cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

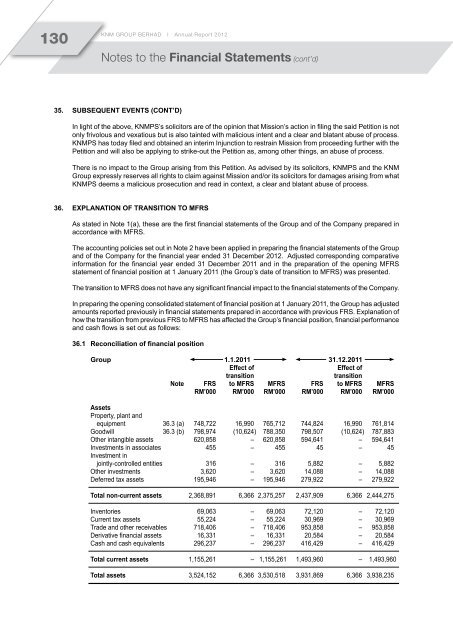

130<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)35. Subsequent events (Cont’d)In light of the above, <strong>KNM</strong>PS’s solicitors are of the opinion that Mission’s action in filing the said Petition is notonly frivolous and vexatious but is also tainted with malicious intent and a clear and blatant abuse of process.<strong>KNM</strong>PS has today filed and obtained an interim Injunction to restrain Mission from proceeding further with thePetition and will also be applying to strike-out the Petition as, among other things, an abuse of process.There is no impact to the Group arising from this Petition. As advised by its solicitors, <strong>KNM</strong>PS and the <strong>KNM</strong>Group expressly reserves all rights to claim against Mission and/or its solicitors for damages arising from what<strong>KNM</strong>PS deems a malicious prosecution and read in context, a clear and blatant abuse of process.36. Explanation of transition to MFRSAs stated in Note 1(a), these are the first financial statements of the Group and of the Company prepared inaccordance with MFRS.The accounting policies set out in Note 2 have been applied in preparing the financial statements of the Groupand of the Company for the financial year ended 31 December 2012. Adjusted corresponding comparativeinformation for the financial year ended 31 December 2011 and in the preparation of the opening MFRSstatement of financial position at 1 January 2011 (the Group’s date of transition to MFRS) was presented.The transition to MFRS does not have any significant financial impact to the financial statements of the Company.In preparing the opening consolidated statement of financial position at 1 January 2011, the Group has adjustedamounts reported previously in financial statements prepared in accordance with previous FRS. Explanation ofhow the transition from previous FRS to MFRS has affected the Group’s financial position, financial performanceand cash flows is set out as follows:36.1 Reconciliation of financial positionGroup 1.1.2011 31.12.2011Effect ofEffect oftransitiontransitionNote FRS to MFRS MFRS FRS to MFRS MFRSRM’000 RM’000 RM’000 RM’000 RM’000 RM’000AssetsProperty, plant andequipment 36.3 (a) 748,722 16,990 765,712 744,824 16,990 761,814Goodwill 36.3 (b) 798,974 (10,624) 788,350 798,507 (10,624) 787,883Other intangible assets 620,858 – 620,858 594,641 – 594,641Investments in associates 455 – 455 45 – 45Investment injointly-controlled entities 316 – 316 5,882 – 5,882Other investments 3,620 – 3,620 14,088 – 14,088Deferred tax assets 195,946 – 195,946 279,922 – 279,922Total non-current assets 2,368,891 6,366 2,375,257 2,437,909 6,366 2,444,275Inventories 69,063 – 69,063 72,120 – 72,120Current tax assets 55,224 – 55,224 30,969 – 30,969Trade and other receivables 718,406 – 718,406 953,858 – 953,858Derivative financial assets 16,331 – 16,331 20,584 – 20,584Cash and cash equivalents 296,237 – 296,237 416,429 – 416,429Total current assets 1,155,261 – 1,155,261 1,493,960 – 1,493,960Total assets 3,524,152 6,366 3,530,518 3,931,869 6,366 3,938,235