cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

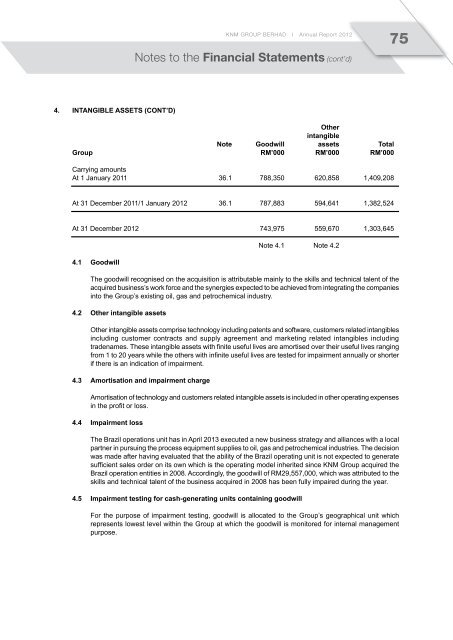

<strong>KNM</strong> GROUP BERHAD I Annual Report 201275Notes to the Financial Statements (cont’d)4. Intangible assets (Cont’d)OtherintangibleNote Goodwill assets TotalGroup RM’000 RM’000 RM’000Carrying amountsAt 1 January 2011 36.1 788,350 620,858 1,409,208At 31 December 2011/1 January 2012 36.1 787,883 594,641 1,382,524At 31 December 2012 743,975 559,670 1,303,6454.1 GoodwillNote 4.1 Note 4.2The goodwill recognised on the acquisition is attributable mainly to the skills and technical talent of theacquired business’s work force and the synergies expected to be achieved from integrating the companiesinto the Group’s existing oil, gas and petrochemical industry.4.2 Other intangible assetsOther intangible assets comprise technology including patents and software, customers related intangiblesincluding customer contracts and supply agreement and marketing related intangibles includingtradenames. These intangible assets with finite useful lives are amortised over their useful lives rangingfrom 1 to 20 years while the others with infinite useful lives are tested for impairment annually or shorterif there is an indication of impairment.4.3 Amortisation and impairment chargeAmortisation of technology and customers related intangible assets is included in other operating expensesin the profit or loss.4.4 Impairment lossThe Brazil operations unit has in April 2013 executed a new business strategy and alliances with a localpartner in pursuing the process equipment supplies to oil, gas and petrochemical industries. The decisionwas made after having evaluated that the ability of the Brazil operating unit is not expected to generatesufficient sales order on its own which is the operating model inherited since <strong>KNM</strong> Group acquired theBrazil operation entities in 2008. Accordingly, the goodwill of RM29,557,000, which was attributed to theskills and technical talent of the business acquired in 2008 has been fully impaired during the year.4.5 Impairment testing for cash-generating units containing goodwillFor the purpose of impairment testing, goodwill is allocated to the Group’s geographical unit whichrepresents lowest level within the Group at which the goodwill is monitored for internal managementpurpose.