cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

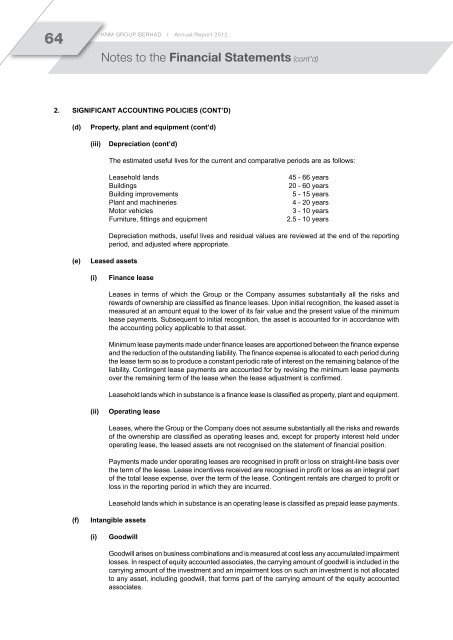

64<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)2. Significant accounting policies (Cont’d)(d)Property, plant and equipment (cont’d)(iii)Depreciation (cont’d)The estimated useful lives for the current and comparative periods are as follows:Leasehold landsBuildingsBuilding improvementsPlant and machineriesMotor vehiclesFurniture, fittings and equipment45 - 66 years20 - 60 years5 - 15 years4 - 20 years3 - 10 years2.5 - 10 yearsDepreciation methods, useful lives and residual values are reviewed at the end of the reportingperiod, and adjusted where appropriate.(e)Leased assets(i)Finance leaseLeases in terms of which the Group or the Company assumes substantially all the risks andrewards of ownership are classified as finance leases. Upon initial recognition, the leased asset ismeasured at an amount equal to the lower of its fair value and the present value of the minimumlease payments. Subsequent to initial recognition, the asset is accounted for in accordance withthe accounting policy applicable to that asset.Minimum lease payments made under finance leases are apportioned between the finance expenseand the reduction of the outstanding liability. The finance expense is allocated to each period duringthe lease term so as to produce a constant periodic rate of interest on the remaining balance of theliability. Contingent lease payments are accounted for by revising the minimum lease paymentsover the remaining term of the lease when the lease adjustment is confirmed.Leasehold lands which in substance is a finance lease is classified as property, plant and equipment.(ii)Operating leaseLeases, where the Group or the Company does not assume substantially all the risks and rewardsof the ownership are classified as operating leases and, except for property interest held underoperating lease, the leased assets are not recognised on the statement of financial position.Payments made under operating leases are recognised in profit or loss on straight-line basis overthe term of the lease. Lease incentives received are recognised in profit or loss as an integral partof the total lease expense, over the term of the lease. Contingent rentals are charged to profit orloss in the reporting period in which they are incurred.Leasehold lands which in substance is an operating lease is classified as prepaid lease payments.(f)Intangible assets(i)GoodwillGoodwill arises on business combinations and is measured at cost less any accumulated impairmentlosses. In respect of equity accounted associates, the carrying amount of goodwill is included in thecarrying amount of the investment and an impairment loss on such an investment is not allocatedto any asset, including goodwill, that forms part of the carrying amount of the equity accountedassociates.