cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

cont'd - KNM Steel Sdn Bhd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

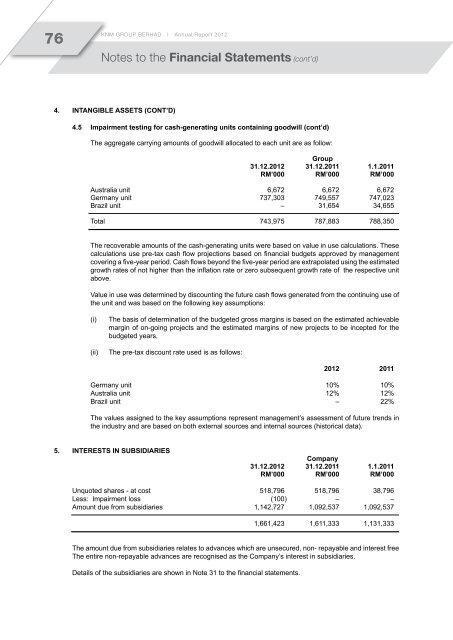

76<strong>KNM</strong> GROUP BERHAD I Annual Report 2012Notes to the Financial Statements (cont’d)4. Intangible assets (Cont’d)4.5 Impairment testing for cash-generating units containing goodwill (cont’d)The aggregate carrying amounts of goodwill allocated to each unit are as follow:Group31.12.2012 31.12.2011 1.1.2011RM’000 RM’000 RM’000Australia unit 6,672 6,672 6,672Germany unit 737,303 749,557 747,023Brazil unit – 31,654 34,655Total 743,975 787,883 788,350The recoverable amounts of the cash-generating units were based on value in use calculations. Thesecalculations use pre-tax cash flow projections based on financial budgets approved by managementcovering a five-year period. Cash flows beyond the five-year period are extrapolated using the estimatedgrowth rates of not higher than the inflation rate or zero subsequent growth rate of the respective unitabove.Value in use was determined by discounting the future cash flows generated from the continuing use ofthe unit and was based on the following key assumptions:(i)(ii)The basis of determination of the budgeted gross margins is based on the estimated achievablemargin of on-going projects and the estimated margins of new projects to be incepted for thebudgeted years.The pre-tax discount rate used is as follows:2012 2011Germany unit 10% 10%Australia unit 12% 12%Brazil unit – 22%The values assigned to the key assumptions represent management’s assessment of future trends inthe industry and are based on both external sources and internal sources (historical data).5. Interests in subsidiariesCompany31.12.2012 31.12.2011 1.1.2011RM’000 RM’000 RM’000Unquoted shares - at cost 518,796 518,796 38,796Less: Impairment loss (100) – –Amount due from subsidiaries 1,142,727 1,092,537 1,092,5371,661,423 1,611,333 1,131,333The amount due from subsidiaries relates to advances which are unsecured, non- repayable and interest freeThe entire non-repayable advances are recognised as the Company’s interest in subsidiaries.Details of the subsidiaries are shown in Note 31 to the financial statements.