MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

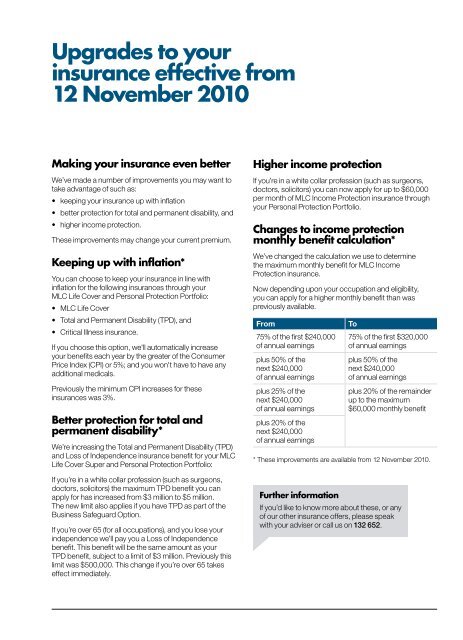

Upgrades to yourinsurance effective from12 November 2010Making your insurance even betterWe’ve made a number of improvements you may want totake advantage of such as:• keeping your insurance up with inflation• better protection for total and permanent disability, and• higher income protection.These improvements may change your current premium.Keeping up with inflation*You can choose to keep your insurance in line withinflation for the following insurances through your<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> and <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong>:• <strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong>• Total and Permanent Disability (TPD), and• Critical Illness insurance.If you choose this option, we'll automatically increaseyour benefits each year by the greater of the ConsumerPrice Index (CPI) or 5%; and you won't have to have anyadditional medicals.Previously the minimum CPI increases for theseinsurances was 3%.Better protection for total andpermanent disability*We’re increasing the Total and Permanent Disability (TPD)and Loss of Independence insurance benefit for your <strong>MLC</strong><strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong>:If you’re in a white collar profession (such as surgeons,doctors, solicitors) the maximum TPD benefit you canapply for has increased from $3 million to $5 million.The new limit also applies if you have TPD as part of theBusiness Safeguard Option.If you’re over 65 (for all occupations), and you lose yourindependence we’ll pay you a Loss of Independencebenefit. This benefit will be the same amount as yourTPD benefit, subject to a limit of $3 million. Previously thislimit was $500,000. This change if you’re over 65 takeseffect immediately.Higher income protectionIf you’re in a white collar profession (such as surgeons,doctors, solicitors) you can now apply for up to $60,000per month of <strong>MLC</strong> Income <strong>Protection</strong> insurance throughyour <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong>.Changes to income protectionmonthly benefit calculation*We’ve changed the calculation we use to determinethe maximum monthly benefit for <strong>MLC</strong> Income<strong>Protection</strong> insurance.Now depending upon your occupation and eligibility,you can apply for a higher monthly benefit than waspreviously available.From75% of the first $240,000of annual earningsplus 50% of thenext $240,000of annual earningsplus 25% of thenext $240,000of annual earningsplus 20% of thenext $240,000of annual earningsTo75% of the first $320,000of annual earningsplus 50% of thenext $240,000of annual earningsplus 20% of the remainderup to the maximum$60,000 monthly benefit* These improvements are available from 12 November 2010.Further informationIf you’d like to know more about these, or anyof our other insurance offers, please speakwith your adviser or call us on 132 652.