MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

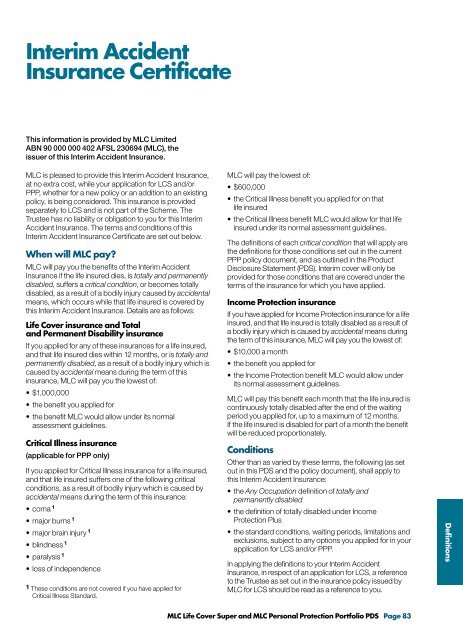

Interim AccidentInsurance CertificateThis information is provided by <strong>MLC</strong> LimitedABN 90 000 000 402 AFSL 230694 (<strong>MLC</strong>), theissuer of this Interim Accident Insurance.<strong>MLC</strong> is pleased to provide this Interim Accident Insurance,at no extra cost, while your application for LCS and/orPPP, whether for a new policy or an addition to an existingpolicy, is being considered. This insurance is providedseparately to LCS and is not part of the Scheme. TheTrustee has no liability or obligation to you for this InterimAccident Insurance. The terms and conditions of thisInterim Accident Insurance Certificate are set out below.When will <strong>MLC</strong> pay?<strong>MLC</strong> will pay you the benefits of the Interim AccidentInsurance if the life insured dies, is totally and permanentlydisabled, suffers a critical condition, or becomes totallydisabled, as a result of a bodily injury caused by accidentalmeans, which occurs while that life insured is covered bythis Interim Accident Insurance. Details are as follows:<strong>Life</strong> <strong>Cover</strong> insurance and Totaland Permanent Disability insuranceIf you applied for any of these insurances for a life insured,and that life insured dies within 12 months, or is totally andpermanently disabled, as a result of a bodily injury which iscaused by accidental means during the term of thisinsurance, <strong>MLC</strong> will pay you the lowest of:• $1,000,000• the benefit you applied for• the benefit <strong>MLC</strong> would allow under its normalassessment guidelines.Critical Illness insurance(applicable for PPP only)If you applied for Critical Illness insurance for a life insured,and that life insured suffers one of the following criticalconditions, as a result of bodily injury which is caused byaccidental means during the term of this insurance:• coma 1• major burns 1• major brain injury 1• blindness 1• paralysis 1• loss of independence1 These conditions are not covered if you have applied forCritical Illness Standard.<strong>MLC</strong> will pay the lowest of:• $600,000• the Critical Illness benefit you applied for on thatlife insured• the Critical Illness benefit <strong>MLC</strong> would allow for that lifeinsured under its normal assessment guidelines.The definitions of each critical condition that will apply arethe definitions for those conditions set out in the currentPPP policy document, and as outlined in the ProductDisclosure Statement (PDS). Interim cover will only beprovided for those conditions that are covered under theterms of the insurance for which you have applied.Income <strong>Protection</strong> insuranceIf you have applied for Income <strong>Protection</strong> insurance for a lifeinsured, and that life insured is totally disabled as a result ofa bodily injury which is caused by accidental means duringthe term of this insurance, <strong>MLC</strong> will pay you the lowest of:• $10,000 a month• the benefit you applied for• the Income <strong>Protection</strong> benefit <strong>MLC</strong> would allow underits normal assessment guidelines.<strong>MLC</strong> will pay this benefit each month that the life insured iscontinuously totally disabled after the end of the waitingperiod you applied for, up to a maximum of 12 months.If the life insured is disabled for part of a month the benefitwill be reduced proportionately.ConditionsOther than as varied by these terms, the following (as setout in this PDS and the policy document), shall apply tothis Interim Accident Insurance:• the Any Occupation definition of totally andpermanently disabled• the definition of totally disabled under Income<strong>Protection</strong> Plus• the standard conditions, waiting periods, limitations andexclusions, subject to any options you applied for in yourapplication for LCS and/or PPP.In applying the definitions to your Interim AccidentInsurance, in respect of an application for LCS, a referenceto the Trustee as set out in the insurance policy issued by<strong>MLC</strong> for LCS should be read as a reference to you.Definitions<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS Page 83