2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

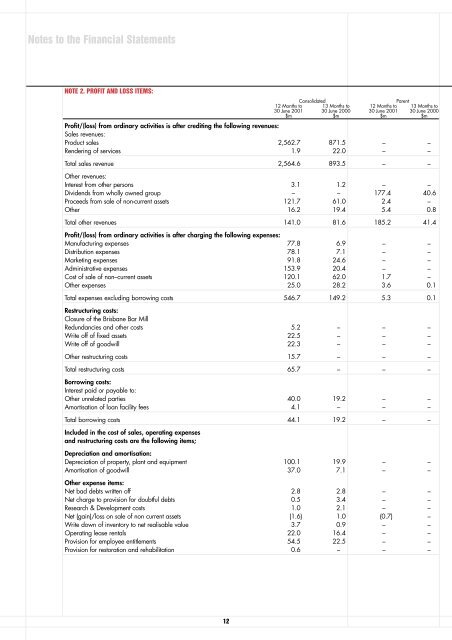

Notes to the Financial StatementsNOTE 2. PROFIT AND LOSS ITEMS:ConsolidatedParent12 Months to 13 Months to 12 Months to 13 Months to30 June <strong>2001</strong> 30 June 2000 30 June <strong>2001</strong> 30 June 2000$m $m $m $mProfit/(loss) from ordinary activities is after crediting the following revenues:Sales revenues:Product sales 2,562.7 871.5 – –Rendering of services 1.9 22.0 – –Total sales revenue 2,564.6 893.5 – –Other revenues:Interest from other persons 3.1 1.2 – –Dividends from wholly owned group – – 177.4 40.6Proceeds from sale of non-current assets 121.7 61.0 2.4 –Other 16.2 19.4 5.4 0.8Total other revenues 141.0 81.6 185.2 41.4Profit/(loss) from ordinary activities is after charging the following expenses:Manufacturing expenses 77.8 6.9 – –Distribution expenses 78.1 7.1 – –Marketing expenses 91.8 24.6 – –Administrative expenses 153.9 20.4 – –Cost of sale of non–current assets 120.1 62.0 1.7 –Other expenses 25.0 28.2 3.6 0.1Total expenses excluding borrowing costs 546.7 149.2 5.3 0.1Restructuring costs:Closure of the Brisbane Bar MillRedundancies and other costs 5.2 – – –Write off of fixed assets 22.5 – – –Write off of goodwill 22.3 – – –Other restructuring costs 15.7 – – –Total restructuring costs 65.7 – – –Borrowing costs:Interest paid or payable to:Other unrelated parties 40.0 19.2 – –Amortisation of loan facility fees 4.1 – – –Total borrowing costs 44.1 19.2 – –Included in the cost of sales, operating expensesand restructuring costs are the following items;Depreciation and amortisation:Depreciation of property, plant and equipment 100.1 19.9 – –Amortisation of goodwill 37.0 7.1 – –Other expense items:Net bad debts written off 2.8 2.8 – –Net charge to provision for doubtful debts 0.5 3.4 – –Research & Development costs 1.0 2.1 – –Net (gain)/loss on sale of non current assets (1.6) 1.0 (0.7) –Write down of inventory to net realisable value 3.7 0.9 – –Operating lease rentals 22.0 16.4 – –Provision for employee entitlements 54.5 22.5 – –Provision for restoration and rehabilitation 0.6 – – –12