Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

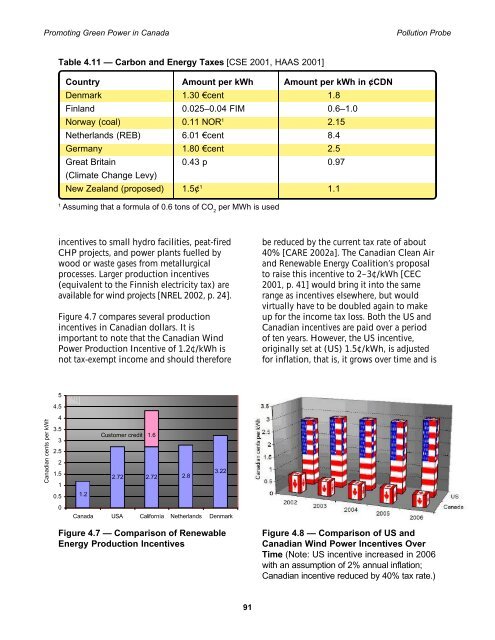

<strong>Promot<strong>in</strong>g</strong> <strong>Green</strong> <strong>Power</strong> <strong>in</strong> <strong>Canada</strong> Pollution ProbeTable 4.11 — Carbon and Energy Taxes [CSE 2001, HAAS 2001]Country Amount per kWh Amount per kWh <strong>in</strong> ¢CDNDenmark 1.30 €cent 1.8F<strong>in</strong>land 0.025–0.04 FIM 0.6–1.0Norway (coal) 0.11 NOR 1 2.15Netherlands (REB) 6.01 €cent 8.4Germany 1.80 €cent 2.5Great Brita<strong>in</strong> 0.43 p 0.97(Climate Change Levy)New Zealand (proposed) 1.5¢ 1 1.11Assum<strong>in</strong>g that a <strong>for</strong>mula of 0.6 tons of CO 2per MWh is used<strong>in</strong>centives to small hydro facilities, peat-firedCHP projects, and power plants fuelled bywood or waste gases from metallurgicalprocesses. Larger production <strong>in</strong>centives(equivalent to the F<strong>in</strong>nish electricity tax) areavailable <strong>for</strong> w<strong>in</strong>d projects [NREL 2002, p. 24].Figure 4.7 compares several production<strong>in</strong>centives <strong>in</strong> Canadian dollars. It isimportant to note that the Canadian W<strong>in</strong>d<strong>Power</strong> Production Incentive of 1.2¢/kWh isnot tax-exempt <strong>in</strong>come and should there<strong>for</strong>ebe reduced by the current tax rate of about40% [CARE 2002a]. The Canadian Clean Airand Renewable Energy Coalition’s proposalto raise this <strong>in</strong>centive to 2–3¢/kWh [CEC2001, p. 41] would br<strong>in</strong>g it <strong>in</strong>to the samerange as <strong>in</strong>centives elsewhere, but wouldvirtually have to be doubled aga<strong>in</strong> to makeup <strong>for</strong> the <strong>in</strong>come tax loss. Both the US andCanadian <strong>in</strong>centives are paid over a periodof ten years. However, the US <strong>in</strong>centive,orig<strong>in</strong>ally set at (US) 1.5¢/kWh, is adjusted<strong>for</strong> <strong>in</strong>flation, that is, it grows over time and is54.5Canadian cents per kWh43.532.521.510.50Customer credit 1.62.72 2.72 2.83.221.2<strong>Canada</strong> USA Cali<strong>for</strong>nia Netherlands DenmarkFigure 4.7 — Comparison of RenewableEnergy Production IncentivesFigure 4.8 — Comparison of US andCanadian W<strong>in</strong>d <strong>Power</strong> Incentives OverTime (Note: US <strong>in</strong>centive <strong>in</strong>creased <strong>in</strong> 2006with an assumption of 2% annual <strong>in</strong>flation;Canadian <strong>in</strong>centive reduced by 40% tax rate.)91