cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

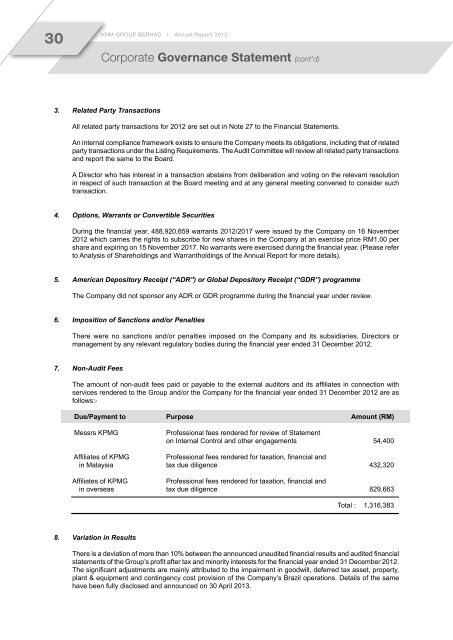

30<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Corporate Governance Statement (cont’d)3. Related Party TransactionsAll related party transactions for 2012 are set out in Note 27 to the Financial Statements.An internal compliance framework exists to ensure the Company meets its obligations, including that of relatedparty transactions under the Listing Requirements. The Audit Committee will review all related party transactionsand report the same to the Board.A Director who has interest in a transaction abstains from deliberation and voting on the relevant resolutionin respect of such transaction at the Board meeting and at any general meeting convened to consider suchtransaction.4. Options, Warrants or Convertible SecuritiesDuring the financial year, 488,920,659 warrants 2012/2017 were issued by the Company on 16 November2012 which carries the rights to subscribe for new shares in the Company at an exercise price RM1.00 pershare and expiring on 15 November 2017. No warrants were exercised during the financial year. (Please referto Analysis of Shareholdings and Warrantholdings of the Annual Report for more details).5. American Depository Receipt (“ADR”) or Global Depository Receipt (“GDR”) programmeThe Company did not sponsor any ADR or GDR programme during the financial year under review.6. Imposition of Sanctions and/or PenaltiesThere were no sanctions and/or penalties imposed on the Company and its subsidiaries, Directors ormanagement by any relevant regulatory bodies during the financial year ended 31 December 2012.7. Non-Audit FeesThe amount of non-audit fees paid or payable to the external auditors and its affiliates in connection withservices rendered to the Group and/or the Company for the financial year ended 31 December 2012 are asfollows:-Due/Payment to Purpose Amount (RM)Messrs KPMGProfessional fees rendered for review of Statementon Internal Control and other engagements 54,400Affiliates of KPMGProfessional fees rendered for taxation, financial andin Malaysia tax due diligence 432,320Affiliates of KPMGProfessional fees rendered for taxation, financial andin overseas tax due diligence 829,663Total : 1,316,3838. Variation in ResultsThere is a deviation of more than 10% between the announced unaudited financial results and audited financialstatements of the Group’s profit after tax and minority interests for the financial year ended 31 December 2012.The significant adjustments are mainly attributed to the impairment in goodwill, deferred tax asset, property,plant & equipment and contingency cost provision of the Company’s Brazil operations. Details of the samehave been fully disclosed and announced on 30 April 2013.