MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

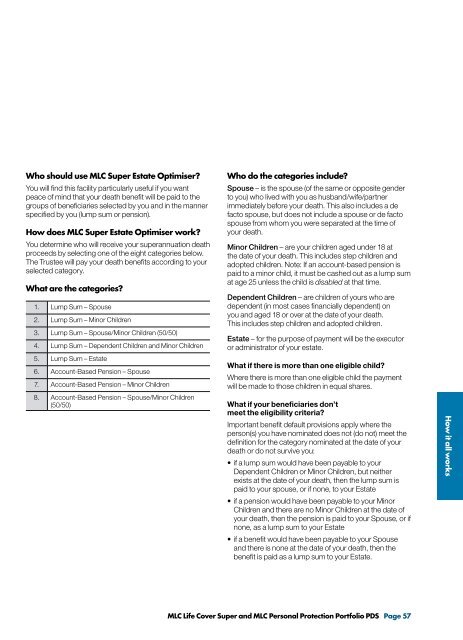

Who should use <strong>MLC</strong> <strong>Super</strong> Estate Optimiser?You will find this facility particularly useful if you wantpeace of mind that your death benefit will be paid to thegroups of beneficiaries selected by you and in the mannerspecified by you (lump sum or pension).How does <strong>MLC</strong> <strong>Super</strong> Estate Optimiser work?You determine who will receive your superannuation deathproceeds by selecting one of the eight categories below.The Trustee will pay your death benefits according to yourselected category.What are the categories?1. Lump Sum – Spouse2. Lump Sum – Minor Children3. Lump Sum – Spouse/Minor Children (50/50)4. Lump Sum – Dependent Children and Minor Children5. Lump Sum – Estate6. Account-Based Pension – Spouse7. Account-Based Pension – Minor Children8. Account-Based Pension – Spouse/Minor Children(50/50)Who do the categories include?Spouse – is the spouse (of the same or opposite genderto you) who lived with you as husband/wife/partnerimmediately before your death. This also includes a defacto spouse, but does not include a spouse or de factospouse from whom you were separated at the time ofyour death.Minor Children – are your children aged under 18 atthe date of your death. This includes step children andadopted children. Note: If an account-based pension ispaid to a minor child, it must be cashed out as a lump sumat age 25 unless the child is disabled at that time.Dependent Children – are children of yours who aredependent (in most cases financially dependent) onyou and aged 18 or over at the date of your death.This includes step children and adopted children.Estate – for the purpose of payment will be the executoror administrator of your estate.What if there is more than one eligible child?Where there is more than one eligible child the paymentwill be made to those children in equal shares.What if your beneficiaries don’tmeet the eligibility criteria?Important benefit default provisions apply where theperson(s) you have nominated does not (do not) meet thedefinition for the category nominated at the date of yourdeath or do not survive you:• if a lump sum would have been payable to yourDependent Children or Minor Children, but neitherexists at the date of your death, then the lump sum ispaid to your spouse, or if none, to your Estate• if a pension would have been payable to your MinorChildren and there are no Minor Children at the date ofyour death, then the pension is paid to your Spouse, or ifnone, as a lump sum to your Estate• if a benefit would have been payable to your Spouseand there is none at the date of your death, then thebenefit is paid as a lump sum to your Estate.How it all works<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS Page 57