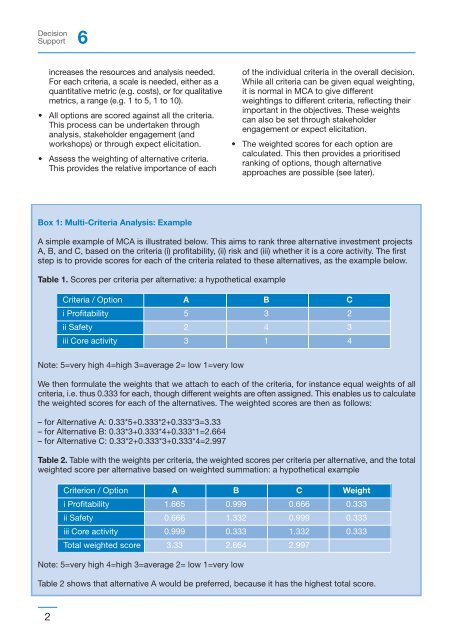

DecisionSupport 6<strong>in</strong>creases the resources and analysis needed.For each criteria, a scale is needed, either as aquantitative metric (e.g. costs), or for qualitativemetrics, a range (e.g. 1 to 5, 1 to 10).• All options are scored aga<strong>in</strong>st <strong>all</strong> the criteria.This process can be undertaken throughanalysis, stakeholder engagement (andworkshops) or through expect elicitation.• Assess the weight<strong>in</strong>g of alternative criteria.This provides the relative importance of eachof the <strong>in</strong>dividual criteria <strong>in</strong> the over<strong>all</strong> decision.While <strong>all</strong> criteria can be given equal weight<strong>in</strong>g,it is normal <strong>in</strong> MCA to give differentweight<strong>in</strong>gs to different criteria, reflect<strong>in</strong>g theirimportant <strong>in</strong> the objectives. These weightscan also be set through stakeholderengagement or expect elicitation.• The weighted scores for each option arecalculated. This then provides a prioritisedrank<strong>in</strong>g of options, though alternativeapproaches are possible (see later).Box 1: Multi-Criteria Analysis: ExampleA simple example of MCA is illustrated below. This aims to rank three alternative <strong>in</strong>vestment projectsA, B, and C, based on the criteria (i) profitability, (ii) risk and (iii) whether it is a core activity. The firststep is to provide scores for each of the criteria related to these alternatives, as the example below.Table 1. Scores per criteria per alternative: a hypothetical exampleCriteria / Option A B Ci Profitability 5 3 2ii Safety 2 4 3iii Core activity 3 1 4Note: 5=very high 4=high 3=average 2= low 1=very lowWe then formulate the weights that we attach to each of the criteria, for <strong>in</strong>stance equal weights of <strong>all</strong>criteria, i.e. thus 0.333 for each, though different weights are often assigned. This enables us to calculatethe weighted scores for each of the alternatives. The weighted scores are then as follows:– for Alternative A: 0.33*5+0.333*2+0.333*3=3.33– for Alternative B: 0.33*3+0.333*4+0.333*1=2.664– for Alternative C: 0.33*2+0.333*3+0.333*4=2.997Table 2. Table with the weights per criteria, the weighted scores per criteria per alternative, and the totalweighted score per alternative based on weighted summation: a hypothetical exampleCriterion / Option A B C Weighti Profitability 1.665 0.999 0.666 0.333ii Safety 0.666 1.332 0.999 0.333iii Core activity 0.999 0.333 1.332 0.333Total weighted score 3.33 2.664 2.997Note: 5=very high 4=high 3=average 2= low 1=very lowTable 2 shows that alternative A would be preferred, because it has the highest total score.2

Multi-Criteria AnalysisIn the implementation of MCA it is important toreflect very carefully on how to score thealternatives and which range of scores should beapplied. It is also essential to make sure that theweighted scores can be added, i.e. <strong>all</strong> criteriashould be formulated <strong>in</strong> positive terms, or <strong>all</strong>criteria should be expressed <strong>in</strong> negative terms.Usu<strong>all</strong>y scores are standardized, so that the highand low levels of the scores represent thejudgement about the performance of thealternatives as precisely as possible. The weightsthen need to be made explicit based on theassessment of the decision makers, or for<strong>in</strong>stance start<strong>in</strong>g from equal weights and thenaccord<strong>in</strong>g to a set of logical and plausibleweights that express the values of variouscategories of stakeholders.This ensures that the impacts of the various setsof weights on the rank<strong>in</strong>g can be assessedtransparently. The process <strong>all</strong>ows decisionmakers to learn about the characteristics of thealternatives and the rank<strong>in</strong>g of the alternativesfor various sets of scores and weights.There are many methods to establish the rank<strong>in</strong>gof the alternatives. The most commonly appliedis the method of weighted summation. However,alternative methods <strong>in</strong>clude pair wisecomparison; Analytic Hierarchy Process (AHP) ormore complicated mathematical methods.Detailed descriptions of these methods areavailable from the sources <strong>in</strong> the further read<strong>in</strong>glist on Multi Criteria Analysis (e.g. Belton andStewart, 2002).Details of the Analytic Hierarchy Processapproach are provided <strong>in</strong> a separate <strong>Policy</strong><strong>Brief<strong>in</strong>g</strong> Note (N o 7).The Application to AdaptationMulti Criteria Analysis has high relevance foradaptation. The criteria can be <strong>in</strong>cluded toconsider the different aspects of uncerta<strong>in</strong>ty aswell as other elements of good adaptation. Asexample, previous adaptation MCAs haveconsidered criteria of robustness, low/no regretcharacteristics or flexibility, as well as cobenefitsand synergies with mitigation.The approach also <strong>all</strong>ows analysis withqualitative <strong>in</strong>formation, which is particularlyuseful given there are often data gaps <strong>in</strong> climatechange adaptation, and/or because there is oftena need to consider additional aspects such asthe acceptability, equity or environmental orsocial performance of options which are difficultto quantify.Applications of MCA to adaptation use some formof climate change <strong>in</strong>formation. In more qualitativestudies, this can use climate model <strong>in</strong>formation tobuild up <strong>in</strong>dications of the future impacts ofclimate change, e.g. <strong>in</strong> terms of changes <strong>in</strong>temperature, weather extremes, runoff and sealevel rise. Similarly the performance of differentadaptation options aga<strong>in</strong>st these risks can beassessed (i.e. scored). An example of thisqualitative type of approach is <strong>in</strong>cluded <strong>in</strong> the casestudy (Van Ierland et al. 2007), which provides anexample of the additional characteristics that canbe <strong>in</strong>cluded for adaptation, i.e. importance,urgency, no regret characteristics, co-benefits andmitigation synergies.It is also possible to undertake MCA <strong>in</strong> a morequalitative climate scenario framework, us<strong>in</strong>gclimate model projections and analysis ofoptions (e.g. costs, effectiveness, performanceaga<strong>in</strong>st wider criteria). An example of thisapproach was undertaken with<strong>in</strong> the ThamesEstuary 2100 (TE2100, EA, 2009) project, whichlooked at future flood defences for London us<strong>in</strong>gvarious sea level rise scenarios. This study useda multi-criteria analysis to complement a formaleconomic cost-benefit analysis. The MCA wasused to consider the data collected as part of theStrategic Environmental Assessment and<strong>in</strong>cluded the heritage, recreation and habitatsensitivity criteria, as well as landscapecharacter and capacity assessments, alongsidecosts and benefits with<strong>in</strong> a Multi Criteria Analysis(scor<strong>in</strong>g & weight<strong>in</strong>g).However, MCA does have some limitations <strong>in</strong>relation to climate change uncerta<strong>in</strong>ty, <strong>in</strong> that ittends to work with <strong>in</strong>dividual scenarios, aga<strong>in</strong>stwhich options are assessed. It is more difficult to<strong>in</strong>corporate the different elements of current andfuture climate risks (the time dimension), and to<strong>in</strong>clude climate change uncerta<strong>in</strong>ty (as well asanalys<strong>in</strong>g how the benefits of differentadaptation options vary aga<strong>in</strong>st differentscenarios), unless multiple runs of the MCA areconducted. The <strong>in</strong>clusion of criteria for howoptions perform aga<strong>in</strong>st uncerta<strong>in</strong>ty can be<strong>in</strong>cluded to address this, but this makes theconsideration of uncerta<strong>in</strong>ty very qualitative.3