2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

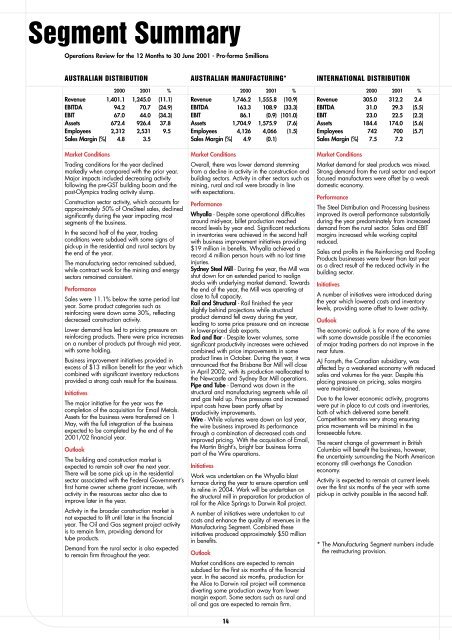

Segment SummaryOperations Review for the 12 Months to 30 June <strong>2001</strong> - Pro-forma $millionsAUSTRALIAN DISTRIBUTION AUSTRALIAN MANUFACTURING* INTERNATIONAL DISTRIBUTION2000 <strong>2001</strong> %Revenue 1,401.1 1,245.0 (11.1)EBITDA 94.2 70.7 (24.9)EBIT 67.0 44.0 (34.3)Assets 672.4 926.4 37.8Employees 2,312 2,531 9.5Sales Margin (%) 4.8 3.5Market ConditionsTrading conditions for the year declinedmarkedly when compared with the prior year.Major impacts included decreasing activityfollowing the pre-GST building boom and thepost-Olympics trading activity slump.Construction sector activity, which accounts forapproximately 50% of <strong>OneSteel</strong> sales, declinedsignificantly during the year impacting mostsegments of the business.In the second half of the year, tradingconditions were subdued with some signs ofpick-up in the residential and rural sectors bythe end of the year.The manufacturing sector remained subdued,while contract work for the mining and energysectors remained consistent.PerformanceSales were 11.1% below the same period lastyear. Some product categories such asreinforcing were down some 30%, reflectingdecreased construction activity.Lower demand has led to pricing pressure onreinforcing products. There were price increaseson a number of products put through mid year,with some holding.Business improvement initiatives provided inexcess of $13 million benefit for the year whichcombined with significant inventory reductionsprovided a strong cash result for the business.InitiativesThe major initiative for the year was thecompletion of the acquisition for Email Metals.Assets for the business were transferred on 1May, with the full integration of the businessexpected to be completed by the end of the<strong>2001</strong>/02 financial year.OutlookThe building and construction market isexpected to remain soft over the next year.There will be some pick up in the residentialsector associated with the Federal Government’sfirst home owner scheme grant increase, withactivity in the resources sector also due toimprove later in the year.Activity in the broader construction market isnot expected to lift until later in the financialyear. The Oil and Gas segment project activityis to remain firm, providing demand fortube products.Demand from the rural sector is also expectedto remain firm throughout the year.2000 <strong>2001</strong> %Revenue 1,746.2 1,555.8 (10.9)EBITDA 163.3 108.9 (33.3)EBIT 86.1 (0.9) (101.0)Assets 1,704.9 1,575.9 (7.6)Employees 4,126 4,066 (1.5)Sales Margin (%) 4.9 (0.1)Market ConditionsOverall, there was lower demand stemmingfrom a decline in activity in the construction andbuilding sectors. Activity in other sectors such asmining, rural and rail were broadly in linewith expectations.PerformanceWhyalla - Despite some operational difficultiesaround mid-year, billet production reachedrecord levels by year end. Significant reductionsin inventories were achieved in the second halfwith business improvement initiatives providing$19 million in benefits. Whyalla achieved arecord 4 million person hours with no lost timeinjuries.Sydney Steel Mill - During the year, the Mill wasshut down for an extended period to realignstocks with underlying market demand. Towardsthe end of the year, the Mill was operating atclose to full capacity.Rail and Structural - Rail finished the yearslightly behind projections while structuralproduct demand fell away during the year,leading to some price pressure and an increasein lower-priced slab exports.Rod and Bar - Despite lower volumes, somesignificant productivity increases were achievedcombined with price improvements in someproduct lines in October. During the year, it wasannounced that the Brisbane Bar Mill will closein April 2002, with its production reallocated tothe Newcastle and Sydney Bar Mill operations.Pipe and Tube - Demand was down in thestructural and manufacturing segments while oiland gas held up. Price pressures and increasedinput costs have been partly offset byproductivity improvements.Wire - While volumes were down on last year,the wire business improved its performancethrough a combination of decreased costs andimproved pricing. With the acquisition of Email,the Martin Bright’s, bright bar business formspart of the Wire operations.InitiativesWork was undertaken on the Whyalla blastfurnace during the year to ensure operation untilits reline in 2004. Work will be undertaken onthe structural mill in preparation for production ofrail for the Alice Springs to Darwin Rail project.A number of initiatives were undertaken to cutcosts and enhance the quality of revenues in theManufacturing Segment. Combined theseinitiatives produced approximately $50 millionin benefits.OutlookMarket conditions are expected to remainsubdued for the first six months of the financialyear. In the second six months, production forthe Alice to Darwin rail project will commencediverting some production away from lowermargin export. Some sectors such as rural andoil and gas are expected to remain firm.2000 <strong>2001</strong> %Revenue 305.0 312.2 2.4EBITDA 31.0 29.3 (5.5)EBIT 23.0 22.5 (2.2)Assets 184.4 174.0 (5.6)Employees 742 700 (5.7)Sales Margin (%) 7.5 7.2Market ConditionsMarket demand for steel products was mixed.Strong demand from the rural sector and exportfocused manufacturers were offset by a weakdomestic economy.PerformanceThe Steel Distribution and Processing businessimproved its overall performance substantiallyduring the year predominately from increaseddemand from the rural sector. Sales and EBITmargins increased while working capitalreduced.Sales and profits in the Reinforcing and RoofingProducts businesses were lower than last yearas a direct result of the reduced activity in thebuilding sector.InitiativesA number of initiatives were introduced duringthe year which lowered costs and inventorylevels, providing some offset to lower activity.OutlookThe economic outlook is for more of the samewith some downside possible if the economiesof major trading partners do not improve in thenear future.AJ Forsyth, the Canadian subsidiary, wasaffected by a weakened economy with reducedsales and volumes for the year. Despite thisplacing pressure on pricing, sales marginswere maintained.Due to the lower economic activity, programswere put in place to cut costs and inventories,both of which delivered some benefit.Competition remains very strong ensuringprice movements will be minimal in theforeseeable future.The recent change of government in BritishColumbia will benefit the business, however,the uncertainty surrounding the North Americaneconomy still overhangs the Canadianeconomy.Activity is expected to remain at current levelsover the first six months of the year with somepick-up in activity possible in the second half.* The Manufacturing Segment numbers includethe restructuring provision.14