cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

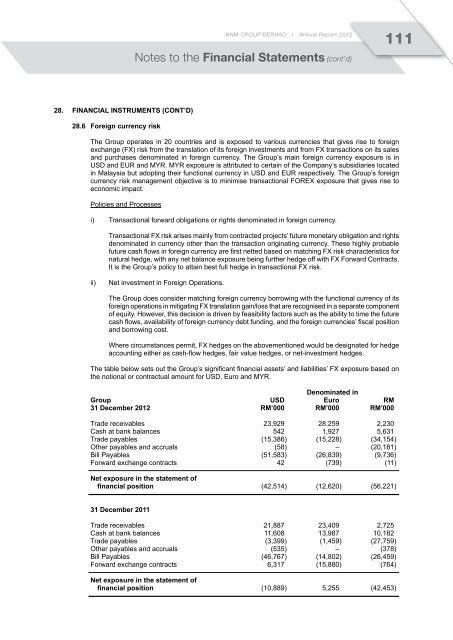

<strong>KNM</strong> GROUP BERHAD I Annual Report 2012111Notes to the Financial Statements (cont’d)28. Financial instruments (Cont’d)28.6 Foreign currency riskThe Group operates in 20 countries and is exposed to various currencies that gives rise to foreignexchange (FX) risk from the translation of its foreign investments and from FX transactions on its salesand purchases denominated in foreign currency. The Group’s main foreign currency exposure is inUSD and EUR and MYR. MYR exposure is attributed to certain of the Company’s subsidiaries locatedin Malaysia but adopting their functional currency in USD and EUR respectively. The Group’s foreigncurrency risk management objective is to minimise transactional FOREX exposure that gives rise toeconomic impact.Policies and Processesi) Transactional forward obligations or rights denominated in foreign currency.Transactional FX risk arises mainly from contracted projects’ future monetary obligation and rightsdenominated in currency other than the transaction originating currency. These highly probablefuture cash flows in foreign currency are first netted based on matching FX risk characteristics fornatural hedge, with any net balance exposure being further hedge off with FX Forward Contracts.It is the Group’s policy to attain best full hedge in transactional FX risk.ii)Net investment in Foreign Operations.The Group does consider matching foreign currency borrowing with the functional currency of itsforeign operations in mitigating FX translation gain/loss that are recognised in a separate componentof equity. However, this decision is driven by feasibility factors such as the ability to time the futurecash flows, availability of foreign currency debt funding, and the foreign currencies’ fiscal positionand borrowing cost.Where circumstances permit, FX hedges on the abovementioned would be designated for hedgeaccounting either as cash-flow hedges, fair value hedges, or net-investment hedges.The table below sets out the Group’s significant financial assets’ and liabilities’ FX exposure based onthe notional or contractual amount for USD, Euro and MYR.Denominated inGroup USD Euro RM31 December 2012 RM’000 RM’000 RM’000Trade receivables 23,929 28,259 2,230Cash at bank balances 542 1,927 5,631Trade payables (15,386) (15,228) (34,154)Other payables and accruals (58) – (20,181)Bill Payables (51,583) (26,839) (9,736)Forward exchange contracts 42 (739) (11)Net exposure in the statement offinancial position (42,514) (12,620) (56,221)31 December 2011Trade receivables 21,887 23,409 2,725Cash at bank balances 11,608 13,987 10,182Trade payables (3,399) (1,459) (27,759)Other payables and accruals (535) – (378)Bill Payables (46,767) (14,802) (26,459)Forward exchange contracts 6,317 (15,880) (764)Net exposure in the statement offinancial position (10,889) 5,255 (42,453)