ Manser 3 01/06/2001 20/06/2001 2010 AGMJA Manzoni 01/08/2004 12/05/2004 2011 AGMMQ Morland 3 08/02/1999 23/02/1999 2010 AGMDF Moyo 01/06/2009 26/05/2009 2012 AGMCA Pérez Dávila 09/11/2005 12/10/2005 2012 AGMR Pieterse 15/05/2008 09/06/2008 2011 AGMMC Ramaphosa 3 08/02/1999 23/02/1999 2010 AGMA Santo Domingo Dávila 09/11/2005 12/10/2005 2012 AGMHA Willard 1 01/08/2009 01/08/2009 2010 AGM1 Mr Armour was appointed to the board on 1 May 2010, and Mr Willard wasappointed to the board on 1 August 2009, and both are therefore obliged tosubmit themselves to election by shareholders at the 2010 AGM.2 Lord Fellowes was last re-elected to the board in July 2009 but has confirmedhis intention not to stand for re-election in July 2010.3 Mr Kahn, Mr Manser, Mr Morland and Mr Ramaphosa submit themselves toannual re-election to the board, having served on the board continuously formore than nine years.Performance reviewTotal shareholder return5-year cumulative TSR performanceValue of £100 invested on 31 March 200530025020015010050<strong>SABMiller</strong>FTSE 1000 2005 2006 2007 2008 2009 2010The graph above compares the company’s TSR over the period from1 April 2005 to 31 March 2010 with the FTSE 100 Total Return Indexover the same period.The company is a member of the FTSE 100 Total Return Indexand, accordingly, this is considered to be an appropriate broadequity market index for the purpose of demonstrating the company’srelative performance.Overview Business review Governance Financial statements Shareholder information