MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

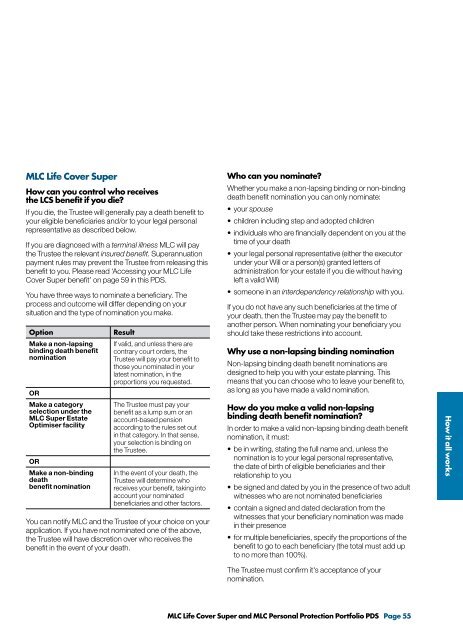

<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong>How can you control who receivesthe LCS benefit if you die?If you die, the Trustee will generally pay a death benefit toyour eligible beneficiaries and/or to your legal personalrepresentative as described below.If you are diagnosed with a terminal illness <strong>MLC</strong> will paythe Trustee the relevant insured benefit. <strong>Super</strong>annuationpayment rules may prevent the Trustee from releasing thisbenefit to you. Please read ‘Accessing your <strong>MLC</strong> <strong>Life</strong><strong>Cover</strong> <strong>Super</strong> benefit’ on page 59 in this PDS.You have three ways to nominate a beneficiary. Theprocess and outcome will differ depending on yoursituation and the type of nomination you make.OptionMake a non-lapsingbinding death benefitnominationORMake a categoryselection under the<strong>MLC</strong> <strong>Super</strong> EstateOptimiser facilityORMake a non-bindingdeathbenefit nominationResultIf valid, and unless there arecontrary court orders, theTrustee will pay your benefit tothose you nominated in yourlatest nomination, in theproportions you requested.The Trustee must pay yourbenefit as a lump sum or anaccount-based pensionaccording to the rules set outin that category. In that sense,your selection is binding onthe Trustee.In the event of your death, theTrustee will determine whoreceives your benefit, taking intoaccount your nominatedbeneficiaries and other factors.You can notify <strong>MLC</strong> and the Trustee of your choice on yourapplication. If you have not nominated one of the above,the Trustee will have discretion over who receives thebenefit in the event of your death.Who can you nominate?Whether you make a non-lapsing binding or non-bindingdeath benefit nomination you can only nominate:• your spouse• children including step and adopted children• individuals who are financially dependent on you at thetime of your death• your legal personal representative (either the executorunder your Will or a person(s) granted letters ofadministration for your estate if you die without havingleft a valid Will)• someone in an interdependency relationship with you.If you do not have any such beneficiaries at the time ofyour death, then the Trustee may pay the benefit toanother person. When nominating your beneficiary youshould take these restrictions into account.Why use a non-lapsing binding nominationNon-lapsing binding death benefit nominations aredesigned to help you with your estate planning. Thismeans that you can choose who to leave your benefit to,as long as you have made a valid nomination.How do you make a valid non-lapsingbinding death benefit nomination?In order to make a valid non-lapsing binding death benefitnomination, it must:• be in writing, stating the full name and, unless thenomination is to your legal personal representative,the date of birth of eligible beneficiaries and theirrelationship to you• be signed and dated by you in the presence of two adultwitnesses who are not nominated beneficiaries• contain a signed and dated declaration from thewitnesses that your beneficiary nomination was madein their presence• for multiple beneficiaries, specify the proportions of thebenefit to go to each beneficiary (the total must add upto no more than 100%).How it all worksThe Trustee must confirm it's acceptance of yournomination.<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS Page 55