cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

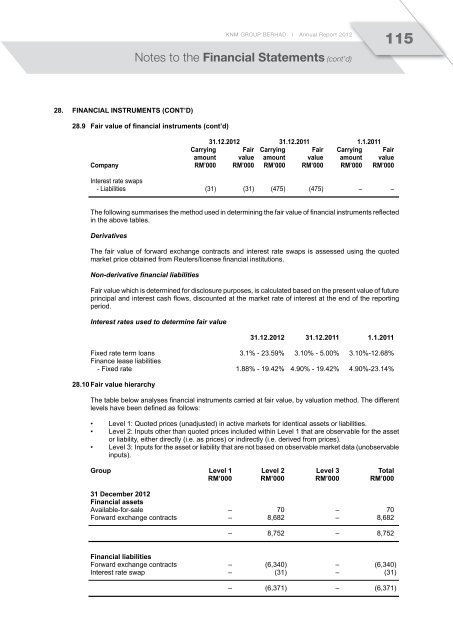

<strong>KNM</strong> GROUP BERHAD I Annual Report 2012115Notes to the Financial Statements (cont’d)28. Financial instruments (Cont’d)28.9 Fair value of financial instruments (cont’d)31.12.2012 31.12.2011 1.1.2011Carrying Fair Carrying Fair Carrying Fairamount value amount value amount valueCompany RM’000 RM’000 RM’000 RM’000 RM’000 RM’000Interest rate swaps- Liabilities (31) (31) (475) (475) – –The following summarises the method used in determining the fair value of financial instruments reflectedin the above tables.DerivativesThe fair value of forward exchange contracts and interest rate swaps is assessed using the quotedmarket price obtained from Reuters/license financial institutions.Non-derivative financial liabilitiesFair value which is determined for disclosure purposes, is calculated based on the present value of futureprincipal and interest cash flows, discounted at the market rate of interest at the end of the reportingperiod.Interest rates used to determine fair value31.12.2012 31.12.2011 1.1.2011Fixed rate term loans 3.1% - 23.59% 3.10% - 5.00% 3.10%-12.68%Finance lease liabilities- Fixed rate 1.88% - 19.42% 4.90% - 19.42% 4.90%-23.14%28.10 Fair value hierarchyThe table below analyses financial instruments carried at fair value, by valuation method. The differentlevels have been defined as follows:• Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities.• Level 2: Inputs other than quoted prices included within Level 1 that are observable for the assetor liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).• Level 3: Inputs for the asset or liability that are not based on observable market data (unobservableinputs).Group Level 1 Level 2 Level 3 TotalRM’000 RM’000 RM’000 RM’00031 December 2012Financial assetsAvailable-for-sale – 70 – 70Forward exchange contracts – 8,682 – 8,682– 8,752 – 8,752Financial liabilitiesForward exchange contracts – (6,340) – (6,340)Interest rate swap – (31) – (31)– (6,371) – (6,371)