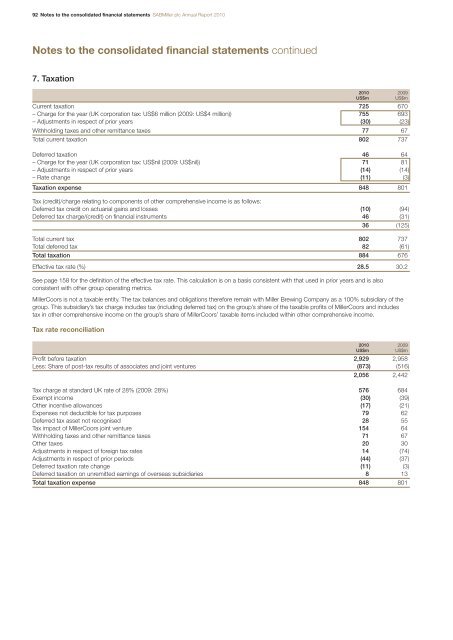

92 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued7. Taxation2010 2009US$mUS$mCurrent taxation 725 670– Charge for the year (UK corporation tax: US$6 million (2009: US$4 million)) 755 693– Adjustments in respect of prior years (30) (23)Withholding taxes and other remittance taxes 77 67Total current taxation 802 737Deferred taxation 46 64– Charge for the year (UK corporation tax: US$nil (2009: US$nil)) 71 81– Adjustments in respect of prior years (14) (14)– Rate change (11) (3)Taxation expense 848 801Tax (credit)/charge relating to components of other comprehensive income is as follows:Deferred tax credit on actuarial gains and losses (10) (94)Deferred tax charge/(credit) on financial instruments 46 (31)36 (125)Total current tax 802 737Total deferred tax 82 (61)Total taxation 884 676Effective tax rate (%) 28.5 30.2See page 158 for the definition of the effective tax rate. This calculation is on a basis consistent with that used in prior years and is alsoconsistent with other group operating metrics.MillerCoors is not a taxable entity. The tax balances and obligations therefore remain with Miller Brewing Company as a 100% subsidiary of thegroup. This subsidiary’s tax charge includes tax (including deferred tax) on the group’s share of the taxable profits of MillerCoors and includestax in other comprehensive income on the group’s share of MillerCoors’ taxable items included within other comprehensive income.Tax rate reconciliation2010 2009US$mUS$mProfit before taxation 2,929 2,958Less: Share of post-tax results of associates and joint ventures (873) (516)2,056 2,442Tax charge at standard UK rate of 28% (2009: 28%) 576 684Exempt income (30) (39)Other incentive allowances (17) (21)Expenses not deductible for tax purposes 79 62Deferred tax asset not recognised 28 55Tax impact of MillerCoors joint venture 154 64Withholding taxes and other remittance taxes 71 67Other taxes 20 30Adjustments in respect of foreign tax rates 14 (74)Adjustments in respect of prior periods (44) (37)Deferred taxation rate change (11) (3)Deferred taxation on unremitted earnings of overseas subsidiaries 8 13Total taxation expense 848 801

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Notes to the consolidated financial statements 938. Earnings per share2010 2009US cents US centsBasic earnings per share 122.6 125.2Diluted earnings per share 122.1 124.6Headline earnings per share 127.3 119.0Adjusted basic earnings per share 161.1 137.5Adjusted diluted earnings per share 160.4 136.8The weighted average number of shares was:2010 2009Millions of shares Millions of sharesOrdinary shares 1,641 1,514Treasury shares (see note 25) (77) (7)ESOP trust ordinary shares (6) (5)Basic shares 1,558 1,502Dilutive ordinary shares from share options 6 8Diluted shares 1,564 1,510The calculation of diluted earnings per share excludes 6,920,802 (2009: 12,793,912) share options that were non-dilutive for the year becausethe exercise price of the option exceeded the fair value of the shares during the year and 10,485,166 (2009: 8,912,780) share awards that werenon-dilutive for the year because the performance conditions attached to the share awards have not been met. These share awards couldpotentially dilute earnings per share in the future.9,932,750 share awards were granted after 31 March 2010 and before the date of signing of these financial statements.Adjusted and headline earningsThe group presents an adjusted earnings per share figure which excludes the impact of amortisation of intangible assets (excluding capitalisedsoftware), certain non-recurring items and post-tax exceptional items in order to present an additional measure of performance for the yearsshown in the consolidated financial statements. Adjusted earnings per share has been based on adjusted earnings for each financial year andon the same number of weighted average shares in issue as the basic earnings per share calculation. Headline earnings per share has beencalculated in accordance with the South African Circular 8/2007 entitled ‘Headline Earnings’ which forms part of the listing requirements for theJSE Ltd (JSE). The adjustments made to arrive at headline earnings and adjusted earnings are as follows:2010 2009US$mUS$mProfit for the financial year attributable to equity holders of the parent 1,910 1,881Headline adjustmentsImpairment of goodwill – 364Impairment of intangible assets – 14Impairment of property, plant and equipment 45 16Loss on disposal of property, plant and equipment 39 10Profit on disposal of businesses – (526)Profit on disposal of available for sale investments (2) –Tax effects of the above items (17) (4)Minority interests’ share of the above items 9 (1)Share of joint ventures’ and associates’ headline adjustments, net of tax and minority interests – 34Headline earnings 1,984 1,788Business capability programme costs 342 –Integration and restructuring costs 41 108Transaction costs 24 –Net loss on fair value movements on capital items 1 8 27Unwind of fair value adjustments on inventory – 9Gain on early termination of financial derivatives – (20)Litigation – 13Amortisation of intangible assets (excluding capitalised software) 150 164Tax effects of the above items (101) (110)Minority interests’ share of the above items (6) (4)Share of joint ventures’ and associates’ other adjustments, net of tax and minority interests 67 90Adjusted earnings 2,509 2,0651 This does not include all fair value movements but includes those in relation to capital items for which hedge accounting cannot be applied.Overview Business review Governance Financial statements Shareholder information