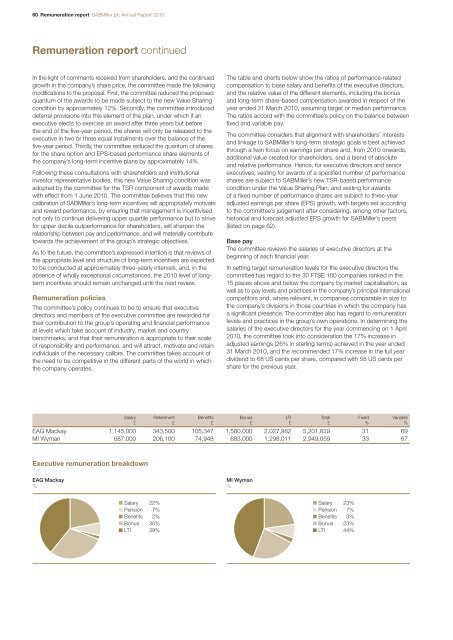

60 Remuneration report <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Remuneration report continuedIn the light of comments received from shareholders, and the continuedgrowth in the company’s share price, the committee made the followingmodifications to the proposal. First, the committee reduced the proposedquantum of the awards to be made subject to the new Value Sharingcondition by approximately 12%. Secondly, the committee introduceddeferral provisions into this element of the plan, under which if anexecutive elects to exercise an award after three years but beforethe end of the five-year period, the shares will only be released to theexecutive in two or three equal instalments over the balance of thefive-year period. Thirdly, the committee reduced the quantum of sharesfor the share option and EPS-based performance share elements ofthe company’s long-term incentive plans by approximately 14%.Following these consultations with shareholders and institutionalinvestor representative bodies, this new Value Sharing condition wasadopted by the committee for the TSR component of awards madewith effect from 1 June 2010. The committee believes that this newcalibration of <strong>SABMiller</strong>’s long-term incentives will appropriately motivateand reward performance, by ensuring that management is incentivisednot only to continue delivering upper quartile performance but to strivefor upper decile outperformance for shareholders, will sharpen therelationship between pay and performance, and will materially contributetowards the achievement of the group’s strategic objectives.As to the future, the committee’s expressed intention is that reviews ofthe appropriate level and structure of long-term incentives are expectedto be conducted at approximately three-yearly intervals, and, in theabsence of wholly exceptional circumstances, the 2010 level of longtermincentives should remain unchanged until the next review.Remuneration policiesThe committee’s policy continues to be to ensure that executivedirectors and members of the executive committee are rewarded fortheir contribution to the group’s operating and financial performanceat levels which take account of industry, market and countrybenchmarks, and that their remuneration is appropriate to their scaleof responsibility and performance, and will attract, motivate and retainindividuals of the necessary calibre. The committee takes account ofthe need to be competitive in the different parts of the world in whichthe company operates.The table and charts below show the ratios of performance-relatedcompensation to base salary and benefits of the executive directors,and the relative value of the different elements, including the bonusand long-term share-based compensation awarded in respect of theyear ended 31 March 2010, assuming target or median performance.The ratios accord with the committee’s policy on the balance betweenfixed and variable pay.The committee considers that alignment with shareholders’ interestsand linkage to <strong>SABMiller</strong>’s long-term strategic goals is best achievedthrough a twin focus on earnings per share and, from 2010 onwards,additional value created for shareholders, and a blend of absoluteand relative performance. Hence, for executive directors and seniorexecutives, vesting for awards of a specified number of performanceshares are subject to <strong>SABMiller</strong>’s new TSR-based performancecondition under the Value Sharing Plan, and vesting for awardsof a fixed number of performance shares are subject to three-yearadjusted earnings per share (EPS) growth, with targets set accordingto the committee’s judgement after considering, among other factors,historical and forecast adjusted EPS growth for <strong>SABMiller</strong>’s peers(listed on page 62).Base payThe committee reviews the salaries of executive directors at thebeginning of each financial year.In setting target remuneration levels for the executive directors thecommittee has regard to the 30 FTSE 100 companies ranked in the15 places above and below the company by market capitalisation, aswell as to pay levels and practices in the company’s principal internationalcompetitors and, where relevant, in companies comparable in size tothe company’s divisions in those countries in which the company hasa significant presence. The committee also has regard to remunerationlevels and practices in the group’s own operations. In determining thesalaries of the executive directors for the year commencing on 1 April2010, the committee took into consideration the 17% increase inadjusted earnings (26% in sterling terms) achieved in the year ended31 March 2010, and the recommended 17% increase in the full yeardividend to 68 US cents per share, compared with 58 US cents pershare for the previous year.Salary Retirement Benefits Bonus LTI Total Fixed Variable£ £ £ £ £ £ % %EAG Mackay 1,145,000 343,500 105,347 1,580,000 2,027,982 5,201,829 31 69MI Wyman 687,000 206,100 74,948 683,000 1,298,011 2,949,059 33 67Executive remuneration breakdownEAG Mackay%MI Wyman%■ Salary 22%■ Pension 7%■ Benefits 2%■ Bonus 30%■ LTI 39%■ Salary 23%■ Pension 7%■ Benefits 3%■ Bonus 23%■ LTI 44%

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Remuneration report 61Details of the salaries applying from 1 April 2010 and the percentagechanges from 31 March 2010 levels for the executive directors areshown in the table below:2010 2011 %Executive directors Salary Salary changeas at 31 March 2010 £ £ from 2010EAG Mackay 1,145,000 1,192,000 4.1MI Wyman 687,000 715,000 4.1The committee also received advice from Kepler Associates, fromthe Chief Executive and from the Group Head of Compensationand Benefits on appropriate pay levels for the other members ofthe company’s executive committee:■ for those executives based in the UK, salaries were determinedby reference to appropriate UK benchmarks; and■ for those executives whose primary responsibilities were foroperations of business units outside the UK, part of base pay wasrelated to appropriate benchmarks in their theatres of operation andthe balance to UK pay levels on the basis that part of their time wasspent on <strong>SABMiller</strong> plc duties and therefore related to the UK andglobal markets.Short-term incentive plansThe executive directors and members of the executive committeeparticipate in an annual short-term incentive plan which deliversa cash bonus upon the achievement of group financial, divisionalfinancial (where applicable), strategic and personal performanceobjectives agreed by the committee. The Chief Executive may earna bonus of up to 175% of base salary. The Chief Financial Officermay earn a bonus of up to 120% of base salary and other executivecommittee members may earn maximum bonuses of between 120%and 150% of their base salary depending upon local market practicesin the locations where they are based.The group financial performance targets for annual incentive plansfor the executive directors and UK-based members of the executivecommittee relate to adjusted EPS growth, EBITA and workingcapital management. The committee believes that linking short-termincentives to profit, earnings per share growth and working capitalmanagement reinforces the company’s business objectives. Thedivisional targets for executive committee members whose primaryresponsibilities are for the operation of business units outside theUK vary according to divisional value drivers derived from groupneeds and include both financial and non-financial targets suchas EBITA, sales volumes, working capital management and otherappropriate measurements. Financial and quantitative performancetargets comprise 60% of the incentive bonus potential. The strategicand personal targets which make up the remaining 40% are specificand measurable, and include a range of specific non-financial keyperformance indicators in appropriate circumstances. In settingindividual strategic and personal targets, the committee has discretionto take into account all factors that it considers appropriate, includingenvironmental, social and governance issues, as noted above.At its meeting on 18 May 2010, the committee reviewed the performanceof the executives participating in the short-term incentive plans. Inlight of the achievement against the group financial targets and thelevels of achievement against their strategic and personal objectives,the committee agreed the level of bonuses in respect of the yearended 31 March 2010 as shown below to the executive directors:2008 2009 2010Bonus Bonus Bonus % of %£ £ £ salary achievementEAG Mackay 1,606,000 888,000 1,580,000 138 79MI Wyman 640,000 400,000 683,000 99 83Long-term incentive plansThe descriptions of the long-term incentive plans in the sectionbelow have been audited.The company has the following share incentive plans currently inactive operation, all of which were approved by shareholders at the2008 AGM. There are also share plans which were introduced at thetime of the company’s primary listing on the London Stock Exchangein 1999, which have now closed and under which no new grants canbe made, although share options which remain outstanding may beexercised until they reach their respective expiry dates in accordancewith the rules that govern the respective share plans, and outstandingperformance share awards which have been granted under the closedplans remain outstanding and pending vesting subject to the attainmentof the respective performance conditions in accordance with their terms.■ Approved Executive Share Option Plan 2008■ Executive Share Option Plan 2008■ South African Executive Share Option Plan 2008■ Executive Share Award Plan 2008■ Stock Appreciation Rights Plan 2008■ Associated Companies Employees Share Plan 2008Share option plansOptions are granted at market price at the time of grant. Optionsgranted under the South African Executive Share Option Plan aredenominated in South African rand and are granted over <strong>SABMiller</strong>plc ordinary shares as traded on the Johannesburg Stock Exchange.Grants of share options are usually made annually to eligible employeeson a discretionary basis taking account of the employee’s performance,future potential and local market practices. Share options typicallyvest over a three-year period and expire on the tenth anniversary ofthe grant date. The table on page 65 gives details of the share optionsheld by executive directors during the year ended 31 March 2010,including details of the performance conditions.For grants made in June 2010, the committee reduced the numberof options granted to the executive directors by approximately 14%compared with the number awarded in May 2009, and Mr Mackayand Mr Wyman were granted 250,000 and 150,000 share optionsrespectively (2009: 290,000 and 175,000 share options respectively).Performance share award plansThe company currently operates the <strong>SABMiller</strong> Executive Share AwardPlan 2008 (the Award Plan) to make awards of performance shares tomembers of the executive committee (including the executive directors)and certain other eligible employees on a discretionary basis takingaccount of the employee’s performance, future potential and localmarket practices. Awards under the Award Plan to members of theexecutive committee in the year ended 31 March 2010 were madein two parts. The first part vests in two tranches on the third and fifthanniversary of the grant date, subject to a relative total shareholderreturn (TSR) based performance condition. The second part of theaward vests in a single tranche on the third anniversary of the grantdate, subject to an earnings per share (EPS) based performancecondition. Further details on performance share awards made toexecutive directors and the respective performance conditions canbe found in the tables on pages 66 and 67.The Award Plan and the older performance share schemes are operatedin conjunction with the company’s Employees’ Benefit Trust (EBT). Thetrustee of the EBT grants awards in consultation with the company.Overview Business review Governance Financial statements Shareholder information