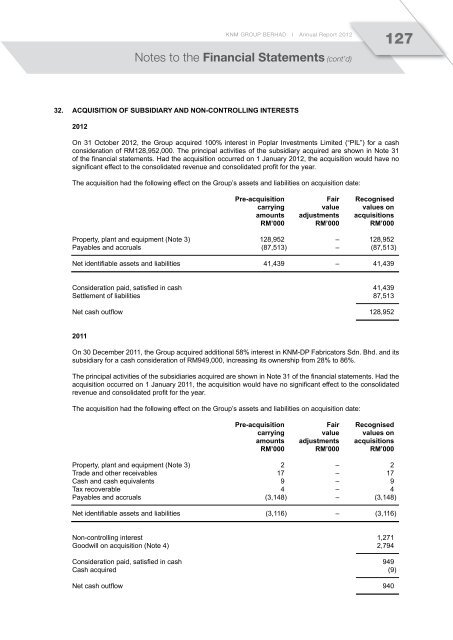

<strong>KNM</strong> GROUP BERHAD I Annual Report 2012127Notes to the Financial Statements (cont’d)32. Acquisition of subsidiary and non-controlling interests2012On 31 October 2012, the Group acquired 100% interest in Poplar Investments Limited (“PIL”) for a cashconsideration of RM128,952,000. The principal activities of the subsidiary acquired are shown in Note 31of the financial statements. Had the acquisition occurred on 1 January 2012, the acquisition would have nosignificant effect to the consolidated revenue and consolidated profit for the year.The acquisition had the following effect on the Group’s assets and liabilities on acquisition date:Pre-acquisition Fair Recognisedcarrying value values onamounts adjustments acquisitionsRM’000 RM’000 RM’000Property, plant and equipment (Note 3) 128,952 – 128,952Payables and accruals (87,513) – (87,513)Net identifiable assets and liabilities 41,439 – 41,439Consideration paid, satisfied in cash 41,439Settlement of liabilities 87,513Net cash outflow 128,9522011On 30 December 2011, the Group acquired additional 58% interest in <strong>KNM</strong>-DP Fabricators <strong>Sdn</strong>. <strong>Bhd</strong>. and itssubsidiary for a cash consideration of RM949,000, increasing its ownership from 28% to 86%.The principal activities of the subsidiaries acquired are shown in Note 31 of the financial statements. Had theacquisition occurred on 1 January 2011, the acquisition would have no significant effect to the consolidatedrevenue and consolidated profit for the year.The acquisition had the following effect on the Group’s assets and liabilities on acquisition date:Pre-acquisition Fair Recognisedcarrying value values onamounts adjustments acquisitionsRM’000 RM’000 RM’000Property, plant and equipment (Note 3) 2 – 2Trade and other receivables 17 – 17Cash and cash equivalents 9 – 9Tax recoverable 4 – 4Payables and accruals (3,148) – (3,148)Net identifiable assets and liabilities (3,116) – (3,116)Non-controlling interest 1,271Goodwill on acquisition (Note 4) 2,794Consideration paid, satisfied in cash 949Cash acquired (9)Net cash outflow 940

128<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)33. Operating LeasesNon-cancellable operating lease rentals are payable as follows:Group31.12.2012 31.12.2011 1.1.2011RM’000 RM’000 RM’000Less than one year 348 – –More than one year 261 – –609 – –The Group leases computer hardware and software under operating leases. The lease typically runs for aperiod of 2 years. The lease does not include contingent rental.34. Significant events during the year34.1 On 26 January 2012, <strong>KNM</strong> Project Services Limited (“KPSL”), a wholly-owned subsidiary of the Companycompleted the transfer of 310 shares of GBP1.00 each (representing 31% equity interest) in Energy ParkInvestments Limited (“EPIL”) for a total cash consideration of GBP310 (approximately RM1,488) fromPeterborough Renewable Energy Limited (“Investment”). Pursuant to the completion of this transfer,EPIL became an 80% subsidiary of KPSL.34.2 On 14 March 2012, <strong>KNM</strong> Europa BV, a wholly-owned subsidiary of the Company incorporated <strong>KNM</strong>Technical Services LLC (“<strong>KNM</strong>TS”) in the Republic of Uzbekistan, representing 100% equity interest in<strong>KNM</strong>TS for a total investment sum of USD1,500 (approximately RM4,662).34.3 On 31 October 2012, KMK Power <strong>Sdn</strong> <strong>Bhd</strong>, completed its acquisition of one (1) ordinary share of GBP1.00representing 100% equity interest in Poplar Investments Limited (“PIL”). The total cost of investment isapproximately GBP26.0 million (approximately RM128.95 million) (Note 3.2).34.4 On 20 November 2012, <strong>KNM</strong> Group Berhad (“<strong>KNM</strong>”) completed its Rights Issue exercise involving theissuance of 488,920,659 new ordinary shares of RM1.00 each in <strong>KNM</strong> (“<strong>KNM</strong> Shares”) (“Rights Shares”)on the basis of one (1) Rights Share for every two (2) existing <strong>KNM</strong> Shares held together with up to488,920,659 free detachable warrants (“Warrants”) on the basis of one (1) Warrant for every one (1)Rights Share subscribed for.34.5 On 13 December 2012, <strong>KNM</strong> Group Berhad (“<strong>KNM</strong>”) entered into a Shareholders cum Joint VentureAgreement with HMS Oil & Gas <strong>Sdn</strong> <strong>Bhd</strong> (“HMS”) to establish a company known as <strong>KNM</strong> HMS Energy<strong>Sdn</strong> <strong>Bhd</strong> on a 70% (<strong>KNM</strong>) : 30% (HMS) equity basis.35. Subsequent events35.1 KPS Inc., a wholly-owned Canadian subsidiary of <strong>KNM</strong>, had on 2 January 2013 incorporated a newsubsidiary, KPS Technology Group LLC in Houston, Texas for a total cash consideration of USD2.00.