MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

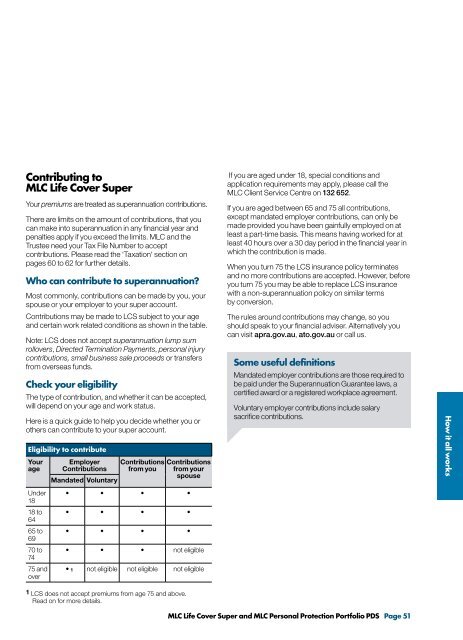

Contributing to<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong>Your premiums are treated as superannuation contributions.There are limits on the amount of contributions, that youcan make into superannuation in any financial year andpenalties apply if you exceed the limits. <strong>MLC</strong> and theTrustee need your Tax File Number to acceptcontributions. Please read the ‘Taxation‘ section onpages 60 to 62 for further details.Who can contribute to superannuation?Most commonly, contributions can be made by you, yourspouse or your employer to your super account.Contributions may be made to LCS subject to your ageand certain work related conditions as shown in the table.Note: LCS does not accept superannuation lump sumrollovers, Directed Termination Payments, personal injurycontributions, small business sale proceeds or transfersfrom overseas funds.Check your eligibilityThe type of contribution, and whether it can be accepted,will depend on your age and work status.Here is a quick guide to help you decide whether you orothers can contribute to your super account.Eligibility to contributeYourageUnder1818 to6465 to6970 to7475 andoverEmployerContributionsMandated VoluntaryContributionsfrom youContributionsfrom yourspouse• • • •• • • •• • • •• • • not eligible• 1 not eligible not eligible not eligibleIf you are aged under 18, special conditions andapplication requirements may apply, please call the<strong>MLC</strong> Client Service Centre on 132 652.If you are aged between 65 and 75 all contributions,except mandated employer contributions, can only bemade provided you have been gainfully employed on atleast a part-time basis. This means having worked for atleast 40 hours over a 30 day period in the financial year inwhich the contribution is made.When you turn 75 the LCS insurance policy terminatesand no more contributions are accepted. However, beforeyou turn 75 you may be able to replace LCS insurancewith a non-superannuation policy on similar termsby conversion.The rules around contributions may change, so youshould speak to your financial adviser. Alternatively youcan visit apra.gov.au, ato.gov.au or call us.Some useful definitionsMandated employer contributions are those required tobe paid under the <strong>Super</strong>annuation Guarantee laws, acertified award or a registered workplace agreement.Voluntary employer contributions include salarysacrifice contributions.How it all works1 LCS does not accept premiums from age 75 and above.Read on for more details.<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS Page 51