cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

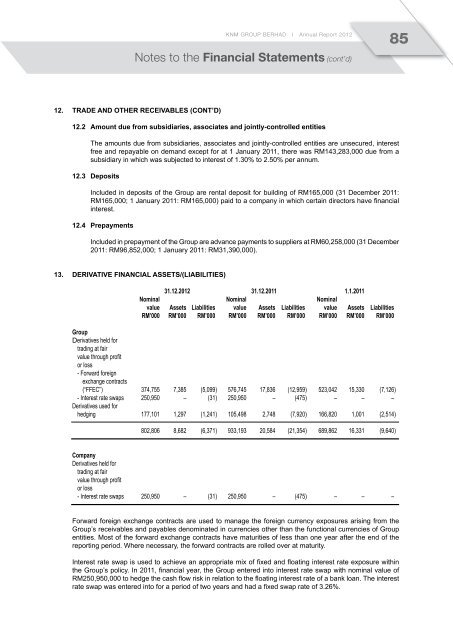

<strong>KNM</strong> GROUP BERHAD I Annual Report 201285Notes to the Financial Statements (cont’d)12. Trade and other receivables (Cont’d)12.2 Amount due from subsidiaries, associates and jointly-controlled entitiesThe amounts due from subsidiaries, associates and jointly-controlled entities are unsecured, interestfree and repayable on demand except for at 1 January 2011, there was RM143,283,000 due from asubsidiary in which was subjected to interest of 1.30% to 2.50% per annum.12.3 DepositsIncluded in deposits of the Group are rental deposit for building of RM165,000 (31 December 2011:RM165,000; 1 January 2011: RM165,000) paid to a company in which certain directors have financialinterest.12.4 PrepaymentsIncluded in prepayment of the Group are advance payments to suppliers at RM60,258,000 (31 December2011: RM96,852,000; 1 January 2011: RM31,390,000).13. Derivative financial assets/(liabilities)31.12.2012 31.12.2011 1.1.2011Nominal Nominal Nominalvalue Assets Liabilities value Assets Liabilities value Assets LiabilitiesRM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000GroupDerivatives held fortrading at fairvalue through profitor loss- Forward foreignexchange contracts(“FFEC”) 374,755 7,385 (5,099) 576,745 17,836 (12,959) 523,042 15,330 (7,126)- Interest rate swaps 250,950 – (31) 250,950 – (475) – – –Derivatives used forhedging 177,101 1,297 (1,241) 105,498 2,748 (7,920) 166,820 1,001 (2,514)802,806 8,682 (6,371) 933,193 20,584 (21,354) 689,862 16,331 (9,640)CompanyDerivatives held fortrading at fairvalue through profitor loss- Interest rate swaps 250,950 – (31) 250,950 – (475) – – –Forward foreign exchange contracts are used to manage the foreign currency exposures arising from theGroup’s receivables and payables denominated in currencies other than the functional currencies of Groupentities. Most of the forward exchange contracts have maturities of less than one year after the end of thereporting period. Where necessary, the forward contracts are rolled over at maturity.Interest rate swap is used to achieve an appropriate mix of fixed and floating interest rate exposure withinthe Group’s policy. In 2011, financial year, the Group entered into interest rate swap with nominal value ofRM250,950,000 to hedge the cash flow risk in relation to the floating interest rate of a bank loan. The interestrate swap was entered into for a period of two years and had a fixed swap rate of 3.26%.