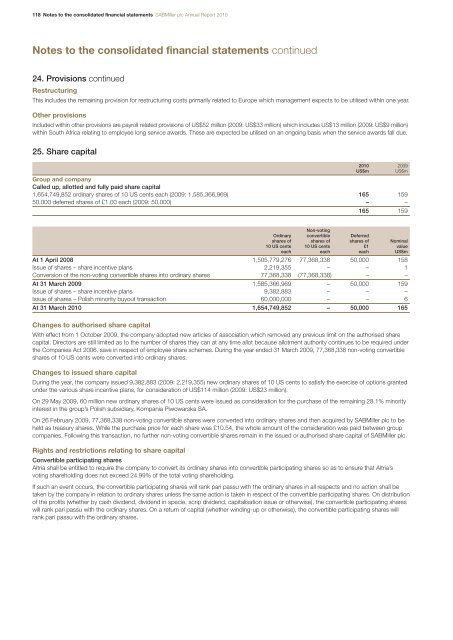

118 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued24. Provisions continuedRestructuringThis includes the remaining provision for restructuring costs primarily related to Europe which management expects to be utilised within one year.Other provisionsIncluded within other provisions are payroll related provisions of US$52 million (2009: US$33 million) which includes US$13 million (2009: US$9 million)within South Africa relating to employee long service awards. These are expected be utilised on an ongoing basis when the service awards fall due.25. Share capital2010 2009US$mUS$mGroup and companyCalled up, allotted and fully paid share capital1,654,749,852 ordinary shares of 10 US cents each (2009: 1,585,366,969) 165 15950,000 deferred shares of £1.00 each (2009: 50,000) – –165 159Non-votingOrdinary convertible Deferredshares of shares of shares of Nominal10 US cents 10 US cents £1 valueeach each each US$mAt 1 April 2008 1,505,779,276 77,368,338 50,000 158Issue of shares – share incentive plans 2,219,355 – – 1Conversion of the non-voting convertible shares into ordinary shares 77,368,338 (77,368,338) – –At 31 March 2009 1,585,366,969 – 50,000 159Issue of shares – share incentive plans 9,382,883 – – –Issue of shares – Polish minority buyout transaction 60,000,000 – – 6At 31 March 2010 1,654,749,852 – 50,000 165Changes to authorised share capitalWith effect from 1 October 2009, the company adopted new articles of association which removed any previous limit on the authorised sharecapital. Directors are still limited as to the number of shares they can at any time allot because allotment authority continues to be required underthe Companies Act 2006, save in respect of employee share schemes. During the year ended 31 March 2009, 77,368,338 non-voting convertibleshares of 10 US cents were converted into ordinary shares.Changes to issued share capitalDuring the year, the company issued 9,382,883 (2009: 2,219,355) new ordinary shares of 10 US cents to satisfy the exercise of options grantedunder the various share incentive plans, for consideration of US$114 million (2009: US$23 million).On 29 May 2009, 60 million new ordinary shares of 10 US cents were issued as consideration for the purchase of the remaining 28.1% minorityinterest in the group’s Polish subsidiary, Kompania Piwowarska SA.On 26 February 2009, 77,368,338 non-voting convertible shares were converted into ordinary shares and then acquired by <strong>SABMiller</strong> plc to beheld as treasury shares. While the purchase price for each share was £10.54, the whole amount of the consideration was paid between groupcompanies. Following this transaction, no further non-voting convertible shares remain in the issued or authorised share capital of <strong>SABMiller</strong> plc.Rights and restrictions relating to share capitalConvertible participating sharesAltria shall be entitled to require the company to convert its ordinary shares into convertible participating shares so as to ensure that Altria’svoting shareholding does not exceed 24.99% of the total voting shareholding.If such an event occurs, the convertible participating shares will rank pari passu with the ordinary shares in all respects and no action shall betaken by the company in relation to ordinary shares unless the same action is taken in respect of the convertible participating shares. On distributionof the profits (whether by cash dividend, dividend in specie, scrip dividend, capitalisation issue or otherwise), the convertible participating shareswill rank pari passu with the ordinary shares. On a return of capital (whether winding-up or otherwise), the convertible participating shares willrank pari passu with the ordinary shares.

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Notes to the consolidated financial statements 11925. Share capital continuedAltria shall be entitled to vote its convertible participating shares at general meetings of the company on a poll on the basis of one-tenth of a votefor every convertible participating share on all resolutions other than a resolution:(i) proposed by any person other than Altria, to wind-up the company;(ii) proposed by any person other than Altria, to appoint an administrator or to approve any arrangement with the company’s creditors;(iii) proposed by the board, to sell all or substantially all of the undertaking of the company; or(iv) proposed by any person other than Altria, to alter any of the class rights attaching to the convertible participating shares or to approvethe creation of any new class of shares, in which case Altria shall be entitled on a poll to vote on the resolution on the basis of one vote foreach convertible participating share, but, for the purposes of any resolution other than a resolution mentioned in (iv) above, the convertibleparticipating shares shall be treated as being of the same class as the ordinary shares and no separate meeting or resolution of the holdersof the convertible participating shares shall be required to be convened or passed.Upon a transfer of convertible participating shares by Altria other than to an affiliate, such convertible participating shares shall convert intoordinary shares.Altria shall be entitled to require the company to convert its convertible participating shares into ordinary shares if:(i) a third party has made a takeover offer for the company and (if such offer becomes or is declared unconditional in all respects) it wouldresult in the voting shareholding of the third party being more than 30% of the total voting shareholding; and(ii) Altria has communicated to the company in writing its intention not itself to make an offer competing with such third party offer, providedthat the conversion date shall be no earlier than the date on which the third party’s offer becomes or is declared unconditional in all respects.Altria shall be entitled to require the company to convert its convertible participating shares into ordinary shares if the voting shareholding ofa third party should be more than 24.99%, provided that:(i) the number of ordinary shares held by Altria following such conversion shall be limited to one ordinary share more than the number ofordinary shares held by the third party; and(ii) such conversion shall at no time result in Altria’s voting shareholding being equal to or greater than the voting shareholding which wouldrequire Altria to make a mandatory offer in terms of rule 9 of the City Code.If Altria wishes to acquire additional ordinary shares (other than pursuant to a pre-emptive issue of new ordinary shares or with the prior approvalof the board), Altria shall first convert into ordinary shares the lesser of:(i) such number of convertible participating shares as would result in Altria’s voting shareholding being such percentage as would, in the eventof Altria subsequently acquiring one additional ordinary share, require Altria to make a mandatory offer in terms of rule 9 of the City Code; and(ii) all of its remaining convertible participating shares.The company shall use its best endeavours to procure that the ordinary shares arising on conversion of the convertible participating sharesare admitted to the Official List and to trading on the London Stock Exchange’s market for listed securities, admitted to listing and trading onthe JSE Securities Exchange South Africa, and admitted to listing and trading on any other stock exchange upon which the ordinary sharesare from time to time listed and traded, but no admission to listing or trading shall be sought for the convertible participating shares whilstthey remain convertible participating shares.Non-voting convertible sharesAt 1 April 2008, Safari, a special purpose vehicle established and financed by a wholly owned subsidiary of <strong>SABMiller</strong> plc, held 77,368,338non-voting convertible shares of US$0.10 each in the capital of the company. On 26 February 2009, these non-voting convertible shares wereconverted into ordinary shares and then acquired by the company to be held as treasury shares. While the purchase price for each share was£10.54, the whole amount of the consideration was paid between group companies. Following this transaction, no further non-voting convertibleshares remain in the issued share capital of the company.Deferred sharesThe deferred shares do not carry any voting rights and do not entitle holders thereof to receive any dividends or other distributions. In the eventof a winding up deferred shareholders would receive no more than the nominal value. Deferred shares represent the only non-equity share capitalof the group.Overview Business review Governance Financial statements Shareholder information