Download all Technical Policy Briefing Notes in a single ... - Mediation

Download all Technical Policy Briefing Notes in a single ... - Mediation

Download all Technical Policy Briefing Notes in a single ... - Mediation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

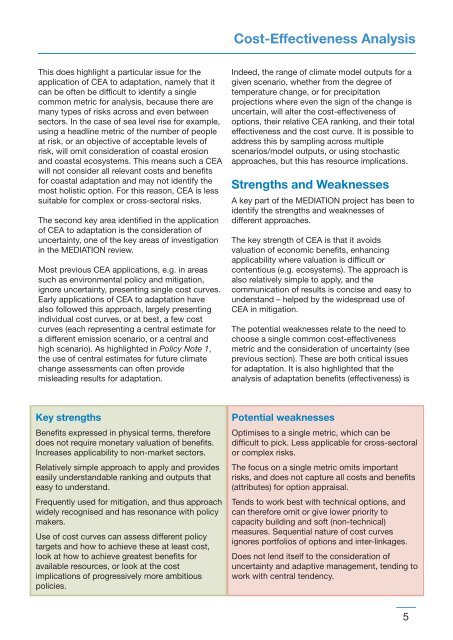

Cost-Effectiveness AnalysisThis does highlight a particular issue for theapplication of CEA to adaptation, namely that itcan be often be difficult to identify a s<strong>in</strong>glecommon metric for analysis, because there aremany types of risks across and even betweensectors. In the case of sea level rise for example,us<strong>in</strong>g a headl<strong>in</strong>e metric of the number of peopleat risk, or an objective of acceptable levels ofrisk, will omit consideration of coastal erosionand coastal ecosystems. This means such a CEAwill not consider <strong>all</strong> relevant costs and benefitsfor coastal adaptation and may not identify themost holistic option. For this reason, CEA is lesssuitable for complex or cross-sectoral risks.The second key area identified <strong>in</strong> the applicationof CEA to adaptation is the consideration ofuncerta<strong>in</strong>ty, one of the key areas of <strong>in</strong>vestigation<strong>in</strong> the MEDIATION review.Most previous CEA applications, e.g. <strong>in</strong> areassuch as environmental policy and mitigation,ignore uncerta<strong>in</strong>ty, present<strong>in</strong>g s<strong>in</strong>gle cost curves.Early applications of CEA to adaptation havealso followed this approach, largely present<strong>in</strong>g<strong>in</strong>dividual cost curves, or at best, a few costcurves (each represent<strong>in</strong>g a central estimate fora different emission scenario, or a central andhigh scenario). As highlighted <strong>in</strong> <strong>Policy</strong> Note 1,the use of central estimates for future climatechange assessments can often providemislead<strong>in</strong>g results for adaptation.Indeed, the range of climate model outputs for agiven scenario, whether from the degree oftemperature change, or for precipitationprojections where even the sign of the change isuncerta<strong>in</strong>, will alter the cost-effectiveness ofoptions, their relative CEA rank<strong>in</strong>g, and their totaleffectiveness and the cost curve. It is possible toaddress this by sampl<strong>in</strong>g across multiplescenarios/model outputs, or us<strong>in</strong>g stochasticapproaches, but this has resource implications.Strengths and WeaknessesA key part of the MEDIATION project has been toidentify the strengths and weaknesses ofdifferent approaches.The key strength of CEA is that it avoidsvaluation of economic benefits, enhanc<strong>in</strong>gapplicability where valuation is difficult orcontentious (e.g. ecosystems). The approach isalso relatively simple to apply, and thecommunication of results is concise and easy tounderstand – helped by the widespread use ofCEA <strong>in</strong> mitigation.The potential weaknesses relate to the need tochoose a s<strong>in</strong>gle common cost-effectivenessmetric and the consideration of uncerta<strong>in</strong>ty (seeprevious section). These are both critical issuesfor adaptation. It is also highlighted that theanalysis of adaptation benefits (effectiveness) isKey strengthsBenefits expressed <strong>in</strong> physical terms, thereforedoes not require monetary valuation of benefits.Increases applicability to non-market sectors.Relatively simple approach to apply and provideseasily understandable rank<strong>in</strong>g and outputs thateasy to understand.Frequently used for mitigation, and thus approachwidely recognised and has resonance with policymakers.Use of cost curves can assess different policytargets and how to achieve these at least cost,look at how to achieve greatest benefits foravailable resources, or look at the costimplications of progressively more ambitiouspolicies.Potential weaknessesOptimises to a s<strong>in</strong>gle metric, which can bedifficult to pick. Less applicable for cross-sectoralor complex risks.The focus on a s<strong>in</strong>gle metric omits importantrisks, and does not capture <strong>all</strong> costs and benefits(attributes) for option appraisal.Tends to work best with technical options, andcan therefore omit or give lower priority tocapacity build<strong>in</strong>g and soft (non-technical)measures. Sequential nature of cost curvesignores portfolios of options and <strong>in</strong>ter-l<strong>in</strong>kages.Does not lend itself to the consideration ofuncerta<strong>in</strong>ty and adaptive management, tend<strong>in</strong>g towork with central tendency.5