cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

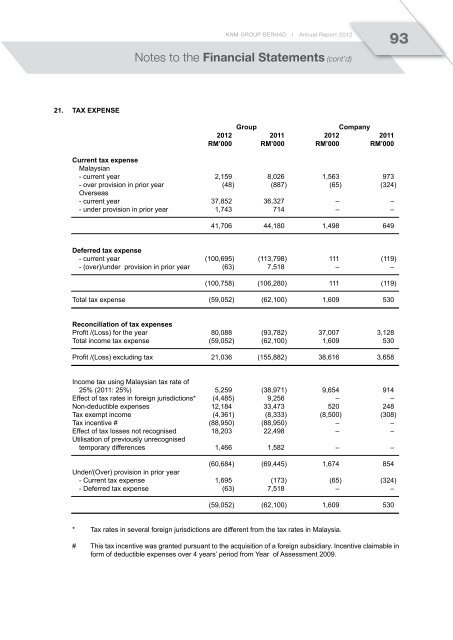

<strong>KNM</strong> GROUP BERHAD I Annual Report 201293Notes to the Financial Statements (cont’d)21. Tax expenseGroupCompany2012 2011 2012 2011RM’000 RM’000 RM’000 RM’000Current tax expenseMalaysian- current year 2,159 8,026 1,563 973- over provision in prior year (48) (887) (65) (324)Overseas- current year 37,852 36,327 – –- under provision in prior year 1,743 714 – –41,706 44,180 1,498 649Deferred tax expense- current year (100,695) (113,798) 111 (119)- (over)/under provision in prior year (63) 7,518 – –(100,758) (106,280) 111 (119)Total tax expense (59,052) (62,100) 1,609 530Reconciliation of tax expensesProfit /(Loss) for the year 80,088 (93,782) 37,007 3,128Total income tax expense (59,052) (62,100) 1,609 530Profit /(Loss) excluding tax 21,036 (155,882) 38,616 3,658Income tax using Malaysian tax rate of25% (2011: 25%) 5,259 (38,971) 9,654 914Effect of tax rates in foreign jurisdictions* (4,485) 9,256 – –Non-deductible expenses 12,184 33,473 520 248Tax exempt income (4,361) (8,333) (8,500) (308)Tax incentive # (88,950) (88,950) – –Effect of tax losses not recognised 18,203 22,498 – –Utilisation of previously unrecognisedtemporary differences 1,466 1,582 – –(60,684) (69,445) 1,674 854Under/(Over) provision in prior year- Current tax expense 1,695 (173) (65) (324)- Deferred tax expense (63) 7,518 – –(59,052) (62,100) 1,609 530* Tax rates in several foreign jurisdictions are different from the tax rates in Malaysia.# This tax incentive was granted pursuant to the acquisition of a foreign subsidiary. Incentive claimable inform of deductible expenses over 4 years’ period from Year of Assessment 2009.