2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

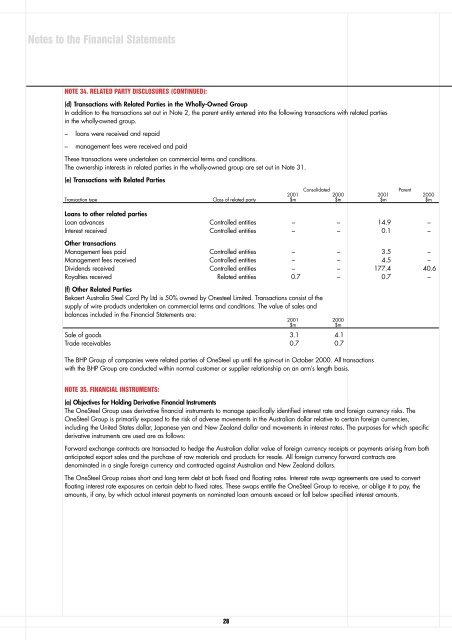

Notes to the Financial StatementsNOTE 34. RELATED PARTY DISCLOSURES (CONTINUED):(d) Transactions with Related Parties in the Wholly-Owned GroupIn addition to the transactions set out in Note 2, the parent entity entered into the following transactions with related partiesin the wholly-owned group.– loans were received and repaid– management fees were received and paidThese transactions were undertaken on commercial terms and conditions.The ownership interests in related parties in the wholly-owned group are set out in Note 31.(e) Transactions with Related PartiesConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000Transaction type Class of related party $m $m $m $mLoans to other related partiesLoan advances Controlled entities – – 14.9 –Interest received Controlled entities – – 0.1 –Other transactionsManagement fees paid Controlled entities – – 3.5 –Management fees received Controlled entities – – 4.5 –Dividends received Controlled entities – – 177.4 40.6Royalties received Related entities 0.7 – 0.7 –(f) Other Related PartiesBekaert Australia Steel Cord Pty Ltd is 50% owned by Onesteel Limited. Transactions consist of thesupply of wire products undertaken on commercial terms and conditions. The value of sales andbalances included in the Financial Statements are:<strong>2001</strong> 2000$m $mSale of goods 3.1 4.1Trade receivables 0.7 0.7The BHP Group of companies were related parties of <strong>OneSteel</strong> up until the spin-out in October 2000. All transactionswith the BHP Group are conducted within normal customer or supplier relationship on an arm’s length basis.NOTE 35. FINANCIAL INSTRUMENTS:(a) Objectives for Holding Derivative Financial InstrumentsThe <strong>OneSteel</strong> Group uses derivative financial instruments to manage specifically identified interest rate and foreign currency risks. The<strong>OneSteel</strong> Group is primarily exposed to the risk of adverse movements in the Australian dollar relative to certain foreign currencies,including the United States dollar, Japanese yen and New Zealand dollar and movements in interest rates. The purposes for which specificderivative instruments are used are as follows:Forward exchange contracts are transacted to hedge the Australian dollar value of foreign currency receipts or payments arising from bothanticipated export sales and the purchase of raw materials and products for resale. All foreign currency forward contracts aredenominated in a single foreign currency and contracted against Australian and New Zealand dollars.The <strong>OneSteel</strong> Group raises short and long term debt at both fixed and floating rates. Interest rate swap agreements are used to convertfloating interest rate exposures on certain debt to fixed rates. These swaps entitle the <strong>OneSteel</strong> Group to receive, or oblige it to pay, theamounts, if any, by which actual interest payments on nominated loan amounts exceed or fall below specified interest amounts.28