cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

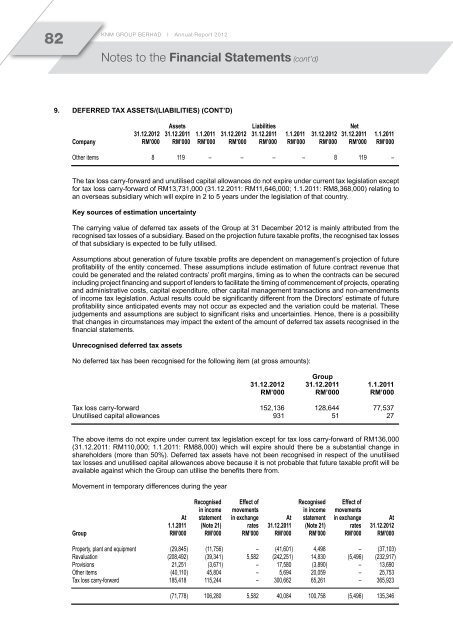

82<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)9. Deferred tax assets/(liabilities) (Cont’d)Assets Liabilities Net31.12.2012 31.12.2011 1.1.2011 31.12.2012 31.12.2011 1.1.2011 31.12.2012 31.12.2011 1.1.2011Company RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000Other items 8 119 – – – – 8 119 –The tax loss carry-forward and unutilised capital allowances do not expire under current tax legislation exceptfor tax loss carry-forward of RM13,731,000 (31.12.2011: RM11,646,000; 1.1.2011: RM8,368,000) relating toan overseas subsidiary which will expire in 2 to 5 years under the legislation of that country.Key sources of estimation uncertaintyThe carrying value of deferred tax assets of the Group at 31 December 2012 is mainly attributed from therecognised tax losses of a subsidiary. Based on the projection future taxable profits, the recognised tax lossesof that subsidiary is expected to be fully utilised.Assumptions about generation of future taxable profits are dependent on management’s projection of futureprofitability of the entity concerned. These assumptions include estimation of future contract revenue thatcould be generated and the related contracts’ profit margins, timing as to when the contracts can be securedincluding project financing and support of lenders to facilitate the timing of commencement of projects, operatingand administrative costs, capital expenditure, other capital management transactions and non-amendmentsof income tax legislation. Actual results could be significantly different from the Directors’ estimate of futureprofitability since anticipated events may not occur as expected and the variation could be material. Thesejudgements and assumptions are subject to significant risks and uncertainties. Hence, there is a possibilitythat changes in circumstances may impact the extent of the amount of deferred tax assets recognised in thefinancial statements.Unrecognised deferred tax assetsNo deferred tax has been recognised for the following item (at gross amounts):Group31.12.2012 31.12.2011 1.1.2011RM’000 RM’000 RM’000Tax loss carry-forward 152,136 128,644 77,537Unutilised capital allowances 931 51 27The above items do not expire under current tax legislation except for tax loss carry-forward of RM136,000(31.12.2011: RM110,000; 1.1.2011: RM88,000) which will expire should there be a substantial change inshareholders (more than 50%). Deferred tax assets have not been recognised in respect of the unutilisedtax losses and unutilised capital allowances above because it is not probable that future taxable profit will beavailable against which the Group can utilise the benefits there from.Movement in temporary differences during the yearRecognised Effect of Recognised Effect ofin income movements in income movementsAt statement in exchange At statement in exchange At1.1.2011 (Note 21) rates 31.12.2011 (Note 21) rates 31.12.2012Group RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000Property, plant and equipment (29,845) (11,756) – (41,601) 4,498 – (37,103)Revaluation (208,492) (39,341) 5,582 (242,251) 14,830 (5,496) (232,917)Provisions 21,251 (3,671) – 17,580 (3,890) – 13,690Other items (40,110) 45,804 – 5,694 20,059 – 25,753Tax loss carry-forward 185,418 115,244 – 300,662 65,261 – 365,923(71,778) 106,280 5,582 40,084 100,758 (5,496) 135,346