2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

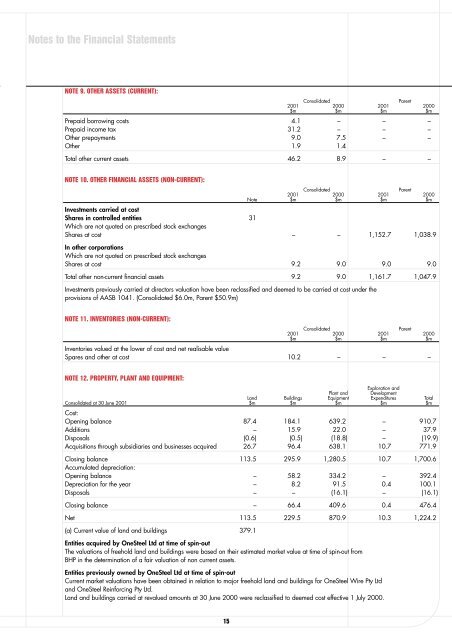

Notes to the Financial StatementsNOTE 9. OTHER ASSETS (CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mPrepaid borrowing costs 4.1 – – –Prepaid income tax 31.2 – – –Other prepayments 9.0 7.5 – –Other 1.9 1.4Total other current assets 46.2 8.9 – –NOTE 10. OTHER FINANCIAL ASSETS (NON-CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000Note $m $m $m $mInvestments carried at costShares in controlled entities 31Which are not quoted on prescribed stock exchangesShares at cost – – 1,152.7 1,038.9In other corporationsWhich are not quoted on prescribed stock exchangesShares at cost 9.2 9.0 9.0 9.0Total other non-current financial assets 9.2 9.0 1,161.7 1,047.9Investments previously carried at directors valuation have been reclassified and deemed to be carried at cost under theprovisions of AASB 1041. (Consolidated $6.0m, Parent $50.9m)NOTE 11. INVENTORIES (NON-CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mInventories valued at the lower of cost and net realisable valueSpares and other at cost 10.2 – – –NOTE 12. PROPERTY, PLANT AND EQUIPMENT:Exploration andPlant and DevelopmentLand Buildings Equipment Expenditures TotalConsolidated at 30 June <strong>2001</strong> $m $m $m $m $mCost:Opening balance 87.4 184.1 639.2 – 910.7Additions – 15.9 22.0 – 37.9Disposals (0.6) (0.5) (18.8) – (19.9)Acquisitions through subsidiaries and businesses acquired 26.7 96.4 638.1 10.7 771.9Closing balance 113.5 295.9 1,280.5 10.7 1,700.6Accumulated depreciation:Opening balance – 58.2 334.2 – 392.4Depreciation for the year – 8.2 91.5 0.4 100.1Disposals – – (16.1) – (16.1)Closing balance – 66.4 409.6 0.4 476.4Net 113.5 229.5 870.9 10.3 1,224.2(a) Current value of land and buildings 379.1Entities acquired by <strong>OneSteel</strong> Ltd at time of spin-outThe valuations of freehold land and buildings were based on their estimated market value at time of spin-out fromBHP in the determination of a fair valuation of non current assets.Entities previously owned by <strong>OneSteel</strong> Ltd at time of spin-outCurrent market valuations have been obtained in relation to major freehold land and buildings for <strong>OneSteel</strong> Wire Pty Ltdand <strong>OneSteel</strong> Reinforcing Pty Ltd.Land and buildings carried at revalued amounts at 30 June 2000 were reclassified to deemed cost effective 1 July 2000.15