Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

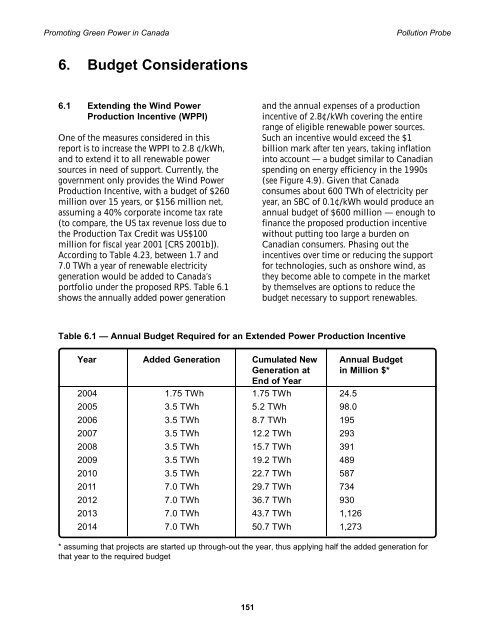

<strong>Promot<strong>in</strong>g</strong> <strong>Green</strong> <strong>Power</strong> <strong>in</strong> <strong>Canada</strong> Pollution Probe6. Budget Considerations6.1 Extend<strong>in</strong>g the W<strong>in</strong>d <strong>Power</strong>Production Incentive (WPPI)One of the measures considered <strong>in</strong> thisreport is to <strong>in</strong>crease the WPPI to 2.8 ¢/kWh,and to extend it to all renewable powersources <strong>in</strong> need of support. Currently, thegovernment only provides the W<strong>in</strong>d <strong>Power</strong>Production Incentive, with a budget of $260million over 15 years, or $156 million net,assum<strong>in</strong>g a 40% corporate <strong>in</strong>come tax rate(to compare, the US tax revenue loss due tothe Production Tax Credit was US$100million <strong>for</strong> fiscal year 2001 [CRS 2001b]).Accord<strong>in</strong>g to Table 4.23, between 1.7 and7.0 TWh a year of renewable electricitygeneration would be added to <strong>Canada</strong>’sportfolio under the proposed RPS. Table 6.1shows the annually added power generationand the annual expenses of a production<strong>in</strong>centive of 2.8¢/kWh cover<strong>in</strong>g the entirerange of eligible renewable power sources.Such an <strong>in</strong>centive would exceed the $1billion mark after ten years, tak<strong>in</strong>g <strong>in</strong>flation<strong>in</strong>to account — a budget similar to Canadianspend<strong>in</strong>g on energy efficiency <strong>in</strong> the 1990s(see Figure 4.9). Given that <strong>Canada</strong>consumes about 600 TWh of electricity peryear, an SBC of 0.1¢/kWh would produce anannual budget of $600 million — enough tof<strong>in</strong>ance the proposed production <strong>in</strong>centivewithout putt<strong>in</strong>g too large a burden onCanadian consumers. Phas<strong>in</strong>g out the<strong>in</strong>centives over time or reduc<strong>in</strong>g the support<strong>for</strong> technologies, such as onshore w<strong>in</strong>d, asthey become able to compete <strong>in</strong> the marketby themselves are options to reduce thebudget necessary to support renewables.Table 6.1 — Annual Budget Required <strong>for</strong> an Extended <strong>Power</strong> Production IncentiveYear Added Generation Cumulated New Annual BudgetGeneration at <strong>in</strong> Million $*End of Year2004 1.75 TWh 1.75 TWh 24.52005 3.5 TWh 5.2 TWh 98.02006 3.5 TWh 8.7 TWh 1952007 3.5 TWh 12.2 TWh 2932008 3.5 TWh 15.7 TWh 3912009 3.5 TWh 19.2 TWh 4892010 3.5 TWh 22.7 TWh 5872011 7.0 TWh 29.7 TWh 7342012 7.0 TWh 36.7 TWh 9302013 7.0 TWh 43.7 TWh 1,1262014 7.0 TWh 50.7 TWh 1,273* assum<strong>in</strong>g that projects are started up through-out the year, thus apply<strong>in</strong>g half the added generation <strong>for</strong>that year to the required budget151