Deepening Integration in SADC - Fes-botswana.org

Deepening Integration in SADC - Fes-botswana.org

Deepening Integration in SADC - Fes-botswana.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table 14 presents GDP growth rates <strong>in</strong> general and of some key<br />

sectors such as agriculture, fisheries, health, education, transport and<br />

communications, the transform<strong>in</strong>g and extractive, and others. Despite<br />

a slight slow down <strong>in</strong> the last two years, the real GDP growth on the<br />

economy is expected at an average of 7% up to 2008 if mega projects<br />

are <strong>in</strong>cluded, and at about 6.5 if these are excluded.<br />

These two approaches allow a more detailed analysis of the economy<br />

behaviour given the fact that large-scale undertak<strong>in</strong>gs have high growth<br />

rates at short term.<br />

6.5 Fiscal Trends<br />

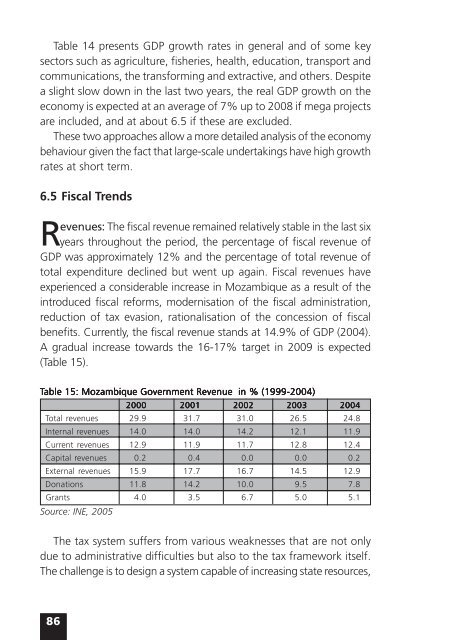

Revenues: The fiscal revenue rema<strong>in</strong>ed relatively stable <strong>in</strong> the last six<br />

years throughout the period, the percentage of fiscal revenue of<br />

GDP was approximately 12% and the percentage of total revenue of<br />

total expenditure decl<strong>in</strong>ed but went up aga<strong>in</strong>. Fiscal revenues have<br />

experienced a considerable <strong>in</strong>crease <strong>in</strong> Mozambique as a result of the<br />

<strong>in</strong>troduced fiscal reforms, modernisation of the fiscal adm<strong>in</strong>istration,<br />

reduction of tax evasion, rationalisation of the concession of fiscal<br />

benefits. Currently, the fiscal revenue stands at 14.9% of GDP (2004).<br />

A gradual <strong>in</strong>crease towards the 16-17% target <strong>in</strong> 2009 is expected<br />

(Table 15).<br />

Table able 15: 15: Mozambique Mozambique Gover Government Gover nment Revenue Revenue <strong>in</strong> <strong>in</strong> % % (1999-2004)<br />

(1999-2004)<br />

2000 2000 2001 2001 2001 2002 2002 2003 2003 2003 2004 2004<br />

2004<br />

Total revenues 29.9 31.7 31.0 26.5 24.8<br />

Internal revenues 14.0 14.0 14.2 12.1 11.9<br />

Current revenues 12.9 11.9 11.7 12.8 12.4<br />

Capital revenues 0.2 0.4 0.0 0.0 0.2<br />

External revenues 15.9 17.7 16.7 14.5 12.9<br />

Donations 11.8 14.2 10.0 9.5 7.8<br />

Grants<br />

Source: INE, 2005<br />

4.0 3.5 6.7 5.0 5.1<br />

The tax system suffers from various weaknesses that are not only<br />

due to adm<strong>in</strong>istrative difficulties but also to the tax framework itself.<br />

The challenge is to design a system capable of <strong>in</strong>creas<strong>in</strong>g state resources,<br />

86