cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

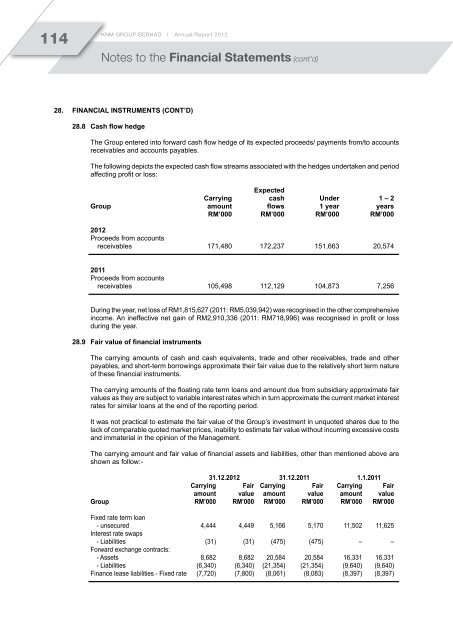

114<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)28. Financial instruments (Cont’d)28.8 Cash flow hedgeThe Group entered into forward cash flow hedge of its expected proceeds/ payments from/to accountsreceivables and accounts payables.The following depicts the expected cash flow streams associated with the hedges undertaken and periodaffecting profit or loss:ExpectedCarrying cash Under 1 – 2Group amount flows 1 year yearsRM’000 RM’000 RM’000 RM’0002012Proceeds from accountsreceivables 171,480 172,237 151,663 20,5742011Proceeds from accountsreceivables 105,498 112,129 104,873 7,256During the year, net loss of RM1,815,627 (2011: RM5,039,942) was recognised in the other comprehensiveincome. An ineffective net gain of RM2,910,336 (2011: RM718,996) was recognised in profit or lossduring the year.28.9 Fair value of financial instrumentsThe carrying amounts of cash and cash equivalents, trade and other receivables, trade and otherpayables, and short-term borrowings approximate their fair value due to the relatively short term natureof these financial instruments.The carrying amounts of the floating rate term loans and amount due from subsidiary approximate fairvalues as they are subject to variable interest rates which in turn approximate the current market interestrates for similar loans at the end of the reporting period.It was not practical to estimate the fair value of the Group’s investment in unquoted shares due to thelack of comparable quoted market prices, inability to estimate fair value without incurring excessive costsand immaterial in the opinion of the Management.The carrying amount and fair value of financial assets and liabilities, other than mentioned above areshown as follow:-31.12.2012 31.12.2011 1.1.2011Carrying Fair Carrying Fair Carrying Fairamount value amount value amount valueGroup RM’000 RM’000 RM’000 RM’000 RM’000 RM’000Fixed rate term loan- unsecured 4,444 4,449 5,166 5,170 11,502 11,625Interest rate swaps- Liabilities (31) (31) (475) (475) – –Forward exchange contracts:- Assets 8,682 8,682 20,584 20,584 16,331 16,331- Liabilities (6,340) (6,340) (21,354) (21,354) (9,640) (9,640)Finance lease liabilities - Fixed rate (7,720) (7,800) (8,061) (8,083) (8,397) (8,397)