MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

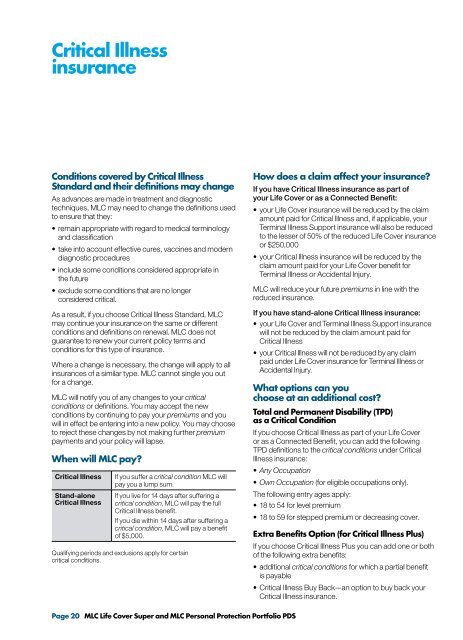

Critical IllnessinsuranceConditions covered by Critical IllnessStandard and their definitions may changeAs advances are made in treatment and diagnostictechniques, <strong>MLC</strong> may need to change the definitions usedto ensure that they:• remain appropriate with regard to medical terminologyand classification• take into account effective cures, vaccines and moderndiagnostic procedures• include some conditions considered appropriate inthe future• exclude some conditions that are no longerconsidered critical.As a result, if you choose Critical Illness Standard, <strong>MLC</strong>may continue your insurance on the same or differentconditions and definitions on renewal. <strong>MLC</strong> does notguarantee to renew your current policy terms andconditions for this type of insurance.Where a change is necessary, the change will apply to allinsurances of a similar type. <strong>MLC</strong> cannot single you outfor a change.<strong>MLC</strong> will notify you of any changes to your criticalconditions or definitions. You may accept the newconditions by continuing to pay your premiums and youwill in effect be entering into a new policy. You may chooseto reject these changes by not making further premiumpayments and your policy will lapse.When will <strong>MLC</strong> pay?Critical IllnessStand-aloneCritical IllnessIf you suffer a critical condition <strong>MLC</strong> willpay you a lump sum.If you live for 14 days after suffering acritical condition, <strong>MLC</strong> will pay the fullCritical Illness benefit.If you die within 14 days after suffering acritical condition, <strong>MLC</strong> will pay a benefitof $5,000.Qualifying periods and exclusions apply for certaincritical conditions.How does a claim affect your insurance?If you have Critical Illness insurance as part ofyour <strong>Life</strong> <strong>Cover</strong> or as a Connected Benefit:• your <strong>Life</strong> <strong>Cover</strong> insurance will be reduced by the claimamount paid for Critical Illness and, if applicable, yourTerminal Illness Support insurance will also be reducedto the lesser of 50% of the reduced <strong>Life</strong> <strong>Cover</strong> insuranceor $250,000• your Critical Illness insurance will be reduced by theclaim amount paid for your <strong>Life</strong> <strong>Cover</strong> benefit forTerminal Illness or Accidental Injury.<strong>MLC</strong> will reduce your future premiums in line with thereduced insurance.If you have stand-alone Critical Illness insurance:• your <strong>Life</strong> <strong>Cover</strong> and Terminal Illness Support insurancewill not be reduced by the claim amount paid forCritical Illness• your Critical Illness will not be reduced by any claimpaid under <strong>Life</strong> <strong>Cover</strong> insurance for Terminal Illness orAccidental Injury.What options can youchoose at an additional cost?Total and Permanent Disability (TPD)as a Critical ConditionIf you choose Critical Illness as part of your <strong>Life</strong> <strong>Cover</strong>or as a Connected Benefit, you can add the followingTPD definitions to the critical conditions under CriticalIllness insurance:• Any Occupation• Own Occupation (for eligible occupations only).The following entry ages apply:• 18 to 54 for level premium• 18 to 59 for stepped premium or decreasing cover.Extra Benefits Option (for Critical Illness Plus)If you choose Critical Illness Plus you can add one or bothof the following extra benefits:• additional critical conditions for which a partial benefitis payable• Critical Illness Buy Back—an option to buy back yourCritical Illness insurance.Page 20 <strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS