MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

MLC Life Cover Super MLC Personal Protection Portfolio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

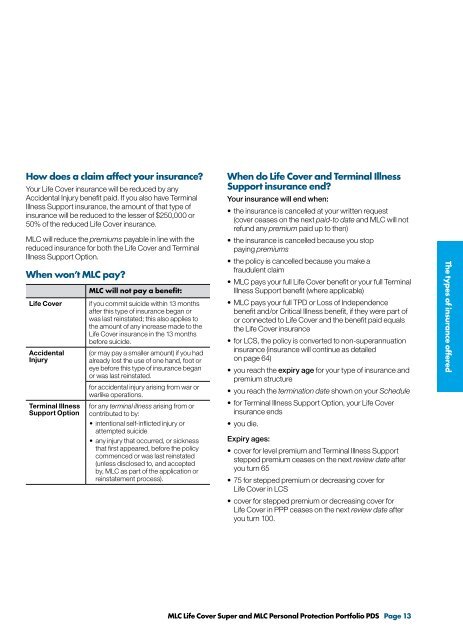

How does a claim affect your insurance?Your <strong>Life</strong> <strong>Cover</strong> insurance will be reduced by anyAccidental Injury benefit paid. If you also have TerminalIllness Support insurance, the amount of that type ofinsurance will be reduced to the lesser of $250,000 or50% of the reduced <strong>Life</strong> <strong>Cover</strong> insurance.<strong>MLC</strong> will reduce the premiums payable in line with thereduced insurance for both the <strong>Life</strong> <strong>Cover</strong> and TerminalIllness Support Option.When won’t <strong>MLC</strong> pay?<strong>Life</strong> <strong>Cover</strong>AccidentalInjuryTerminal IllnessSupport Option<strong>MLC</strong> will not pay a benefit:if you commit suicide within 13 monthsafter this type of insurance began orwas last reinstated; this also applies tothe amount of any increase made to the<strong>Life</strong> <strong>Cover</strong> insurance in the 13 monthsbefore suicide.(or may pay a smaller amount) if you hadalready lost the use of one hand, foot oreye before this type of insurance beganor was last reinstated.for accidental injury arising from war orwarlike operations.for any terminal illness arising from orcontributed to by:• intentional self-inflicted injury orattempted suicide• any injury that occurred, or sicknessthat first appeared, before the policycommenced or was last reinstated(unless disclosed to, and acceptedby, <strong>MLC</strong> as part of the application orreinstatement process).When do <strong>Life</strong> <strong>Cover</strong> and Terminal IllnessSupport insurance end?Your insurance will end when:• the insurance is cancelled at your written request(cover ceases on the next paid-to date and <strong>MLC</strong> will notrefund any premium paid up to then)• the insurance is cancelled because you stoppaying premiums• the policy is cancelled because you make afraudulent claim• <strong>MLC</strong> pays your full <strong>Life</strong> <strong>Cover</strong> benefit or your full TerminalIllness Support benefit (where applicable)• <strong>MLC</strong> pays your full TPD or Loss of Independencebenefit and/or Critical Illness benefit, if they were part ofor connected to <strong>Life</strong> <strong>Cover</strong> and the benefit paid equalsthe <strong>Life</strong> <strong>Cover</strong> insurance• for LCS, the policy is converted to non-superannuationinsurance (insurance will continue as detailedon page 64)• you reach the expiry age for your type of insurance andpremium structure• you reach the termination date shown on your Schedule• for Terminal Illness Support Option, your <strong>Life</strong> <strong>Cover</strong>insurance ends• you die.Expiry ages:• cover for level premium and Terminal Illness Supportstepped premium ceases on the next review date afteryou turn 65• 75 for stepped premium or decreasing cover for<strong>Life</strong> <strong>Cover</strong> in LCS• cover for stepped premium or decreasing cover for<strong>Life</strong> <strong>Cover</strong> in PPP ceases on the next review date afteryou turn 100.The types of insurance offered<strong>MLC</strong> <strong>Life</strong> <strong>Cover</strong> <strong>Super</strong> and <strong>MLC</strong> <strong>Personal</strong> <strong>Protection</strong> <strong>Portfolio</strong> PDS Page 13