2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

2001 Annual Report - OneSteel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

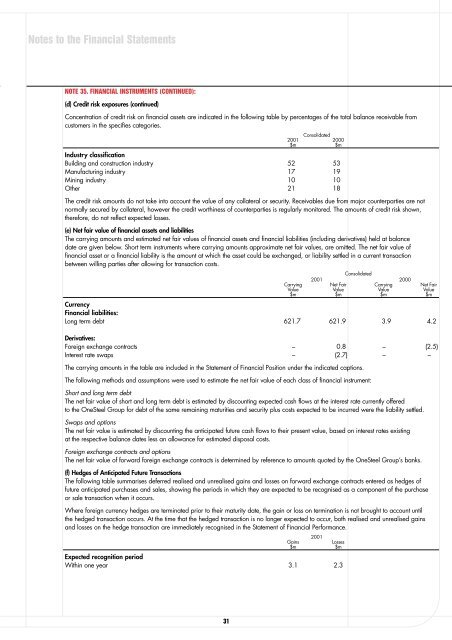

Notes to the Financial StatementsNOTE 35. FINANCIAL INSTRUMENTS (CONTINUED):(d) Credit risk exposures (continued)Concentration of credit risk on financial assets are indicated in the following table by percentages of the total balance receivable fromcustomers in the specifies categories.Consolidated<strong>2001</strong> 2000$m $mIndustry classificationBuilding and construction industry 52 53Manufacturing industry 17 19Mining industry 10 10Other 21 18The credit risk amounts do not take into account the value of any collateral or security. Receivables due from major counterparties are notnormally secured by collateral, however the credit worthiness of counterparties is regularly monitored. The amounts of credit risk shown,therefore, do not reflect expected losses.(e) Net fair value of financial assets and liabilitiesThe carrying amounts and estimated net fair values of financial assets and financial liabilities (including derivatives) held at balancedate are given below. Short term instruments where carrying amounts approximate net fair values, are omitted. The net fair value offinancial asset or a financial liability is the amount at which the asset could be exchanged, or liability settled in a current transactionbetween willing parties after allowing for transaction costs.Consolidated<strong>2001</strong> 2000Carrying Net Fair Carrying Net FairValue Value Value Value$m $m $m $mCurrencyFinancial liabilities:Long term debt 621.7 621.9 3.9 4.2Derivatives:Foreign exchange contracts – 0.8 – (2.5)Interest rate swaps – (2.7) – –The carrying amounts in the table are included in the Statement of Financial Position under the indicated captions.The following methods and assumptions were used to estimate the net fair value of each class of financial instrument:Short and long term debtThe net fair value of short and long term debt is estimated by discounting expected cash flows at the interest rate currently offeredto the <strong>OneSteel</strong> Group for debt of the same remaining maturities and security plus costs expected to be incurred were the liability settled.Swaps and optionsThe net fair value is estimated by discounting the anticipated future cash flows to their present value, based on interest rates existingat the respective balance dates less an allowance for estimated disposal costs.Foreign exchange contracts and optionsThe net fair value of forward foreign exchange contracts is determined by reference to amounts quoted by the <strong>OneSteel</strong> Group’s banks.(f) Hedges of Anticipated Future TransactionsThe following table summarises deferred realised and unrealised gains and losses on forward exchange contracts entered as hedges offuture anticipated purchases and sales, showing the periods in which they are expected to be recognised as a component of the purchaseor sale transaction when it occurs.Where foreign currency hedges are terminated prior to their maturity date, the gain or loss on termination is not brought to account untilthe hedged transaction occurs. At the time that the hedged transaction is no longer expected to occur, both realised and unrealised gainsand losses on the hedge transaction are immediately recognised in the Statement of Financial Performance.<strong>2001</strong>GainsLosses$m $mExpected recognition periodWithin one year 3.1 2.331