2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

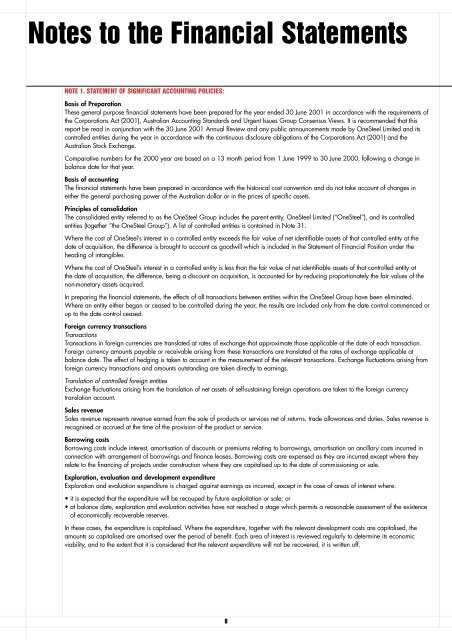

Notes to the Financial StatementsNOTE 1. STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES:Basis of PreparationThese general purpose financial statements have been prepared for the year ended 30 June <strong>2001</strong> in accordance with the requirements ofthe Corporations Act (<strong>2001</strong>), Australian Accounting Standards and Urgent Issues Group Consensus Views. It is recommended that thisreport be read in conjunction with the 30 June <strong>2001</strong> <strong>Annual</strong> Review and any public announcements made by <strong>OneSteel</strong> Limited and itscontrolled entities during the year in accordance with the continuous disclosure obligations of the Corporations Act (<strong>2001</strong>) and theAustralian Stock Exchange.Comparative numbers for the 2000 year are based on a 13 month period from 1 June 1999 to 30 June 2000, following a change inbalance date for that year.Basis of accountingThe financial statements have been prepared in accordance with the historical cost convention and do not take account of changes ineither the general purchasing power of the Australian dollar or in the prices of specific assets.Principles of consolidationThe consolidated entity referred to as the <strong>OneSteel</strong> Group includes the parent entity, <strong>OneSteel</strong> Limited (“<strong>OneSteel</strong>”), and its controlledentities (together “the <strong>OneSteel</strong> Group”). A list of controlled entities is contained in Note 31.Where the cost of <strong>OneSteel</strong>’s interest in a controlled entity exceeds the fair value of net identifiable assets of that controlled entity at thedate of acquisition, the difference is brought to account as goodwill which is included in the Statement of Financial Position under theheading of intangibles.Where the cost of <strong>OneSteel</strong>’s interest in a controlled entity is less than the fair value of net identifiable assets of that controlled entity atthe date of acquisition, the difference, being a discount on acquisition, is accounted for by reducing proportionately the fair values of thenon-monetary assets acquired.In preparing the financial statements, the effects of all transactions between entities within the <strong>OneSteel</strong> Group have been eliminated.Where an entity either began or ceased to be controlled during the year, the results are included only from the date control commenced orup to the date control ceased.Foreign currency transactionsTransactionsTransactions in foreign currencies are translated at rates of exchange that approximate those applicable at the date of each transaction.Foreign currency amounts payable or receivable arising from these transactions are translated at the rates of exchange applicable atbalance date. The effect of hedging is taken to account in the measurement of the relevant transactions. Exchange fluctuations arising fromforeign currency transactions and amounts outstanding are taken directly to earnings.Translation of controlled foreign entitiesExchange fluctuations arising from the translation of net assets of self-sustaining foreign operations are taken to the foreign currencytranslation account.Sales revenueSales revenue represents revenue earned from the sale of products or services net of returns, trade allowances and duties. Sales revenue isrecognised or accrued at the time of the provision of the product or service.Borrowing costsBorrowing costs include interest, amortisation of discounts or premiums relating to borrowings, amortisation on ancillary costs incurred inconnection with arrangement of borrowings and finance leases. Borrowing costs are expensed as they are incurred except where theyrelate to the financing of projects under construction where they are capitalised up to the date of commissioning or sale.Exploration, evaluation and development expenditureExploration and evaluation expenditure is charged against earnings as incurred, except in the case of areas of interest where:• it is expected that the expenditure will be recouped by future exploitation or sale; or• at balance date, exploration and evaluation activities have not reached a stage which permits a reasonable assessment of the existenceof economically recoverable reserves.In these cases, the expenditure is capitalised. Where the expenditure, together with the relevant development costs are capitalised, theamounts so capitalised are amortised over the period of benefit. Each area of interest is reviewed regularly to determine its economicviability, and to the extent that it is considered that the relevant expenditure will not be recovered, it is written off.8