2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

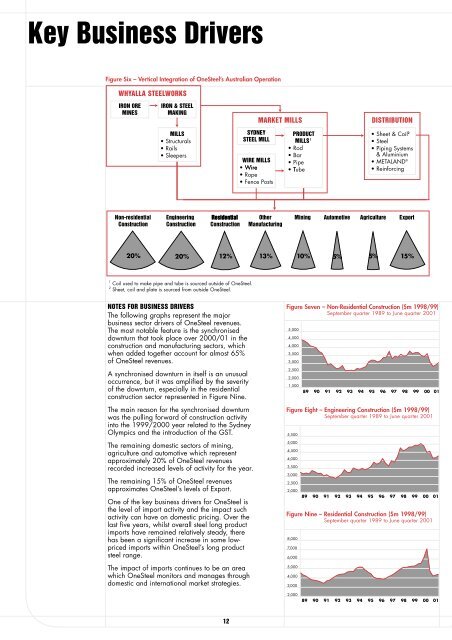

Key Business DriversFigure Six – Vertical Integration of <strong>OneSteel</strong>’s Australian OperationWHYALLA STEELWORKSIRON OREMINESIRON & STEELMAKINGMARKET MILLSDISTRIBUTIONMILLS• Structurals• Rails• SleepersSYDNEYSTEEL MILLWIRE MILLS• Wire• Rope• Fence PostsPRODUCT1MILLS• Rod• Bar• Pipe• Tube• Sheet & Coil 2• Steel• Piping Systems& Aluminium• METALAND ®• ReinforcingNon-residentialConstructionEngineeringConstructionResidential Other Mining Automotive AgricultureConstruction ManufacturingExport20% 20% 12% 13% 10% 5% 5% 15%1 Coil used to make pipe and tube is sourced outside of <strong>OneSteel</strong>.2 Sheet, coil and plate is sourced from outside <strong>OneSteel</strong>.NOTES FOR BUSINESS DRIVERSThe following graphs represent the majorbusiness sector drivers of <strong>OneSteel</strong> revenues.The most notable feature is the synchroniseddownturn that took place over 2000/01 in theconstruction and manufacturing sectors, whichwhen added together account for almost 65%of <strong>OneSteel</strong> revenues.A synchronised downturn in itself is an unusualoccurrence, but it was amplified by the severityof the downturn, especially in the residentialconstruction sector represented in Figure Nine.The main reason for the synchronised downturnwas the pulling forward of construction activityinto the 1999/2000 year related to the SydneyOlympics and the introduction of the GST.The remaining domestic sectors of mining,agriculture and automotive which representapproximately 20% of <strong>OneSteel</strong> revenuesrecorded increased levels of activity for the year.The remaining 15% of <strong>OneSteel</strong> revenuesapproximates <strong>OneSteel</strong>’s levels of Export.One of the key business drivers for <strong>OneSteel</strong> isthe level of import activity and the impact suchactivity can have on domestic pricing. Over thelast five years, whilst overall steel long productimports have remained relatively steady, therehas been a significant increase in some lowpricedimports within <strong>OneSteel</strong>’s long productsteel range.The impact of imports continues to be an areawhich <strong>OneSteel</strong> monitors and manages throughdomestic and international market strategies.Figure Seven – Non-Residential Construction ($m 1998/99)September quarter 1989 to June quarter <strong>2001</strong>5,0004,5004,0003,5003,0002,5002,0001,500Figure Eight – Engineering Construction ($m 1998/99)September quarter 1989 to June quarter <strong>2001</strong>5,5005,0004,5004,0003,5003,0002,5002,00089 90 91 92 93 94 95 96 97 98 99 00 018,0007,0006,0005,0004,0003,00089 90 91 92 93 94 95 96 97 98 99 00 01Figure Nine – Residential Construction ($m 1998/99)September quarter 1989 to June quarter <strong>2001</strong>2,00089 90 91 92 93 94 95 96 97 98 99 00 0112