cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

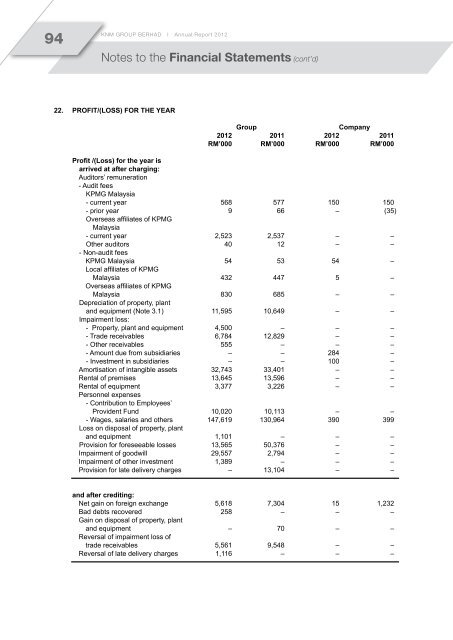

94<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)22. Profit/(Loss) for the yearGroupCompany2012 2011 2012 2011RM’000 RM’000 RM’000 RM’000Profit /(Loss) for the year isarrived at after charging:Auditors’ remuneration- Audit feesKPMG Malaysia- current year 568 577 150 150- prior year 9 66 – (35)Overseas affiliates of KPMGMalaysia- current year 2,523 2,537 – –Other auditors 40 12 – –- Non-audit feesKPMG Malaysia 54 53 54 –Local affiliates of KPMGMalaysia 432 447 5 –Overseas affiliates of KPMGMalaysia 830 685 – –Depreciation of property, plantand equipment (Note 3.1) 11,595 10,649 – –Impairment loss:- Property, plant and equipment 4,500 – – –- Trade receivables 6,784 12,829 – –- Other receivables 555 – – –- Amount due from subsidiaries – – 284 –- Investment in subsidiaries – – 100 –Amortisation of intangible assets 32,743 33,401 – –Rental of premises 13,645 13,596 – –Rental of equipment 3,377 3,226 – –Personnel expenses- Contribution to Employees’Provident Fund 10,020 10,113 – –- Wages, salaries and others 147,619 130,964 390 399Loss on disposal of property, plantand equipment 1,101 – – –Provision for foreseeable losses 13,565 50,376 – –Impairment of goodwill 29,557 2,794 – –Impairment of other investment 1,389 – – –Provision for late delivery charges – 13,104 – –and after crediting:Net gain on foreign exchange 5,618 7,304 15 1,232Bad debts recovered 258 – – –Gain on disposal of property, plantand equipment – 70 – –Reversal of impairment loss oftrade receivables 5,561 9,548 – –Reversal of late delivery charges 1,116 – – –