2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

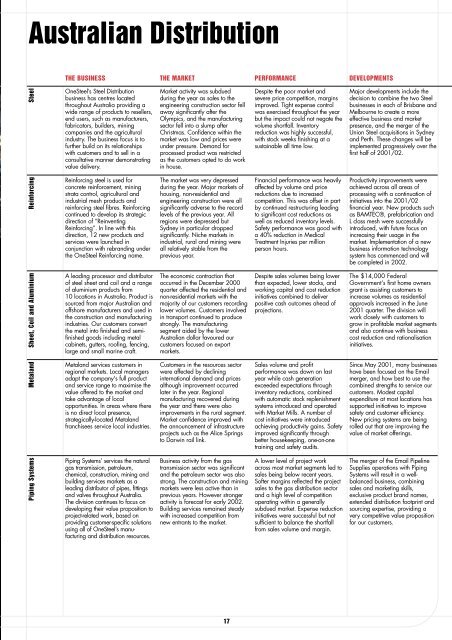

Australian DistributionTHE BUSINESS THE MARKET PERFORMANCE DEVELOPMENTSSheet, Coil and Aluminium ReinforcingSteel<strong>OneSteel</strong>’s Steel Distributionbusiness has centres locatedthroughout Australia providing awide range of products to resellers,end users, such as manufacturers,fabricators, builders, miningcompanies and the agriculturalindustry. The business focus is tofurther build on its relationshipswith customers and to sell in aconsultative manner demonstratingvalue delivery.Reinforcing steel is used forconcrete reinforcement, miningstrata control, agricultural andindustrial mesh products andreinforcing steel fibres. Reinforcingcontinued to develop its strategicdirection of “ReinventingReinforcing”. In line with thisdirection, 12 new products andservices were launched inconjunction with rebranding underthe <strong>OneSteel</strong> Reinforcing name.A leading processor and distributorof steel sheet and coil and a rangeof aluminium products from10 locations in Australia. Product issourced from major Australian andoffshore manufacturers and used inthe construction and manufacturingindustries. Our customers convertthe metal into finished and semifinishedgoods including metalcabinets, gutters, roofing, fencing,large and small marine craft.Market activity was subduedduring the year as sales to theengineering construction sector fellaway significantly after theOlympics, and the manufacturingsector fell into a slump afterChristmas. Confidence within themarket was low and prices wereunder pressure. Demand forprocessed product was restrictedas the customers opted to do workin house.The market was very depressedduring the year. Major markets ofhousing, non-residential andengineering construction were allsignificantly adverse to the recordlevels of the previous year. Allregions were depressed butSydney in particular droppedsignificantly. Niche markets inindustrial, rural and mining wereall relatively stable from theprevious year.The economic contraction thatoccurred in the December 2000quarter affected the residential andnon-residential markets with themajority of our customers recordinglower volumes. Customers involvedin transport continued to producestrongly. The manufacturingsegment aided by the lowerAustralian dollar favoured ourcustomers focused on exportmarkets.Despite the poor market andsevere price competition, marginsimproved. Tight expense controlwas exercised throughout the yearbut the impact could not negate thevolume shortfall. Inventoryreduction was highly successful,with stock weeks finishing at asustainable all time low.Financial performance was heavilyaffected by volume and pricereductions due to increasedcompetition. This was offset in partby continued restructuring leadingto significant cost reductions aswell as reduced inventory levels.Safety performance was good witha 40% reduction in MedicalTreatment Injuries per millionperson hours.Despite sales volumes being lowerthan expected, lower stocks, andworking capital and cost reductioninitiatives combined to deliverpositive cash outcomes ahead ofprojections.Major developments include thedecision to combine the two Steelbusinesses in each of Brisbane andMelbourne to create a moreeffective business and marketpresence, and the merger of theUnion Steel acquisitions in Sydneyand Perth. These changes will beimplemented progressively over thefirst half of <strong>2001</strong>/02.Productivity improvements wereachieved across all areas ofprocessing with a continuation ofinitiatives into the <strong>2001</strong>/02financial year. New products suchas BAMTEC®, prefabrication andL class mesh were successfullyintroduced, with future focus onincreasing their usage in themarket. Implementation of a newbusiness information technologysystem has commenced and willbe completed in 2002.The $14,000 FederalGovernment’s first home ownersgrant is assisting customers toincrease volumes as residentialapprovals increased in the June<strong>2001</strong> quarter. The division willwork closely with customers togrow in profitable market segmentsand also continue with businesscost reduction and rationalisationinitiatives.MetalandMetaland services customers inregional markets. Local managersadapt the company's full productand service range to maximise thevalue offered to the market andtake advantage of localopportunities. In areas where thereis no direct local presence,strategically-located Metalandfranchisees service local industries.Customers in the resources sectorwere affected by declininginternational demand and pricesalthough improvement occurredlater in the year. Regionalmanufacturing recovered duringthe year and there were alsoimprovements in the rural segment.Market confidence improved withthe announcement of infrastructureprojects such as the Alice Springsto Darwin rail link.Sales volume and profitperformance was down on lastyear while cash generationexceeded expectations throughinventory reductions, combinedwith automatic stock replenishmentsystems introduced and operatedwith Market Mills. A number ofcost initiatives were introducedachieving productivity gains. Safetyimproved significantly throughbetter housekeeping, one-on-onetraining and safety audits.Since May <strong>2001</strong>, many businesseshave been focused on the Emailmerger, and how best to use thecombined strengths to service ourcustomers. Modest capitalexpenditure at most locations hassupported initiatives to improvesafety and customer efficiency.New pricing systems are beingrolled out that are improving thevalue of market offerings.Piping SystemsPiping Systems’ services the naturalgas transmission, petroleum,chemical, construction, mining andbuilding services markets as aleading distributor of pipes, fittingsand valves throughout Australia.The division continues to focus ondeveloping their value proposition toproject-related work, based onproviding customer-specific solutionsusing all of <strong>OneSteel</strong>’s manufacturingand distribution resources.Business activity from the gastransmission sector was significantand the petroleum sector was alsostrong. The construction and miningmarkets were less active than inprevious years. However strongeractivity is forecast for early 2002.Building services remained steadywith increased competition fromnew entrants to the market.A lower level of project workacross most market segments led tosales being below recent years.Softer margins reflected the projectsales to the gas distribution sectorand a high level of competitionoperating within a generallysubdued market. Expense reductioninitiatives were successful but notsufficient to balance the shortfallfrom sales volume and margin.The merger of the Email PipelineSupplies operations with PipingSystems will result in a wellbalancedbusiness, combiningsales and marketing skills,exclusive product brand names,extended distribution footprint andsourcing expertise, providing avery competitive value propositionfor our customers.17