2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

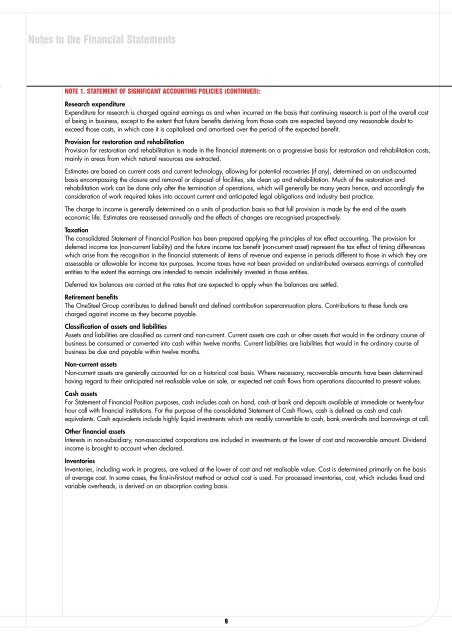

Notes to the Financial StatementsNOTE 1. STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED):Research expenditureExpenditure for research is charged against earnings as and when incurred on the basis that continuing research is part of the overall costof being in business, except to the extent that future benefits deriving from those costs are expected beyond any reasonable doubt toexceed those costs, in which case it is capitalised and amortised over the period of the expected benefit.Provision for restoration and rehabilitationProvision for restoration and rehabilitation is made in the financial statements on a progressive basis for restoration and rehabilitation costs,mainly in areas from which natural resources are extracted.Estimates are based on current costs and current technology, allowing for potential recoveries (if any), determined on an undiscountedbasis encompassing the closure and removal or disposal of facilities, site clean up and rehabilitation. Much of the restoration andrehabilitation work can be done only after the termination of operations, which will generally be many years hence, and accordingly theconsideration of work required takes into account current and anticipated legal obligations and industry best practice.The charge to income is generally determined on a units of production basis so that full provision is made by the end of the assetseconomic life. Estimates are reassessed annually and the effects of changes are recognised prospectively.TaxationThe consolidated Statement of Financial Position has been prepared applying the principles of tax effect accounting. The provision fordeferred income tax (non-current liability) and the future income tax benefit (non-current asset) represent the tax effect of timing differenceswhich arise from the recognition in the financial statements of items of revenue and expense in periods different to those in which they areassessable or allowable for income tax purposes. Income taxes have not been provided on undistributed overseas earnings of controlledentities to the extent the earnings are intended to remain indefinitely invested in those entities.Deferred tax balances are carried at the rates that are expected to apply when the balances are settled.Retirement benefitsThe <strong>OneSteel</strong> Group contributes to defined benefit and defined contribution superannuation plans. Contributions to these funds arecharged against income as they become payable.Classification of assets and liabilitiesAssets and liabilities are classified as current and non-current. Current assets are cash or other assets that would in the ordinary course ofbusiness be consumed or converted into cash within twelve months. Current liabilities are liabilities that would in the ordinary course ofbusiness be due and payable within twelve months.Non-current assetsNon-current assets are generally accounted for on a historical cost basis. Where necessary, recoverable amounts have been determinedhaving regard to their anticipated net realisable value on sale, or expected net cash flows from operations discounted to present values.Cash assetsFor Statement of Financial Position purposes, cash includes cash on hand, cash at bank and deposits available at immediate or twenty-fourhour call with financial institutions. For the purpose of the consolidated Statement of Cash Flows, cash is defined as cash and cashequivalents. Cash equivalents include highly liquid investments which are readily convertible to cash, bank overdrafts and borrowings at call.Other financial assetsInterests in non-subsidiary, non-associated corporations are included in investments at the lower of cost and recoverable amount. Dividendincome is brought to account when declared.InventoriesInventories, including work in progress, are valued at the lower of cost and net realisable value. Cost is determined primarily on the basisof average cost. In some cases, the first-in-first-out method or actual cost is used. For processed inventories, cost, which includes fixed andvariable overheads, is derived on an absorption costing basis.9