Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

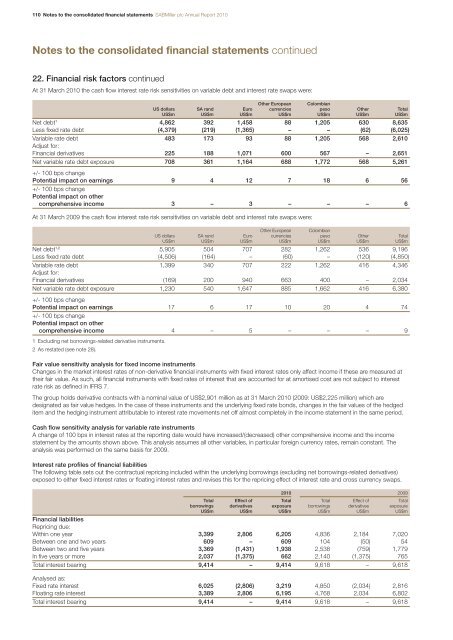

110 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued22. Financial risk factors continuedAt 31 March 2010 the cash flow interest rate risk sensitivities on variable debt and interest rate swaps were:Other European ColombianUS dollars SA rand Euro currencies peso Other TotalUS$m US$m US$m US$m US$m US$m US$mNet debt 1 4,862 392 1,458 88 1,205 630 8,635Less fixed rate debt (4,379) (219) (1,365) – – (62) (6,025)Variable rate debt 483 173 93 88 1,205 568 2,610Adjust for:Financial derivatives 225 188 1,071 600 567 – 2,651Net variable rate debt exposure 708 361 1,164 688 1,772 568 5,261+/- 100 bps changePotential impact on earnings 9 4 12 7 18 6 56+/- 100 bps changePotential impact on othercomprehensive income 3 – 3 – – – 6At 31 March 2009 the cash flow interest rate risk sensitivities on variable debt and interest rate swaps were:Other European ColombianUS dollars SA rand Euro currencies peso Other TotalUS$m US$m US$m US$m US$m US$m US$mNet debt 1,2 5,905 504 707 282 1,262 536 9,196Less fixed rate debt (4,506) (164) – (60) – (120) (4,850)Variable rate debt 1,399 340 707 222 1,262 416 4,346Adjust for:Financial derivatives (169) 200 940 663 400 – 2,034Net variable rate debt exposure 1,230 540 1,647 885 1,662 416 6,380+/- 100 bps changePotential impact on earnings 17 6 17 10 20 4 74+/- 100 bps changePotential impact on othercomprehensive income 4 – 5 – – – 91 Excluding net borrowings-related derivative instruments.2 As restated (see note 28).Fair value sensitivity analysis for fixed income instrumentsChanges in the market interest rates of non-derivative financial instruments with fixed interest rates only affect income if these are measured attheir fair value. As such, all financial instruments with fixed rates of interest that are accounted for at amortised cost are not subject to interestrate risk as defined in IFRS 7.The group holds derivative contracts with a nominal value of US$2,901 million as at 31 March 2010 (2009: US$2,225 million) which aredesignated as fair value hedges. In the case of these instruments and the underlying fixed rate bonds, changes in the fair values of the hedgeditem and the hedging instrument attributable to interest rate movements net off almost completely in the income statement in the same period.Cash flow sensitivity analysis for variable rate instrumentsA change of 100 bps in interest rates at the reporting date would have increased/(decreased) other comprehensive income and the incomestatement by the amounts shown above. This analysis assumes all other variables, in particular foreign currency rates, remain constant. Theanalysis was performed on the same basis for 2009.Interest rate profiles of financial liabilitiesThe following table sets out the contractual repricing included within the underlying borrowings (excluding net borrowings-related derivatives)exposed to either fixed interest rates or floating interest rates and revises this for the repricing effect of interest rate and cross currency swaps.2010 2009Total Effect of Total Total Effect of Totalborrowings derivatives exposure borrowings derivatives exposureUS$m US$m US$m US$m US$m US$mFinancial liabilitiesRepricing due:Within one year 3,399 2,806 6,205 4,836 2,184 7,020Between one and two years 609 – 609 104 (50) 54Between two and five years 3,369 (1,431) 1,938 2,538 (759) 1,779In five years or more 2,037 (1,375) 662 2,140 (1,375) 765Total interest bearing 9,414 – 9,414 9,618 – 9,618Analysed as:Fixed rate interest 6,025 (2,806) 3,219 4,850 (2,034) 2,816Floating rate interest 3,389 2,806 6,195 4,768 2,034 6,802Total interest bearing 9,414 – 9,414 9,618 – 9,618