MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

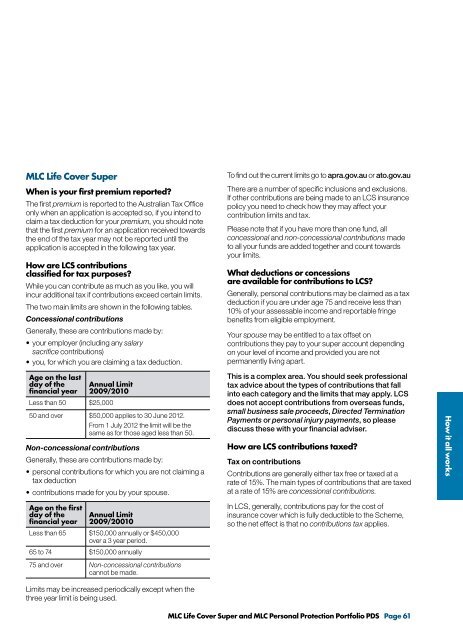

<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong>When is your first premium reported?The first premium is reported to the Australian Tax Officeonly when an application is accepted so, if you intend toclaim a tax deduction for your premium, you should notethat the first premium for an application received towardsthe end of the tax year may not be reported until theapplication is accepted in the following tax year.How are LCS contributionsclassified for tax purposes?While you can contribute as much as you like, you willincur additional tax if contributions exceed certain limits.The two main limits are shown in the following tables.Concessional contributionsGenerally, these are contributions made by:• your employer (including any salarysacrifice contributions)• you, for which you are claiming a tax deduction.Age on the lastday of thefinancial yearAnnual Limit2009/2010Less than 50 $25,00050 and over $50,000 applies to 30 June 2012.From 1 July 2012 the limit will be thesame as for those aged less than 50.Non-concessional contributionsGenerally, these are contributions made by:• personal contributions for which you are not claiming atax deduction• contributions made for you by your spouse.Age on the firstday of thefinancial yearAnnual Limit2009/20010Less than 65 $150,000 annually or $450,000over a 3 year period.65 to 74 $150,000 annually75 and over Non-concessional contributionscannot be made.To find out the current limits go to apra.gov.au or ato.gov.auThere are a number of specific inclusions and exclusions.If other contributions are being made to an LCS insurancepolicy you need to check how they may affect yourcontribution limits and tax.Please note that if you have more than one fund, allconcessional and non-concessional contributions madeto all your funds are added together and count towardsyour limits.What deductions or concessionsare available for contributions to LCS?Generally, personal contributions may be claimed as a taxdeduction if you are under age 75 and receive less than10% of your assessable income and reportable fringebenefits from eligible employment.Your spouse may be entitled to a tax offset oncontributions they pay to your super account dependingon your level of income and provided you are notpermanently living apart.This is a complex area. You should seek professionaltax advice about the types of contributions that fallinto each category and the limits that may apply. LCSdoes not accept contributions from overseas funds,small business sale proceeds, Directed TerminationPayments or personal injury payments, so pleasediscuss these with your financial adviser.How are LCS contributions taxed?Tax on contributionsContributions are generally either tax free or taxed at arate of 15%. The main types of contributions that are taxedat a rate of 15% are concessional contributions.In LCS, generally, contributions pay for the cost ofinsurance cover which is fully deductible to the Scheme,so the net effect is that no contributions tax applies.How it all worksLimits may be increased periodically except when thethree year limit is being used.<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS Page 61