Download all Technical Policy Briefing Notes in a single ... - Mediation

Download all Technical Policy Briefing Notes in a single ... - Mediation

Download all Technical Policy Briefing Notes in a single ... - Mediation

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

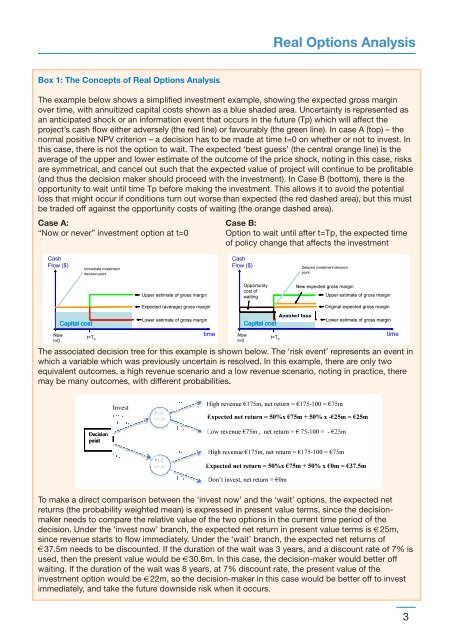

Real Options AnalysisBox 1: The Concepts of Real Options AnalysisThe example below shows a simplified <strong>in</strong>vestment example, show<strong>in</strong>g the expected gross marg<strong>in</strong>over time, with annuitized capital costs shown as a blue shaded area. Uncerta<strong>in</strong>ty is represented asan anticipated shock or an <strong>in</strong>formation event that occurs <strong>in</strong> the future (Tp) which will affect theproject’s cash flow either adversely (the red l<strong>in</strong>e) or favourably (the green l<strong>in</strong>e). In case A (top) – thenormal positive NPV criterion – a decision has to be made at time t=0 on whether or not to <strong>in</strong>vest. Inthis case, there is not the option to wait. The expected ‘best guess’ (the central orange l<strong>in</strong>e) is theaverage of the upper and lower estimate of the outcome of the price shock, not<strong>in</strong>g <strong>in</strong> this case, risksare symmetrical, and cancel out such that the expected value of project will cont<strong>in</strong>ue to be profitable(and thus the decision maker should proceed with the <strong>in</strong>vestment). In Case B (bottom), there is theopportunity to wait until time Tp before mak<strong>in</strong>g the <strong>in</strong>vestment. This <strong>all</strong>ows it to avoid the potenti<strong>all</strong>oss that might occur if conditions turn out worse than expected (the red dashed area), but this mustbe traded off aga<strong>in</strong>st the opportunity costs of wait<strong>in</strong>g (the orange dashed area).Case A: Case B:“Now or never” <strong>in</strong>vestment option at t=0 Option to wait until after t=Tp, the expected timeof policy change that affects the <strong>in</strong>vestmentThe associated decision tree for this example is shown below. The ‘risk event’ represents an event <strong>in</strong>which a variable which was previously uncerta<strong>in</strong> is resolved. In this example, there are only twoequivalent outcomes, a high revenue scenario and a low revenue scenario, not<strong>in</strong>g <strong>in</strong> practice, theremay be many outcomes, with different probabilities.To make a direct comparison between the ‘<strong>in</strong>vest now’ and the ‘wait’ options, the expected netreturns (the probability weighted mean) is expressed <strong>in</strong> present value terms, s<strong>in</strong>ce the decisionmakerneeds to compare the relative value of the two options <strong>in</strong> the current time period of thedecision. Under the ‘<strong>in</strong>vest now’ branch, the expected net return <strong>in</strong> present value terms is €25m,s<strong>in</strong>ce revenue starts to flow immediately. Under the ‘wait’ branch, the expected net returns of€37.5m needs to be discounted. If the duration of the wait was 3 years, and a discount rate of 7% isused, then the present value would be €30.6m. In this case, the decision-maker would better offwait<strong>in</strong>g. If the duration of the wait was 8 years, at 7% discount rate, the present value of the<strong>in</strong>vestment option would be €22m, so the decision-maker <strong>in</strong> this case would be better off to <strong>in</strong>vestimmediately, and take the future downside risk when it occurs.3