MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

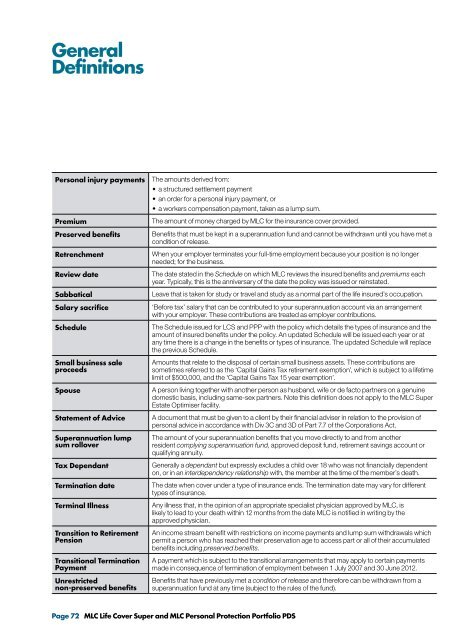

GeneralDefinitions<strong>Personal</strong> injury paymentsPremiumPreserved benefitsRetrenchmentReview dateSabbaticalSalary sacrificeScheduleSmall business saleproceedsSpouseStatement of Advice<strong>Super</strong>annuation lumpsum rolloverTax DependantTermination dateTerminal IllnessTransition to RetirementPensionTransitional TerminationPaymentUnrestrictednon‐preserved benefitsThe amounts derived from:• a structured settlement payment• an order for a personal injury payment, or• a workers compensation payment, taken as a lump sum.The amount of money charged by <strong>MLC</strong> for the insurance cover provided.Benefits that must be kept in a superannuation fund and cannot be withdrawn until you have met acondition of release.When your employer terminates your full-time employment because your position is no longerneeded; for the business.The date stated in the Schedule on which <strong>MLC</strong> reviews the insured benefits and premiums eachyear. Typically, this is the anniversary of the date the policy was issued or reinstated.Leave that is taken for study or travel and study as a normal part of the life insured’s occupation.‘Before tax’ salary that can be contributed to your superannuation account via an arrangementwith your employer. These contributions are treated as employer contributions.The Schedule issued for LCS and PPP with the policy which details the types of insurance and theamount of insured benefits under the policy. An updated Schedule will be issued each year or atany time there is a change in the benefits or types of insurance. The updated Schedule will replacethe previous Schedule.Amounts that relate to the disposal of certain small business assets. These contributions aresometimes referred to as the ‘Capital Gains Tax retirement exemption’, which is subject to a lifetimelimit of $500,000, and the ‘Capital Gains Tax 15 year exemption’.A person living together with another person as husband, wife or de facto partners on a genuinedomestic basis, including same-sex partners. Note this definition does not apply to the <strong>MLC</strong> <strong>Super</strong>Estate Optimiser facility.A document that must be given to a client by their financial adviser in relation to the provision ofpersonal advice in accordance with Div 3C and 3D of Part 7.7 of the Corporations Act.The amount of your superannuation benefits that you move directly to and from anotherresident complying superannuation fund, approved deposit fund, retirement savings account orqualifying annuity.Generally a dependant but expressly excludes a child over 18 who was not financially dependenton, or in an interdependency relationship with, the member at the time of the member’s death.The date when cover under a type of insurance ends. The termination date may vary for differenttypes of insurance.Any illness that, in the opinion of an appropriate specialist physician approved by <strong>MLC</strong>, islikely to lead to your death within 12 months from the date <strong>MLC</strong> is notified in writing by theapproved physician.An income stream benefit with restrictions on income payments and lump sum withdrawals whichpermit a person who has reached their preservation age to access part or all of their accumulatedbenefits including preserved benefits.A payment which is subject to the transitional arrangements that may apply to certain paymentsmade in consequence of termination of employment between 1 July 2007 and 30 June 2012.Benefits that have previously met a condition of release and therefore can be withdrawn from asuperannuation fund at any time (subject to the rules of the fund).Page 72 <strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS