2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

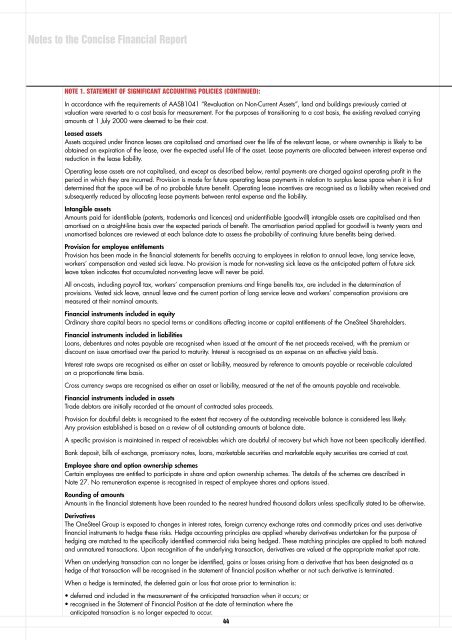

Notes to the Concise Financial <strong>Report</strong>NOTE 1. STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED):In accordance with the requirements of AASB1041 “Revaluation on Non-Current Assets”, land and buildings previously carried atvaluation were reverted to a cost basis for measurement. For the purposes of transitioning to a cost basis, the existing revalued carryingamounts at 1 July 2000 were deemed to be their cost.Leased assetsAssets acquired under finance leases are capitalised and amortised over the life of the relevant lease, or where ownership is likely to beobtained on expiration of the lease, over the expected useful life of the asset. Lease payments are allocated between interest expense andreduction in the lease liability.Operating lease assets are not capitalised, and except as described below, rental payments are charged against operating profit in theperiod in which they are incurred. Provision is made for future operating lease payments in relation to surplus lease space when it is firstdetermined that the space will be of no probable future benefit. Operating lease incentives are recognised as a liability when received andsubsequently reduced by allocating lease payments between rental expense and the liability.Intangible assetsAmounts paid for identifiable (patents, trademarks and licences) and unidentifiable (goodwill) intangible assets are capitalised and thenamortised on a straight-line basis over the expected periods of benefit. The amortisation period applied for goodwill is twenty years andunamortised balances are reviewed at each balance date to assess the probability of continuing future benefits being derived.Provision for employee entitlementsProvision has been made in the financial statements for benefits accruing to employees in relation to annual leave, long service leave,workers’ compensation and vested sick leave. No provision is made for non-vesting sick leave as the anticipated pattern of future sickleave taken indicates that accumulated non-vesting leave will never be paid.All on-costs, including payroll tax, workers’ compensation premiums and fringe benefits tax, are included in the determination ofprovisions. Vested sick leave, annual leave and the current portion of long service leave and workers’ compensation provisions aremeasured at their nominal amounts.Financial instruments included in equityOrdinary share capital bears no special terms or conditions affecting income or capital entitlements of the <strong>OneSteel</strong> Shareholders.Financial instruments included in liabilitiesLoans, debentures and notes payable are recognised when issued at the amount of the net proceeds received, with the premium ordiscount on issue amortised over the period to maturity. Interest is recognised as an expense on an effective yield basis.Interest rate swaps are recognised as either an asset or liability, measured by reference to amounts payable or receivable calculatedon a proportionate time basis.Cross currency swaps are recognised as either an asset or liability, measured at the net of the amounts payable and receivable.Financial instruments included in assetsTrade debtors are initially recorded at the amount of contracted sales proceeds.Provision for doubtful debts is recognised to the extent that recovery of the outstanding receivable balance is considered less likely.Any provision established is based on a review of all outstanding amounts at balance date.A specific provision is maintained in respect of receivables which are doubtful of recovery but which have not been specifically identified.Bank deposit, bills of exchange, promissory notes, loans, marketable securities and marketable equity securities are carried at cost.Employee share and option ownership schemesCertain employees are entitled to participate in share and option ownership schemes. The details of the schemes are described inNote 27. No remuneration expense is recognised in respect of employee shares and options issued.Rounding of amountsAmounts in the financial statements have been rounded to the nearest hundred thousand dollars unless specifically stated to be otherwise.DerivativesThe <strong>OneSteel</strong> Group is exposed to changes in interest rates, foreign currency exchange rates and commodity prices and uses derivativefinancial instruments to hedge these risks. Hedge accounting principles are applied whereby derivatives undertaken for the purpose ofhedging are matched to the specifically identified commercial risks being hedged. These matching principles are applied to both maturedand unmatured transactions. Upon recognition of the underlying transaction, derivatives are valued at the appropriate market spot rate.When an underlying transaction can no longer be identified, gains or losses arising from a derivative that has been designated as ahedge of that transaction will be recognised in the statement of financial position whether or not such derivative is terminated.When a hedge is terminated, the deferred gain or loss that arose prior to termination is:• deferred and included in the measurement of the anticipated transaction when it occurs; or• recognised in the Statement of Financial Position at the date of termination where theanticipated transaction is no longer expected to occur.44