2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

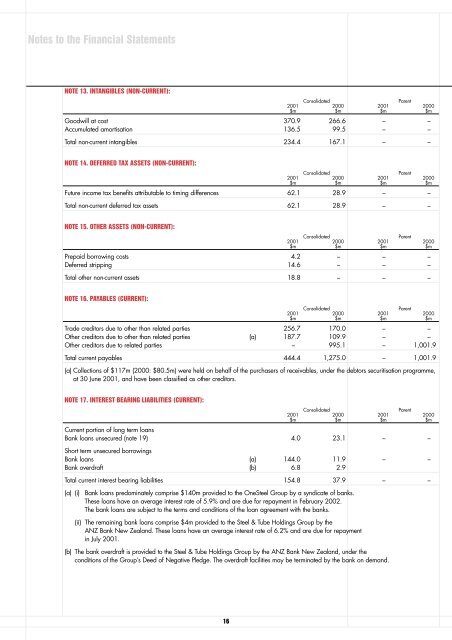

Notes to the Financial StatementsNOTE 13. INTANGIBLES (NON-CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mGoodwill at cost 370.9 266.6 – –Accumulated amortisation 136.5 99.5 – –Total non-current intangibles 234.4 167.1 – –NOTE 14. DEFERRED TAX ASSETS (NON-CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mFuture income tax benefits attributable to timing differences 62.1 28.9 – –Total non-current deferred tax assets 62.1 28.9 – –NOTE 15. OTHER ASSETS (NON-CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mPrepaid borrowing costs 4.2 – – –Deferred stripping 14.6 – – –Total other non-current assets 18.8 – – –NOTE 16. PAYABLES (CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mTrade creditors due to other than related parties 256.7 170.0 – –Other creditors due to other than related parties (a) 187.7 109.9 – –Other creditors due to related parties – 995.1 – 1,001.9Total current payables 444.4 1,275.0 – 1,001.9(a) Collections of $117m (2000: $80.5m) were held on behalf of the purchasers of receivables, under the debtors securitisation programme,at 30 June <strong>2001</strong>, and have been classified as other creditors.NOTE 17. INTEREST BEARING LIABILITIES (CURRENT):ConsolidatedParent<strong>2001</strong> 2000 <strong>2001</strong> 2000$m $m $m $mCurrent portion of long term loansBank loans unsecured (note 19) 4.0 23.1 – –Short term unsecured borrowingsBank loans (a) 144.0 11.9 – –Bank overdraft (b) 6.8 2.9Total current interest bearing liabilities 154.8 37.9 – –(a) (i)Bank loans predominately comprise $140m provided to the <strong>OneSteel</strong> Group by a syndicate of banks.These loans have an average interest rate of 5.9% and are due for repayment in February 2002.The bank loans are subject to the terms and conditions of the loan agreement with the banks.(ii) The remaining bank loans comprise $4m provided to the Steel & Tube Holdings Group by theANZ Bank New Zealand. These loans have an average interest rate of 6.2% and are due for repaymentin July <strong>2001</strong>.(b) The bank overdraft is provided to the Steel & Tube Holdings Group by the ANZ Bank New Zealand, under theconditions of the Group’s Deed of Negative Pledge. The overdraft facilities may be terminated by the bank on demand.16