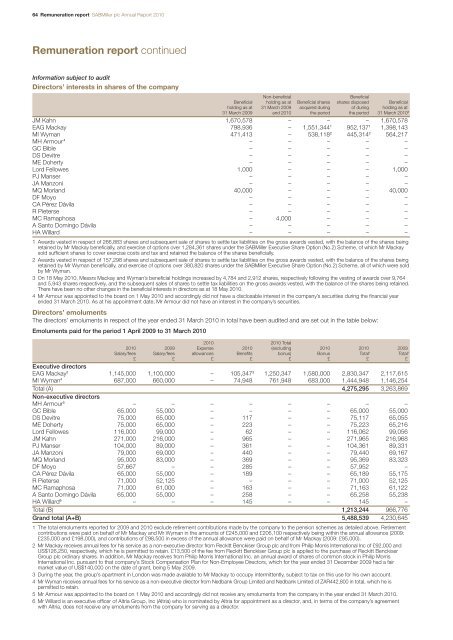

64 Remuneration report <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Remuneration report continuedInformation subject to auditDirectors’ interests in shares of the companyNon-beneficialBeneficialBeneficial holding as at Beneficial shares shares disposed Beneficialholding as at 31 March 2009 acquired during of during holding as at31 March 2009 and 2010 the period the period 31 March 2010 3JM Kahn 1,670,578 – – – 1,670,578EAG Mackay 798,936 – 1,551,344 1 952,137 1 1,398,143MI Wyman 471,413 – 538,118 2 445,314 2 564,217MH Armour 4 – – – – –GC Bible – – – – –DS Devitre – – – – –ME Doherty – – – – –Lord Fellowes 1,000 – – – 1,000PJ Manser – – – – –JA Manzoni – – – – –MQ Morland 40,000 – – – 40,000DF Moyo – – – – –CA Pérez Dávila – – – – –R Pieterse – – – – –MC Ramaphosa – 4,000 – – –A Santo Domingo Dávila – – – – –HA Willard – – – – –1 Awards vested in respect of 266,883 shares and subsequent sale of shares to settle tax liabilities on the gross awards vested, with the balance of the shares beingretained by Mr Mackay beneficially, and exercise of options over 1,284,361 shares under the <strong>SABMiller</strong> Executive Share Option (No.2) Scheme, of which Mr Mackaysold sufficient shares to cover exercise costs and tax and retained the balance of the shares beneficially.2 Awards vested in respect of 157,298 shares and subsequent sale of shares to settle tax liabilities on the gross awards vested, with the balance of the shares beingretained by Mr Wyman beneficially, and exercise of options over 380,820 shares under the <strong>SABMiller</strong> Executive Share Option (No.2) Scheme, all of which were soldby Mr Wyman.3 On 18 May 2010, Messrs Mackay and Wyman’s beneficial holdings increased by 4,784 and 2,912 shares, respectively following the vesting of awards over 9,764and 5,943 shares respectively, and the subsequent sales of shares to settle tax liabilities on the gross awards vested, with the balance of the shares being retained.There have been no other changes in the beneficial interests in directors as at 18 May 2010.4 Mr Armour was appointed to the board on 1 May 2010 and accordingly did not have a disclosable interest in the company’s securities during the financial yearended 31 March 2010. As at his appointment date, Mr Armour did not have an interest in the company’s securities.Directors’ emolumentsThe directors’ emoluments in respect of the year ended 31 March 2010 in total have been audited and are set out in the table below:Emoluments paid for the period 1 April 2009 to 31 March 20102010 2010 Total2010 2009 Expense 2010 (excluding 2010 2010 2009Salary/fees Salary/fees allowances Benefits bonus) Bonus Total 1 Total 1£ £ £ £ £ £ £ £Executive directorsEAG Mackay 2 1,145,000 1,100,000 – 105,347 3 1,250,347 1,580,000 2,830,347 2,117,615MI Wyman 4 687,000 660,000 – 74,948 761,948 683,000 1,444,948 1,146,254Total (A) 4,275,295 3,263,869Non-executive directorsMH Armour 5 – – – – – – – –GC Bible 65,000 55,000 – – – – 65,000 55,000DS Devitre 75,000 65,000 – 117 – – 75,117 65,055ME Doherty 75,000 65,000 – 223 – – 75,223 65,216Lord Fellowes 116,000 99,000 – 62 – – 116,062 99,056JM Kahn 271,000 216,000 – 965 – – 271,965 216,968PJ Manser 104,000 89,000 – 361 – – 104,361 89,331JA Manzoni 79,000 69,000 – 440 – – 79,440 69,167MQ Morland 95,000 83,000 – 369 – – 95,369 83,323DF Moyo 57,667 – – 285 – – 57,952 –CA Pérez Dávila 65,000 55,000 – 189 – – 65,189 55,175R Pieterse 71,000 52,125 – – – – 71,000 52,125MC Ramaphosa 71,000 61,000 – 163 – – 71,163 61,122A Santo Domingo Dávila 65,000 55,000 – 258 – – 65,258 55,238HA Willard 6 – – – 145 – – 145 –Total (B) 1,213,244 966,776Grand total (A+B) 5,488,539 4,230,6451 The total emoluments reported for 2009 and 2010 exclude retirement contributions made by the company to the pension schemes as detailed above. Retirementcontributions were paid on behalf of Mr Mackay and Mr Wyman in the amounts of £245,000 and £206,100 respectively being within the annual allowance (2009:£235,000 and £198,000), and contributions of £98,500 in excess of the annual allowance were paid on behalf of Mr Mackay (2009: £95,000).2 Mr Mackay receives annual fees for his service as a non-executive director from Reckitt Benckiser Group plc and from Philip Morris International Inc of £92,000 andUS$126,250, respectively, which he is permitted to retain. £13,500 of the fee from Reckitt Benckiser Group plc is applied to the purchase of Reckitt BenckiserGroup plc ordinary shares. In addition, Mr Mackay receives from Philip Morris International Inc. an annual award of shares of common stock in Philip MorrisInternational Inc. pursuant to that company’s Stock Compensation Plan for Non-Employee Directors, which for the year ended 31 December 2009 had a fairmarket value of US$140,000 on the date of grant, being 5 May 2009.3 During the year, the group’s apartment in London was made available to Mr Mackay to occupy intermittently, subject to tax on this use for his own account.4 Mr Wyman receives annual fees for his service as a non-executive director from Nedbank Group Limited and Nedbank Limited of ZAR442,800 in total, which he ispermitted to retain.5 Mr Armour was appointed to the board on 1 May 2010 and accordingly did not receive any emoluments from the company in the year ended 31 March 2010.6 Mr Willard is an executive officer of Altria Group, Inc (Altria) who is nominated by Altria for appointment as a director, and, in terms of the company’s agreementwith Altria, does not receive any emoluments from the company for serving as a director.

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Remuneration report 65Share incentive plansThe interests of the executive directors in shares of the company provided in the form of options and awards are shown in the tables below,and have been audited. During the year ended 31 March 2010 the highest and lowest market prices for the company’s shares were £10.45(on 20 April 2009) and £19.59 (on 29 March 2010) respectively and the market price on 31 March 2010 was £19.32.Share optionsShare options Sale price/Subscription Share options Share options Share options Share options vested and market priceExercisable for price outstanding as at granted during exercised outstanding as at exercisable as at (if applicable)3-10 years from £ 31 March 2009 the year during the year 31 March 2010 31 March 2010 £EAG Mackay 02/06/2000 1 4.11 159,416 – 159,416 – 12.5601/06/2001 1 5.16 161,589 – 161,589 – – 12.5631/05/2002 2 5.705 201,578 – 201,578 – – 12.5623/05/2003 2 4.1575 327,721 – 327,721 – – 12.5621/05/2004 2 6.605 222,704 – 222,704 – – 12.6320/05/2005 2 8.28 211,353 – 211,353 4 – 18.0219/05/2006 3 10.61 230,000 – – 230,000 154,100 5 n/a18/05/2007 3 11.67 230,000 – – 230,000 6 – n/a16/05/2008 3 12.50 230,000 – – 230,000 – n/a14/11/2008 3 9.295 60,000 – – 60,000 – n/a15/05/2009 3 12.31 – 290,000 – 290,000 – n/a2,034,361 290,000 1,284,361 1,040,000 7 154,100MI Wyman 31/05/2002 1 5.705 93,339 – 93,339 – – 12.5521/05/2004 2 6.605 102,195 – 102,195 – – 16.8520/05/2005 2 8.28 95,109 – 91,486 4 3,623 3,623 4 17.0719/05/2006 3 10.61 140,000 – 93,800 5 46,200 – 18.8918/05/2007 3 11.67 140,000 – – 140,000 6 – n/a16/05/2008 3 12.50 140,000 – – 140,000 – n/a01/08/2008 3 10.49 35,000 – – 35,000 – n/a15/05/2009 3 12.31 – 175,000 – 175,000 – n/a745,643 175,000 380,820 539,823 7 3,6231 The performance condition for options granted prior to 2002 required growth in adjusted EPS (expressed in sterling) of 3% per annum compound in excess of thechange in the Retail Price Index (RPI) over any three-year period within the 10-year option life. This performance condition was satisfied in respect of all optionsgranted to executive directors in 2000 and 2001.2 The performance condition for options granted in 2002 and until 2005 required compound annualised adjusted EPS growth (expressed in sterling) of RPI + 3%subject to testing at three, four and five-year intervals from a fixed base for vesting of the base annual award. Half of any additional annual amount vested at compoundannualised adjusted EPS growth of RPI + 4%; and the other half of any additional annual amount vested at compound annualised adjusted EPS growth of RPI + 5%.After the five-year test any unvested portion of the option lapsed.3 The performance condition for options granted in 2006 and onwards requires compound annualised adjusted EPS growth of RPI + 3% from a fixed base forvesting of the base annual award. Half of any additional annual amount vests at compound annualised adjusted EPS growth of RPI + 4%; and the other half ofany additional annual amount vests at compound annualised adjusted EPS growth of RPI + 5%. The performance tests are applied to two-thirds of the awardafter three years and one-third of the award after five years, with any unvested portion of the options lapsing after three years or five years, as the case may be,and with no provision for retesting any part of the awards.4 In the year ended 31 March 2009, options granted in 2005 vested in full and became exercisable as the company’s adjusted EPS for the year ended 31 March 2008,at 71.28 pence (converted from US$ at the average exchange rate over the period 1 April 2007 to 31 March 2008) was more than 27.1% higher (the aggregateof RPI movement and 5% per annum compound growth) than the adjusted EPS of 54.7 pence for the year ended 31 March 2005 (the base year calculation of theperformance condition) converted from US$ at the average exchange rate for the period from 1 April 2004 to 31 March 2005. The mid market close on 20 May 2008was £12.74.5 Two-thirds of the share options indicated were eligible to be tested against the performance condition described in this report for the three years ended 31 March2009, and on 19 May 2009 vested in full and became exercisable as the company’s adjusted EPS for the year ended 31 March 2009, at 79.7 pence (convertedfrom US$ at the average exchange rate over the period 1 April 2008 to 31 March 2009) was more than 24.2% higher (the aggregate of RPI movement and 5%per annum compound growth) than the adjusted EPS of 61.1 pence for the year ended 31 March 2006 (the base year calculation of the performance condition)converted from US$ at the average exchange rate for the period from 1 April 2005 to 31 March 2006. The mid market close on 19 May 2009 was £12.57. Theone-third which remain unvested will be eligible to be tested against the performance condition described in note 3 above for the five years ending 31 March 2011.6 Two-thirds of the share options indicated were eligible to be tested against the performance condition described in this report for the three years ended 31 March2010, and on 18 May 2010 vested in full and became exercisable as the company’s adjusted EPS for the year ended 31 March 2010, at 100.7 pence (convertedfrom US$ at the average exchange rate over the period 1 April 2009 to 31 March 2010) was 28.7% higher than the adjusted EPS of 63.4 pence for the year ended31 March 2007 (the base year calculation of the performance condition converted from US$ at the average exchange rate for the period from 1 April 2006 to31 March 2007) plus the aggregate of RPI movement and 5% per annum compound growth. The mid market close on 18 May 2010 was £20.76. The one-thirdwhich remain unvested will be eligible to be tested against the performance condition described in note 3 above for the five years ending 31 March 2012.7 Messrs Mackay and Wyman were granted 250,000 and 150,000 share options respectively at a subscription price of £19.51 per share on 1 June 2010.Overview Business review Governance Financial statements Shareholder information