cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

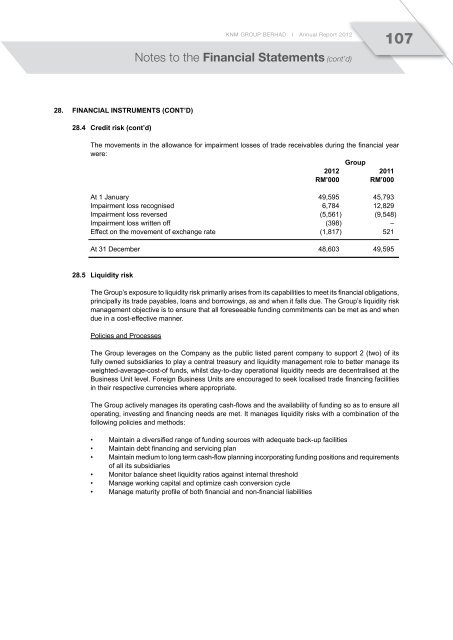

<strong>KNM</strong> GROUP BERHAD I Annual Report 2012107Notes to the Financial Statements (cont’d)28. Financial instruments (Cont’d)28.4 Credit risk (cont’d)The movements in the allowance for impairment losses of trade receivables during the financial yearwere:Group2012 2011RM’000 RM’000At 1 January 49,595 45,793Impairment loss recognised 6,784 12,829Impairment loss reversed (5,561) (9,548)Impairment loss written off (398) –Effect on the movement of exchange rate (1,817) 521At 31 December 48,603 49,59528.5 Liquidity riskThe Group’s exposure to liquidity risk primarily arises from its capabilities to meet its financial obligations,principally its trade payables, loans and borrowings, as and when it falls due. The Group’s liquidity riskmanagement objective is to ensure that all foreseeable funding commitments can be met as and whendue in a cost-effective manner.Policies and ProcessesThe Group leverages on the Company as the public listed parent company to support 2 (two) of itsfully owned subsidiaries to play a central treasury and liquidity management role to better manage itsweighted-average-cost-of funds, whilst day-to-day operational liquidity needs are decentralised at theBusiness Unit level. Foreign Business Units are encouraged to seek localised trade financing facilitiesin their respective currencies where appropriate.The Group actively manages its operating cash-flows and the availability of funding so as to ensure alloperating, investing and financing needs are met. It manages liquidity risks with a combination of thefollowing policies and methods:• Maintain a diversified range of funding sources with adequate back-up facilities• Maintain debt financing and servicing plan• Maintain medium to long term cash-flow planning incorporating funding positions and requirementsof all its subsidiaries• Monitor balance sheet liquidity ratios against internal threshold• Manage working capital and optimize cash conversion cycle• Manage maturity profile of both financial and non-financial liabilities