Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

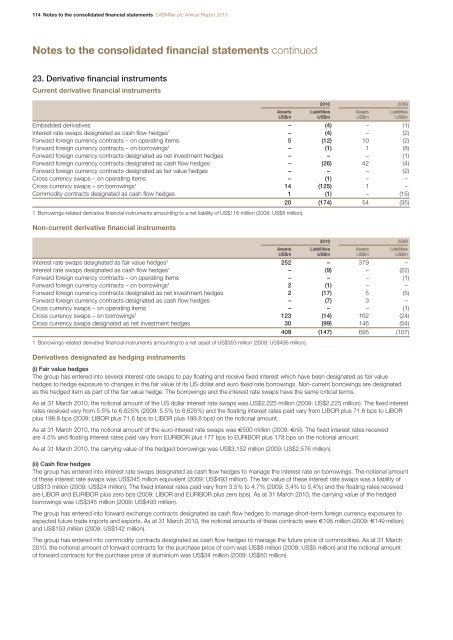

114 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued23. Derivative financial instrumentsCurrent derivative financial instruments2010 2009Assets Liabilities Assets LiabilitiesUS$m US$m US$m US$mEmbedded derivatives – (4) – (1)Interest rate swaps designated as cash flow hedges 1 – (4) – (2)Forward foreign currency contracts – on operating items 5 (12) 10 (2)Forward foreign currency contracts – on borrowings 1 – (1) 1 (8)Forward foreign currency contracts designated as net investment hedges – – – (1)Forward foreign currency contracts designated as cash flow hedges – (26) 42 (4)Forward foreign currency contracts designated as fair value hedges – – – (2)Cross currency swaps – on operating items – (1) – –Cross currency swaps – on borrowings 1 14 (125) 1 –Commodity contracts designated as cash flow hedges 1 (1) – (15)20 (174) 54 (35)1 Borrowings-related derivative financial instruments amounting to a net liability of US$116 million (2009: US$8 million).Non-current derivative financial instruments2010 2009Assets Liabilities Assets LiabilitiesUS$m US$m US$m US$mInterest rate swaps designated as fair value hedges 1 252 – 379 –Interest rate swaps designated as cash flow hedges 1 – (9) – (22)Forward foreign currency contracts – on operating items – – – (1)Forward foreign currency contracts – on borrowings 1 2 (1) – –Forward foreign currency contracts designated as net investment hedges 2 (17) 5 (5)Forward foreign currency contracts designated as cash flow hedges – (7) 3 –Cross currency swaps – on operating items – – – (1)Cross currency swaps – on borrowings 1 123 (14) 162 (24)Cross currency swaps designated as net investment hedges 30 (99) 146 (54)409 (147) 695 (107)1 Borrowings-related derivative financial instruments amounting to a net asset of US$353 million (2009: US$495 million).Derivatives designated as hedging instruments(i) Fair value hedgesThe group has entered into several interest rate swaps to pay floating and receive fixed interest which have been designated as fair valuehedges to hedge exposure to changes in the fair value of its US dollar and euro fixed rate borrowings. Non-current borrowings are designatedas the hedged item as part of the fair value hedge. The borrowings and the interest rate swaps have the same critical terms.As at 31 March 2010, the notional amount of the US dollar interest rate swaps was US$2,225 million (2009: US$2,225 million). The fixed interestrates received vary from 5.5% to 6.625% (2009: 5.5% to 6.625%) and the floating interest rates paid vary from LIBOR plus 71.6 bps to LIBORplus 198.8 bps (2009: LIBOR plus 71.6 bps to LIBOR plus 198.8 bps) on the notional amount.As at 31 March 2010, the notional amount of the euro interest rate swaps was €500 million (2009: €nil). The fixed interest rates receivedare 4.5% and floating interest rates paid vary from EURIBOR plus 177 bps to EURIBOR plus 178 bps on the notional amount.As at 31 March 2010, the carrying value of the hedged borrowings was US$3,152 million (2009: US$2,576 million).(ii) Cash flow hedgesThe group has entered into interest rate swaps designated as cash flow hedges to manage the interest rate on borrowings. The notional amountof these interest rate swaps was US$345 million equivalent (2009: US$493 million). The fair value of these interest rate swaps was a liability ofUS$13 million (2009: US$24 million). The fixed interest rates paid vary from 3.5% to 4.7% (2009: 3.4% to 5.4%) and the floating rates receivedare LIBOR and EURIBOR plus zero bps (2009: LIBOR and EURIBOR plus zero bps). As at 31 March 2010, the carrying value of the hedgedborrowings was US$345 million (2009: US$493 million).The group has entered into forward exchange contracts designated as cash flow hedges to manage short-term foreign currency exposures toexpected future trade imports and exports. As at 31 March 2010, the notional amounts of these contracts were €195 million (2009: €149 million)and US$153 million (2009: US$142 million).The group has entered into commodity contracts designated as cash flow hedges to manage the future price of commodities. As at 31 March2010, the notional amount of forward contracts for the purchase price of corn was US$8 million (2009: US$5 million) and the notional amountof forward contracts for the purchase price of aluminium was US$34 million (2009: US$50 million).