cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

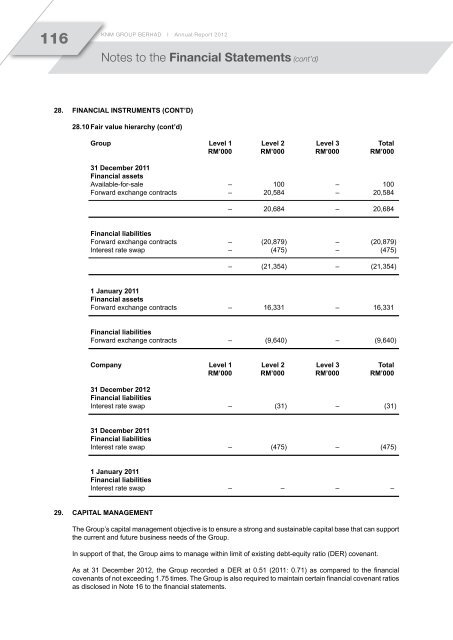

116<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)28. Financial instruments (Cont’d)28.10 Fair value hierarchy (cont’d)Group Level 1 Level 2 Level 3 TotalRM’000 RM’000 RM’000 RM’00031 December 2011Financial assetsAvailable-for-sale – 100 – 100Forward exchange contracts – 20,584 – 20,584– 20,684 – 20,684Financial liabilitiesForward exchange contracts – (20,879) – (20,879)Interest rate swap – (475) – (475)– (21,354) – (21,354)1 January 2011Financial assetsForward exchange contracts – 16,331 – 16,331Financial liabilitiesForward exchange contracts – (9,640) – (9,640)Company Level 1 Level 2 Level 3 TotalRM’000 RM’000 RM’000 RM’00031 December 2012Financial liabilitiesInterest rate swap – (31) – (31)31 December 2011Financial liabilitiesInterest rate swap – (475) – (475)1 January 2011Financial liabilitiesInterest rate swap – – – –29. Capital managementThe Group’s capital management objective is to ensure a strong and sustainable capital base that can supportthe current and future business needs of the Group.In support of that, the Group aims to manage within limit of existing debt-equity ratio (DER) covenant.As at 31 December 2012, the Group recorded a DER at 0.51 (2011: 0.71) as compared to the financialcovenants of not exceeding 1.75 times. The Group is also required to maintain certain financial covenant ratiosas disclosed in Note 16 to the financial statements.