cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

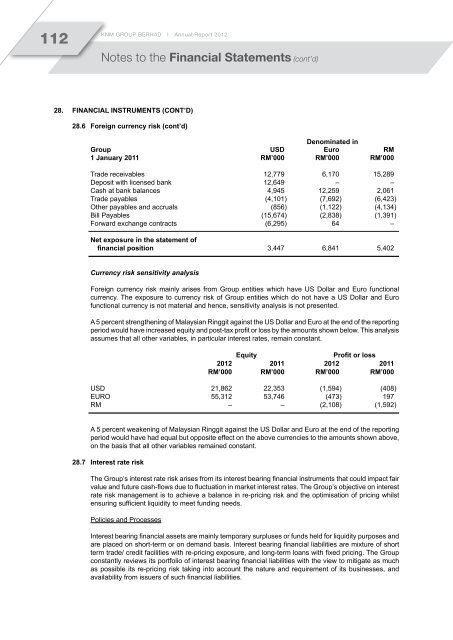

112<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)28. Financial instruments (Cont’d)28.6 Foreign currency risk (cont’d)Denominated inGroup USD Euro RM1 January 2011 RM’000 RM’000 RM’000Trade receivables 12,779 6,170 15,289Deposit with licensed bank 12,649 – –Cash at bank balances 4,945 12,259 2,061Trade payables (4,101) (7,692) (6,423)Other payables and accruals (856) (1,122) (4,134)Bill Payables (15,674) (2,838) (1,391)Forward exchange contracts (6,295) 64 –Net exposure in the statement offinancial position 3,447 6,841 5,402Currency risk sensitivity analysisForeign currency risk mainly arises from Group entities which have US Dollar and Euro functionalcurrency. The exposure to currency risk of Group entities which do not have a US Dollar and Eurofunctional currency is not material and hence, sensitivity analysis is not presented.A 5 percent strengthening of Malaysian Ringgit against the US Dollar and Euro at the end of the reportingperiod would have increased equity and post-tax profit or loss by the amounts shown below. This analysisassumes that all other variables, in particular interest rates, remain constant.EquityProfit or loss2012 2011 2012 2011RM’000 RM’000 RM’000 RM’000USD 21,862 22,353 (1,594) (408)EURO 55,312 53,746 (473) 197RM – – (2,108) (1,592)A 5 percent weakening of Malaysian Ringgit against the US Dollar and Euro at the end of the reportingperiod would have had equal but opposite effect on the above currencies to the amounts shown above,on the basis that all other variables remained constant.28.7 Interest rate riskThe Group’s interest rate risk arises from its interest bearing financial instruments that could impact fairvalue and future cash-flows due to fluctuation in market interest rates. The Group’s objective on interestrate risk management is to achieve a balance in re-pricing risk and the optimisation of pricing whilstensuring sufficient liquidity to meet funding needs.Policies and ProcessesInterest bearing financial assets are mainly temporary surpluses or funds held for liquidity purposes andare placed on short-term or on demand basis. Interest bearing financial liabilities are mixture of shortterm trade/ credit facilities with re-pricing exposure, and long-term loans with fixed pricing. The Groupconstantly reviews its portfolio of interest bearing financial liabilities with the view to mitigate as muchas possible its re-pricing risk taking into account the nature and requirement of its businesses, andavailability from issuers of such financial liabilities.